(Sponsored)

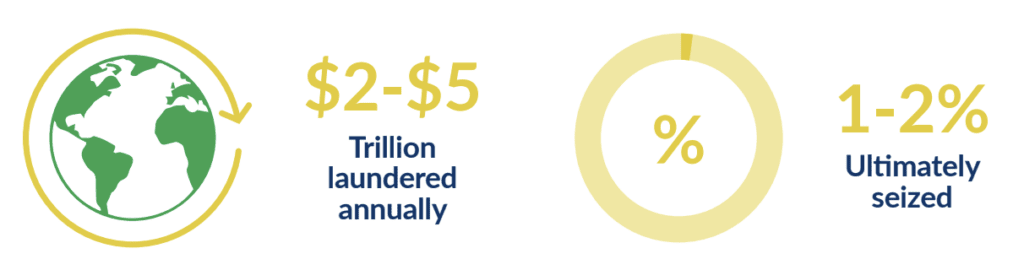

In today’s world, financial criminals are often a step ahead of regulators and financial institutions who struggle to effectively guard against the threat of money laundering and financial crime. It was once estimated by the International Monetary Fund (IMF) that money laundered throughout the world on an annual basis can be up to 2% – 5% of the global GDP ($2 – $5 trillion based on today’s figures) with only 1 – 2% of the illicit funds ultimately being seized. As a result, compliance and operations professionals are on edge as they attempt to juggle multiple priorities with looming threats of severe financial losses, fines/penalties, adverse operational impacts, and reputational damage.

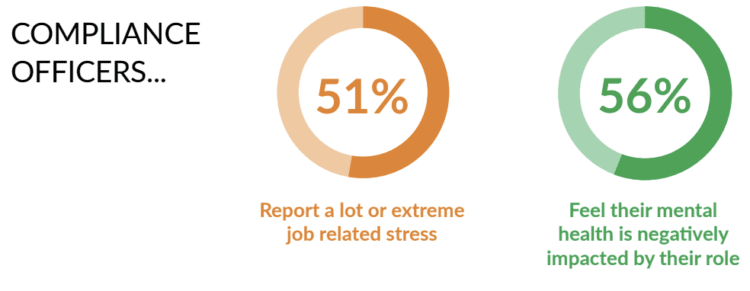

Unsurprisingly, a recent survey by Corporate Compliance Insights reveals significant hurdles to getting the job done. Out of 240 compliance officers surveyed across industries, nations, and job levels, 53% said they lack the resources to perform their job to its full potential, 40% lack organizational support and 59% feel burned out. There is no doubt that working in Compliance and Operations is a tough way to make a living and the road ahead will not get easier.

In speaking directly with senior leaders from across the financial services industry, there are several themes that have emerged as points of concern in the fight against financial crime:

Unclear decision rights

Between the first-line, second-line and Risk Management partners who are often in the middle, KYC/AML operations simply have too many cooks in the kitchen. Teams often don’t have clarity on who makes the final decision when it comes to priorities and risk acceptance. Operations may be focused on innovation and BAU while Compliance is focused on identifying multiple data remediation opportunities. Who makes the final call on what the team will prioritize? It’s often not clear and the result is frustration, frequent pivots, power grabs and lack of direction, all of which erode performance and increase risk.

Antiquated technology and manual processes

Disconnected systems, lack of automated due diligence and verification methods and exchanging documents/information via email top the list of concerns. Imagine teams existing to control for the accurate transfer of data inputs from one system to another, transaction monitoring false positive rates exceeding 95% or Operations personnel routinely exchanging 20+ emails with clients to collect KYC data points. This is the reality for many firms, and it negatively impacts data quality, efficiency, and client experience. It also leaves skilled associates under-utilized and focused on performing repetitive and mundane work where errors often occur. All of this is very expensive. Fenergo’s 2022 survey (of 1,055 top Corporate Bank executives) revealed that 72% of respondents estimated the cost of KYC to be an astronomical $1000 – $3000 per client.

Internal Competition for resources

While every Compliance Officer would like to see the bulk of available resources being applied to compliance efforts, business leaders need to allocate their budgets to promote business growth and stay ahead of the compliance curve. It often feels like important initiatives fall through the cracks while resources are applied to fire-fighting and reacting to the latest crisis or remediation project. Leaders are left to make impossible decisions that may keep one group above water while setting others up for future Matters Requiring Attention (MRAs), Consent Orders or a degraded client experience which threatens market share. Lacking the capacity to drive innovation while keeping up with business as usual and required remediation across functional groups is a key risk facing many institutions today.

