How to Automate Processes with Cognitive Computing

Margin lending involves banks accepting credit, market and liquidity risks simultaneously and the risk is primarily dependent on collateral value that is highly dynamic. In the credit life cycle, a number of banks – even large ones – run their complex processes in manual/semi-automated modes that not only are error-prone, but also tend to delay critical decisions, leading to credit losses. In this article from Tata Consultancy Services, experts provide an approach to automate critical processes by leveraging AI – a key step in achieving improved efficiency, reducing risk and minimizing cost of operations.

with co-author Raamprasad C

A margin loan is a flexible line of credit that can be used to borrow money for investment purposes, such as investing in listed securities, unlisted corporate bonds and managed funds. It helps increase the buyer’s exposure in the domestic and international share market by boosting buying power in the following ways:

- By having more to invest, the investor has an opportunity to diversify the risk by spreading the exposure across a wider variety of investments.

- The borrower has to invest a lesser amount up front, as the remaining would be taken care of by margin loan, thereby magnifying the potential returns on the investment made.

- Tax benefits for the interests paid – along with more liquidity – can be considered as other advantages of margin lending.

Risks to the Borrower

Though there are many benefits of margin lending, like any other investment, a margin loan involves some risk. These risks are associated with the market volatility and margin calls (when security portfolio falls significantly), which can lead to potential losses to the investor, as they will be forced to sell the shares at a very low price, thereby leading to capital loss for a stock, which could potentially surge in the near future, giving substantial gains to any other debt-free investor.

The most common risks associated with interest-only loans are:

- Margin calls as a result of market volatility and/or high gearing levels – This can lead to liquidity crunch due to market factors.

- Increase in borrowing costs (i.e., interest rate increases)

- Reductions in loan-to-value ratios (LVR) assigned to securities.

How are lenders affected?

Banks have a sizeable exposure to margin loans and hence are involved in potential risks due to the exposure. The risk is not restricted to one particular portfolio, but can be a mix of credit, market and liquidity-related risks.

Falling MTM value of the portfolio – If the value of the portfolio of assets securing a margin loan starts declining, the lender has to be quick in making a margin call and work on further action if required. There can be a possibility of the borrower failing to meet the margin calls, wherein the bank must take appropriate enforcement action or sell out the assets.

Borrower insolvency and associated credit risk – Any loan transaction can be associated with an innate risk of borrower default and the corresponding liquidity crunch the lender might face. Margin loans present a greater risk to lenders in times of a market downturn. The risk mitigation strategy for such situations depends on the risk appetite of the lender, along with the quick turnaround time to exercise the rights.

Delays to the timing of enforcement – In a volatile, rapidly declining market, a lender will wish to act speedily in order to ensure maximum recovery and minimize its exposure.

Liquidity risk due to external factors – The possibility of the collateral provided turning illiquid due to local or international market conditions can lead to potential liquidity risk, as the value of the collateral declines substantially.

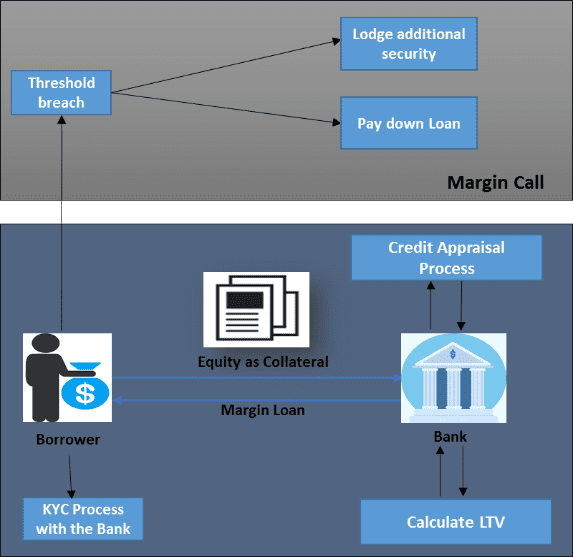

Process

Margin lending involves leveraging one’s own position, wherein the stocks bought by the customer – in collaboration with the margin loan provided – would be serving as the collateral until the entire sum is paid back or the stocks are sold. The borrower who wishes to buy a particular stock, but is unwilling or unable to invest the entire amount, can invest partly through the margin lending technique. The broker who is also involved in the transaction would calculate the LVR of the borrower based on the credit score and behavioral scorecard and provide a percent of the total investment, thereby giving the borrower an opportunity to increase the gains with significantly lesser investment.

A margin call usually occurs when the market value of the security portfolio falls significantly, which in turn will reduce the borrowing limit. This will also cause a rise in gearing level, as the loan balance has not changed. If the current gearing level exceeds your maximum loan-to-value ratio, a margin call may occur.

The process explained has a few things in common. They are:

