An incredibly well-timed trade on a predictions market regarding the US capture of Venezuela’s president has catalyzed an ongoing conversation about the risks to corporate America of prediction markets, online gambling and prop betting. As CCI’s Jennifer L. Gaskin reports, the recent public scandals may be just a taste of what’s to come.

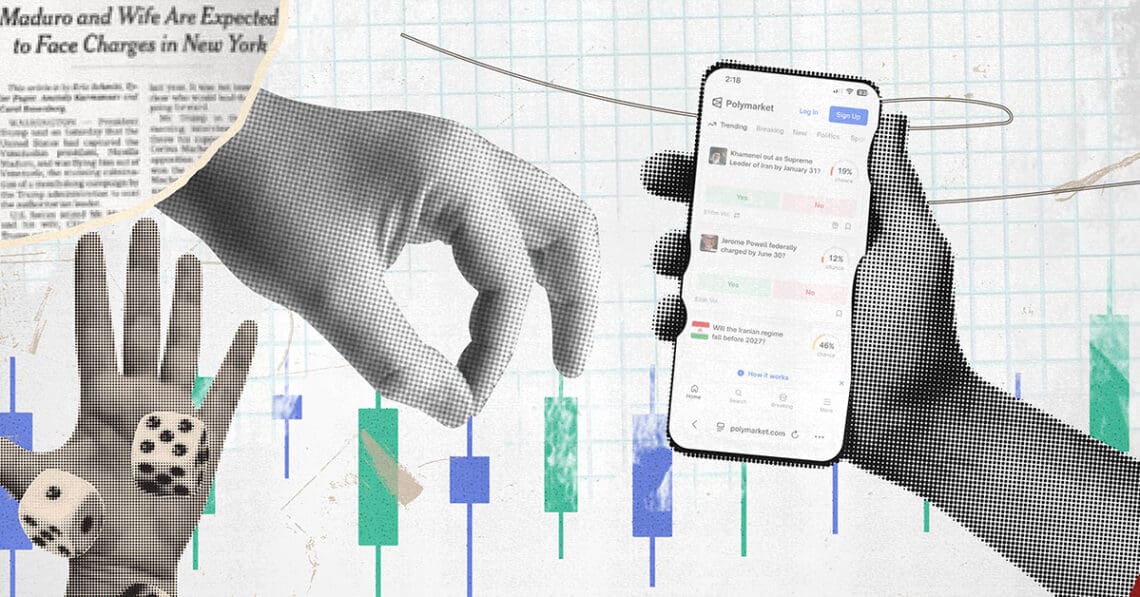

Among the potential outcomes users can bet on via Polymarket, an online predictions platform, are relatively innocuous events like which teams will win major sporting events or whether upcoming film releases will reach certain levels at the box office. But alongside such trivial events are other bets users can make with dramatic real-world outcomes: who will win the 2028 US presidential election, whether Israel will strike Iran by the end of January or when the US will invade Venezuela.

Such geopolitical speculation has already made at least one Polymarket user $400,000 richer, as a mystery trader on the platform made a well-timed purchase just hours before the shocking Jan. 3 capture of Venezuelan President Nicolás Maduro by American military forces. Perhaps the timing was truly coincidental, but the increasing popularity of futures markets like Polymarket and Kalshi raises undeniable questions about what is predicting and what is insider trading.

Put another way: Was the prediction about Maduro a stroke of good luck or did the trader make their purchase because they knew a US military operation had already begun? And to set this in the context of corporate America, what happens when someone with information about what will be said in an upcoming earnings call decides to take out their phone and make another well-timed purchase?

While prediction platforms like Polymarket and Kalshi reject their products being labeled as gambling, wagering or betting, the similarities are striking, and coupled with the recent high-profile arrests of dozens of people in connection with illegal sports betting, including an NBA head coach, the risks to organizations, even those outside the gaming industry, seem undeniable, Stephen Piepgrass, a partner in the Richmond office of Troutman Pepper Locke, told CCI.

