Governance

Emerging Challenges Affecting Independent Directors

Considering the limitations of any one individual’s capabilities, the time one is practically able to spend, and one’s access to company information – such as operations and finance – it may be time to augment our expectations of independent directors. What independent directors need for effective governance is a holistic view, but they may not be prepared for that full...

CII Urges IPOs to Adopt Equitable Equity Structures

Members of the Council of Institutional Investors in March adopted a new policy urging companies to use a one-share, one-vote structure when they IPO. CEOs of multiple-class structures often justify them as promoting management’s ability to pursue long-term investment in the face of short-term market pressures. But the results of this approach don’t support that reasoning.

Corporate Governance and the Imagination of Reality

Valeant Pharmaceuticals has come under fire in the past few months for its too-cozy relationship with a third-party vendor. The company, like China’s Anbang Group, also operates under a debt-fueled acquisition model that has left investor confidence shaken of late. After all, business survival will trump ethical practices almost every time.

Cyber Governance – Sticking Your Head in the Sand Is Not an Option

The roles the Board of Directors and the audit committee play in cybersecurity are becoming increasingly critical. This article explores the new emphasis on Boards and audit committees being responsible for cyber risk. No longer will that responsibility be voluntary.

Thinking About Share Buybacks with Eyes Wide Open

It’s commonplace for organizations flush with cash to buy back their own shares, thereby returning money to shareholders. Is it the most effective way to leverage liquidity, though? The Board of Directors needs to be aware of the short- and long-term benefits (and costs) of a share buyback program.

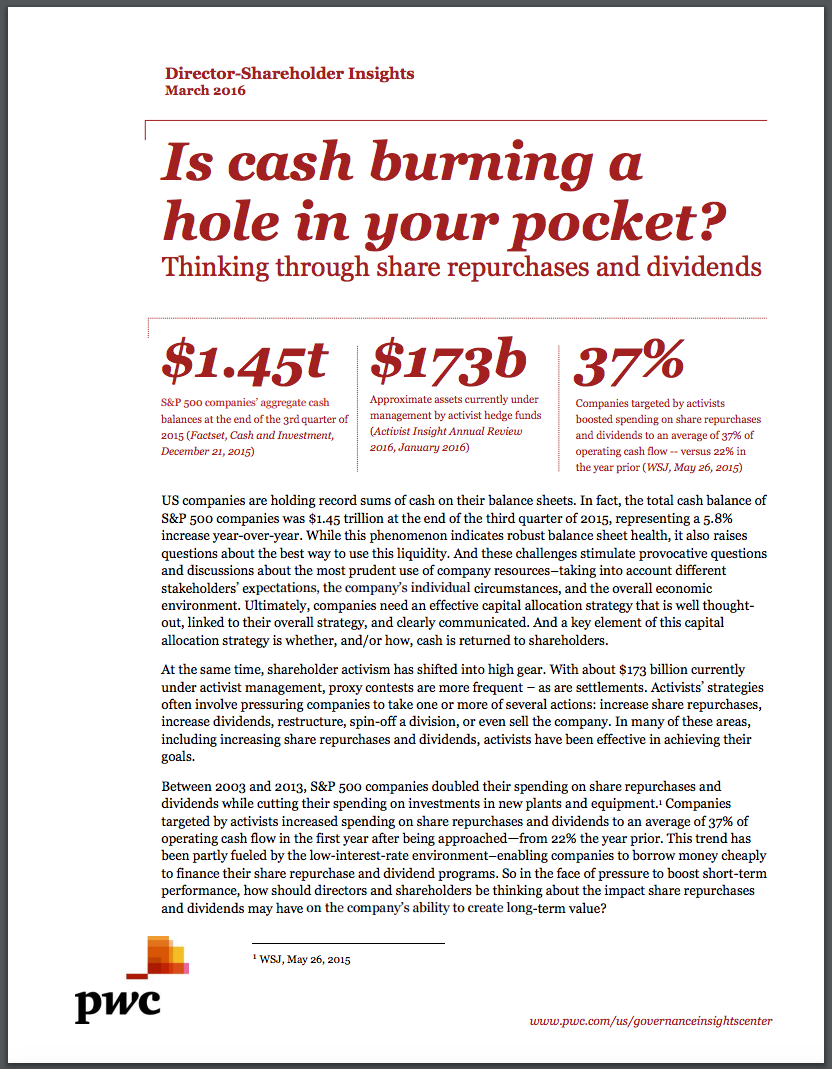

PWC: SHARE REPURCHASES AND DIVIDENDS

Is Cash Burning a Hole in Your Pocket? With record sums of cash on the balance sheets of U.S. companies, there are questions about the best way to use this liquidity. Activists often pressure companies to increase share repurchases, increase dividends, restructure, spin-off a division or even sell the company. And activists are often successful in achieving their goals. PwC’s...

The Examiners are Coming!

Regulatory examinations shouldn’t be confrontational events, as the licensee’s and the regulator’s missions should be aligned – that is, honest, fair, equitable and efficient operations. This article discusses points and tips for you to keep in mind as you plan for your first or next examination.

Corporate “Successor” Liability

In the acquisition of another business, your firm may pick up more than assets and personnel; depending on how the merger is structured, you may be on the hook for the dissolved company’s environmental liabilities.

PwC Report on Share Repurchases and Dividends

With record sums of cash on the balance sheets of U.S. companies, there are questions about the best way to use this liquidity. Activists often pressure companies to increase share repurchases, increase dividends, restructure, spin-off a division or even sell the company. And activists are often successful in achieving their goals. PwC's Governance Insights Center recently released a report titled...

Three Information Governance White Papers from ZLTECH

Compliance Pre-Review and Advanced Sampling Information Governance is a Strategy, Not a Tool The Rise of Unified Information Governance

Proxy Access Shareholder Proposals: SEC Issues No-Action Responses

The SEC staff recently issued responses to no-action requests from issuers seeking to exclude proxy access shareholder proposals from their proxy materials on the grounds that the proposals had been substantially implemented. The staff granted no-action relief to most of the companies, but denied relief to others, with the ownership threshold in the previously adopted proxy access bylaw appearing to...

Board Oversight of Management’s Risk Appetite and Tolerance: What Does it Really Mean?

Improved Board risk oversight may be the most important factor in preventing corporate governance breakdowns. This theory is picking up steam among experts, and the expectation now is that Boards should oversee management’s risk appetite and tolerance and ensure alignment with its own.