- Manual intensive

- No real-time monitoring and analysis

- Higher scope for manual error

- Needs frequent checks and limit approvals

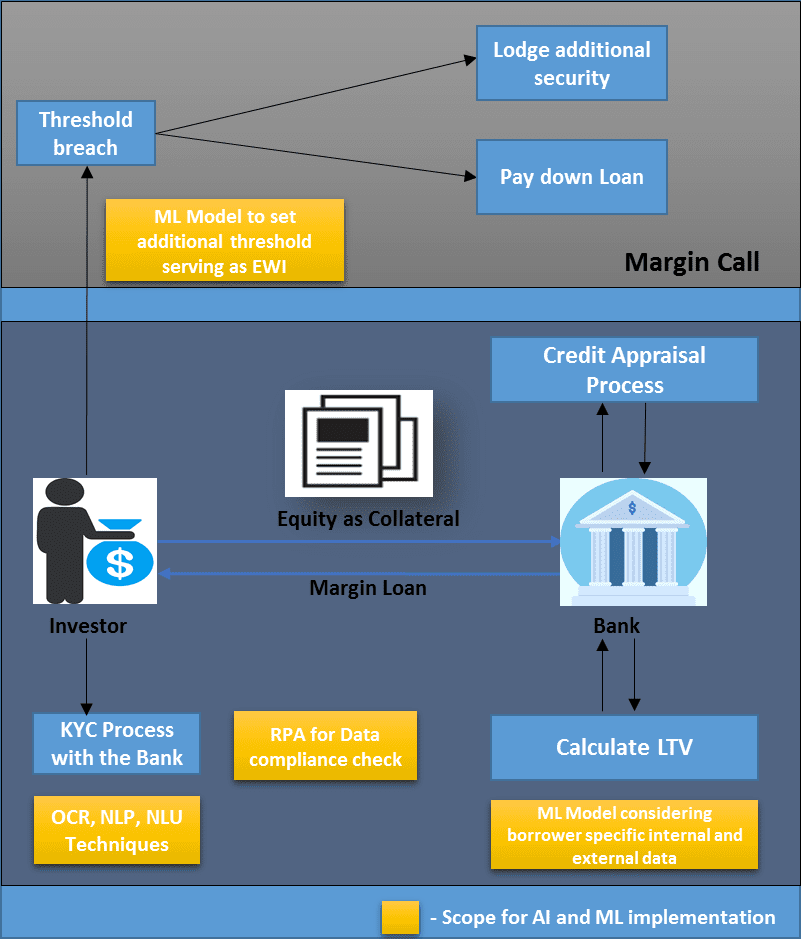

Artificial Intelligence to the Rescue

In the current digital world, there are plenty of scopes of automating simple, repetitive, manual-intensive processes. Margin lending, as we have seen, is a case of high-risk investment where mitigation can be done by having proper checks at the right places. Automating manual-intensive, mundane processes can help reduce the risk and provide an early warning signal to the lender on the potential candidates of default, thereby enabling the bank to expedite the process to exercise the rights at the right time and reduce potential losses.

A suite of automation and machine learning services can help enhance the existing margin lending system to make it more secure, accurate, scalable and efficient.

Optical Character Recognition (OCR) and Natural Language Processing (NLP)

The margin lending process will require the customer’s updated information to calculate the LVR and subsequently decide on the amount to be disbursed for the security to be purchased. The information will include the basic details about the customer, which will be available as part of the initial KYC process. The back-office process of collecting the customer details can be automated using OCR technology to scan the images, extract data and ingest the details collected into the core database of the bank for subsequent usage. Apart from the static data, the lender will require additional information, like current news about the borrower that might be available in the public domain, annual reports analysis in the case of a commercial customer and similar details to evaluate the borrower’s ability to repay. These processes can be automated using natural language understanding (NLU) and natural language processing (NLP) techniques.

Robotic Process Automation (RPA) & Machine Learning (ML)

RPA can be used to automate back-office manual processes. It can also be used for data compliance to verify if all the data has been provided and is up-to-date. A cognitive feature helps the bot intimate the borrower of the additional details required to stay compliant and update the details once provided.

Machine learning is one of the critical processes that, if implemented properly, can help reduce a major portion of risks involved in margin lending. A ML model that considers all the historical data, along with the current market volatility and customer credit score card, can help set dynamic threshold limits for different customers. This threshold would be a bit lower than the LVR value that initiates a margin call. This eventually helps both the bank and the borrower be informed of the probable scenario, which helps them take corresponding steps to avert a catastrophic situation. Apart from an early warning system, ML models can also be used to identify concentration risks involved in the investments made, which – along with the current sector-specific status – helps alert the stakeholders of the need for diversification.

Conclusion

High-risk investments like margin lending require a lot of timely checks, and a mere manual process will not be sufficient to alert the parties involved on time. Intelligent automation techniques and the fusion of digital with operational excellence helps develop a more efficient system which benefits both the borrower and the banks involved in the transaction. These techniques provide the right foundation to exploit the emerging cognitive automation techniques, making the system smarter and thereby reducing human effort on repetitive, primitive tasks.

Raamprasad C is working as a Banking, Financial Services and Insurance (BFSI) Risk Management Analyst with Tata Consultancy Services (TCS). Currently, he is associated with the Risk Management Strategy team and has contributed significantly to the innovative digital and cognitive solutions in the space of risk and regulatory compliance. Raamprasad holds a master’s degree from the Great Lakes Institute of Management (GLIM), Chennai.

Raamprasad C is working as a Banking, Financial Services and Insurance (BFSI) Risk Management Analyst with Tata Consultancy Services (TCS). Currently, he is associated with the Risk Management Strategy team and has contributed significantly to the innovative digital and cognitive solutions in the space of risk and regulatory compliance. Raamprasad holds a master’s degree from the Great Lakes Institute of Management (GLIM), Chennai.

Subramanian Venkataraman is a Senior Consultant in the Risk Management Practice of Tata Consultancy Services' Banking and Financial Services Business Unit. He drives initiatives in the areas of credit risk, conduct risk and other allied areas. He manages research and competency development for the group. His risk consulting experience revolves around ERM, credit risk, market risk, stress testing, model validation and risk-adjusted performance management. He has developed a number of solutions for banking clients and authored point of views.

Subramanian Venkataraman is a Senior Consultant in the Risk Management Practice of Tata Consultancy Services' Banking and Financial Services Business Unit. He drives initiatives in the areas of credit risk, conduct risk and other allied areas. He manages research and competency development for the group. His risk consulting experience revolves around ERM, credit risk, market risk, stress testing, model validation and risk-adjusted performance management. He has developed a number of solutions for banking clients and authored point of views.