“It opened a whole Pandora’s box that I think people don’t often, as of today, they don’t recognize, but I think we’re going to be seeing the fallout from this for years and years to come,” Piepgrass said. “And to use a different analogy, the arrests that we’ve seen and the cases that have been brought in the sports wagering context to me are maybe just a canary in the coal mine. There may be a lot more to come in other contexts that we haven’t even thought about as you play out the implications of what’s now available.”

Regardless of whether US courts will eventually settle on labeling platforms like Polymarket and Kalshi as betting sites, the increasing popularity of legal sports betting and gray-area prediction markets means new risk vectors for corporations — risks they may not be prepared to address, Piepgrass and other experts told CCI.

Yes, You Can Fire an Employee for a Problematic Post, but Should You?

Almost anything can be viewed as politically incendiary, increasing the temptation for quick action

Read moreDetailsRegulatory picture

States are largely responsible for regulating gambling in their borders, and a movement began to legalize sports betting after a 2018 US Supreme Court decision that struck down a federal prohibition. As of early 2026, 40 states have at least partially legalized sports betting, while 32 of them permit online sports wagering, including through smartphone apps.

The regulatory status of prediction markets like Kalshi and Polymarket, which is currently in a dispute with users about what constitutes a US invasion of Venezuela, is much less settled, but their activities may fall under the purview of the Commodity Futures Trading Commission (CFTC).

Following a 2022 CFTC enforcement action, Polymarket only recently was allowed to return to the US market, and its event contracts are formally considered derivatives, while the commission abandoned its case against Kalshi in 2025 and the company is now focusing on disputes at the state level. The issue is likely to make its way to the US Supreme Court, Piepgrass said.

“The states, many of them, have taken the position that, in fact, if it quacks like a duck and walks like a duck, it’s a duck, and that this is, in fact, sports betting,” he told CCI.

While this question is perhaps most immediately pertinent to companies operating in prediction markets, the ripple effects will extend to those providing third-party services as well as potential investors in this lucrative industry, Piepgrass said.

Prediction vs. insider trading

Kalshi prohibits insider trading on its platform, but Polymarket’s terms of service aren’t as explicit, and CEO Shayne Coplan has gone so far as to seemingly endorse the practice, telling an Axios interviewer in fall 2025, “what’s cool about Polymarket is that it creates this financial incentive for people to go and divulge the information to the market.”

The use of material nonpublic information in stock trading is illegal, of course, and multiple federal agencies, led by the SEC, work to prevent, investigate and punish insider trading. But one aspect of Polymarket makes that platform a particular risk: anonymity. Using a VPN and cryptocurrency, a prediction markets trader would likely be able to cover their tracks more effectively than, say, a corporate board member or executive engaging in traditional insider stock trading.

For compliance officers and other corporate integrity professionals, this is a moment to reconsider training, communication and controls around potentially sensitive information, and perhaps to expand their scope of what they consider sensitive, Ethisphere’s Erica Salmon Byrne said in a January podcast episode discussing the Polymarket Maduro trade.

“Ask yourself whether there is the kind of information that your employees have access to on a regular basis that would cause them to be tempted to access a market like Polymarket to try to make money off of that information,” Salmon Byrne said. “That’s going to be a larger employee base probably than the people that you think about from an insider trading perspective.”

While information traditionally tied to insider trading risks — mergers and acquisitions, major product launches and financial performance — are still likely threats for improper activity in prediction markets, companies may want to broaden their scope when thinking about sensitive information.

For example, as of Jan. 7, Polymarket listed more than 30 events around corporate quarterly earnings calls, the details of which are already known by many people within the companies in question, and which might not traditionally draw red flags for insider trading risk. The nature of prediction markets could change that calculus.

“If you’re a publicly traded company, you need to be thinking very carefully about what is the interplay between those things and who’s making ‘bets’ on what you’re going to do as a company,” Piepgrass said. “And is there exposure there for insiders that may be participating in one market and not the other?”