Over-burdened teams

The folks who are keeping the engine going are becoming gradually disengaged, stressed and anxious in relation to their workload and the support they receive from their organization. They often work in siloed teams that create inefficiency through hand-offs, ineffective communication and a classic “check the box” approach. Additional data points from the Corporate Compliance Insights Survey referenced above indicate that 51% of Compliance officers reported “a lot” or “extreme” job related stress while 56% feel their mental health was negatively impacted by their role.

“Compliance and operations professionals are on edge as they attempt to juggle multiple priorities.”

Given the challenges, Senior Compliance and Operations Executives need to take decisive action to address these concerns and ensure the effectiveness of their anti-financial crime programs:

- Clarify roles and responsibilities across their first- and second-line functions. Performing an updated RACI (responsible, accountable, consulted and informed) exercise with participation from all key stakeholders is a great way to get everyone on the same page. This will lead to faster, more effective decision making that allows the team to cut through ambiguity and stay on track with strategic plans while tackling challenges in real time.

- Leverage data to analyze volume trends related to key KYC/AML processes over time. Peaks and valleys don’t always fit into normal business cycles, and they require further digging to identify opportunities for process improvements or tech enhancements. Issues causing volume spikes or drops can sometimes extend across groups which requires collaboration and coordinated problem solving. Executive leaders need to synchronize efforts across teams to ensure silos are broken down and groups are working together to solve the most pressing problems.

- Review KYC/AML process maps in detail with key stakeholders while documenting pain points and potential solutions. Take steps to streamline processes and build a multi-year technology road map that will be championed and supported by senior executive leadership. Consider partnering with a firm who specializes in client life cycle tools. The goal is to create a seamless client experience starting with digital document exchange and automated workflows to capture and verify data while providing transparency to clients and relationship managers on where they stand in the perpetual KYC process. Compliance and audit partners should be included in this exercise to ensure a one-team approach that mitigates risk while improving efficiency.

- Build a partnership with a firm that can help you effectively increase capacity to maintain strong business as usual performance while improving technology, process, and governance. None of the above can be done without identifying shortfalls and establishing the ability to flex up resources where required so that the strategic plan can stay on track without being compromised by unexpected challenges.

- Connect the dots and align effort with the true value of AML teams. Anti-Money Laundering efforts need to answer a higher calling and purpose. Senior executives need to talk about the activities that generate illicit funds and the impact they have on our society. They must ensure that organizations and roles are structured in a way that helps associates have a clear line of sight into how they are helping to prevent and detect financial crime. The culture in AML needs to evolve from “checking the box” to true adaptive problem solving and collaboration across functional areas and lines of defense with solid plans to break down siloes, improve technology, and simplify processes.

“The future holds a lot of promise when we work together to build a stronger AML community.”

The future holds a lot of promise when we work together to build a stronger AML community. With financial crime serving as an ever-present threat, it’s important to work with partner firms to ensure you are properly resourced and never in the fight alone. Whether you seek thought leadership, insight into how to improve your program’s effectiveness or resources to improve your speed and quality, we are here to help you maximize effectiveness and mitigate risk for the good of your institution and our global community. Reach out to us today to learn more.

About Phaxis:

Phaxis is the leading workforce solutions firm specializing in connecting the best talent with top employers from across the financial services, technology, and healthcare sectors. The Professional Services Division of Phaxis employs top industry experts to advise the firm’s Financial Institution clients on strategic priorities and resourcing plans to address critical operational and compliance challenges. Phaxis is based in New York with offices in Charlotte, Charleston, Atlanta, and Tampa.

Learn more at

Alex Roberto serves as managing director and solutions lead for the professional services division of Phaxis. In this role, he advises the firm’s financial institution clients on how to tackle their most pressing challenges in the battle against financial crime. As a 20-year veteran of the banking industry, Alex has experience and expertise that spans across AML/KYC compliance, strategy and operations, risk management, process improvement, business development and leading large and complex business units within top 10 U.S. banks. Through these experiences, he has led multiple efforts to scale operations by streamlining processes, implementing automation, redesigning operating models and delivering on C-level strategic initiatives.

Alex Roberto serves as managing director and solutions lead for the professional services division of Phaxis. In this role, he advises the firm’s financial institution clients on how to tackle their most pressing challenges in the battle against financial crime. As a 20-year veteran of the banking industry, Alex has experience and expertise that spans across AML/KYC compliance, strategy and operations, risk management, process improvement, business development and leading large and complex business units within top 10 U.S. banks. Through these experiences, he has led multiple efforts to scale operations by streamlining processes, implementing automation, redesigning operating models and delivering on C-level strategic initiatives.