Employee communication is critical, both to mitigate the risk of insider trading and its prediction market equivalent and to safeguard company information, Salmon Byrne said.

“There’s so many potential corrupting influences of this kind of activity that as compliance teams, we need to be comfortable talking about why this would be detrimental to our reputation, why this would undermine our intangible assets, why this would lead to a potential impact evaluation in the business so that [employees] can think about that information as a company asset.”

Age-old risks meet new tech

Neither insider trading nor problem gambling are new issues, but their facilitation via technology creates a host of new risks, experts said.

Estimates place the size of the US online sports betting audience at between one in 10 adults and one in four, while younger Americans are more likely than older generations to gamble on sports, whether online, with friends or at a casino.

What used to be taboo has become commonplace, said Braden Perry, a white-collar defense attorney at Kennyhertz Perry in Kansas City.

“You don’t have to go anywhere to gamble; you can be betting trifectas on your phone while at the office,” Perry said. “Gambling used to be a quote-unquote vice, and now it seems like it’s everyday behavior, and that’s also changed the mindset of individuals, and it may make them more prone to make those types of gambles that they ordinarily wouldn’t have done in the first place.”

For media consumers, messaging around gambling, prop betting and prediction markets has become ubiquitous. An analysis of the NHL’s 2025 Stanley Cup Finals revealed that viewers encountered an average of 3.5 marketing messages from betting firms per minute. Viewers of the 2026 Golden Globes saw Polymarket odds on a variety of award winners mentioned during the broadcast in real time.

Sports leagues and franchises are betting big on gambling, said Matt DiFebo, assistant professor of practice and director of sport business at Stetson University’s business school, which means fans shouldn’t expect gambling messaging to let up anytime soon.

“For teams and leagues, they love it because it’s fan engagement,” DiFebo told CCI. “These consumers that may not be the biggest fan of a team are still engaged in sport because they want to see who wins and what the point spread is.”

The types of wagers available have also changed; spectators can not only bet on whether a team will win or lose, but they can also place prop bets, such as if a particular player will score a certain number of points. Such wagers were involved in the recent NBA scandal, while in November, several men’s college basketball players had their eligibility revoked by the NCAA for allegations they tried to ensure certain prop bets were successful.

The fallout is not limited to legal or financial trouble. In addition to high-profile scandals like the recent arrests or the controversial Maduro trade on Polymarket, problem gambling is on the rise in states with legal sports betting, according to a 2025 study published in the Journal of the American Medical Association.

Often with addiction, a third party is a destructive influence, and by removing access to the third party — say, a drug dealer or enabling family member — the addict has a better chance for success, but the nature of online gambling makes that virtually impossible without chucking the entire phone, said Pamela Garber, a licensed therapist based in New York.

“Now the third party for gambling, it’s the app, to the point that I’ve had clients delete apps in session,” Garber said. “So, imagine having the drug dealer with you all the time. And in working with other addictions, someone can disengage from, say, people, places, things, but with gambling, they’re not going to disengage from their phone — and it’s accessible 24/7.”

Jennifer L. Gaskin is editorial director of Corporate Compliance Insights. A newsroom-forged journalist, she began her career in community newspapers. Her first assignment was covering a county council meeting where the main agenda item was whether the clerk's office needed a new printer (it did). Starting with her early days at small local papers, Jennifer has worked as a reporter, photographer, copy editor, page designer, manager and more. She joined the staff of Corporate Compliance Insights in 2021.

Jennifer L. Gaskin is editorial director of Corporate Compliance Insights. A newsroom-forged journalist, she began her career in community newspapers. Her first assignment was covering a county council meeting where the main agenda item was whether the clerk's office needed a new printer (it did). Starting with her early days at small local papers, Jennifer has worked as a reporter, photographer, copy editor, page designer, manager and more. She joined the staff of Corporate Compliance Insights in 2021.