Most public companies will be required to disclose details about executive compensation starting with next year’s proxy statements, under rules the SEC formally adopted in August. Haynes Boone partner Rosebud Nau and associate Alexandria Pencsak sort through the information that will soon be required.

In August, the SEC adopted Release No. 34-95607 implementing pay versus performance disclosures called for under Section 953(d) of the Dodd-Frank Wall Street Reform and Consumer Protection Act. As set forth in new paragraph (v) of Item 402 of Regulation S-K, covered public companies will be required to include significant new information reflecting the relationship between executive compensation “actually paid” (as defined in the rule) by the company and the company’s performance.

The new rule applies to public reporting companies, except emerging growth companies, foreign private issuers and registered investment companies. The new rule also applies to smaller reporting companies (SRCs) but with scaled disclosure requirements described below.

Covered public companies must include this disclosure in proxy or information statements covering fiscal years ending on or after Dec. 16, 2022 — for calendar year-end companies, this means a proxy or information statement filed in 2023. Notably, the new disclosure is not required in an annual report on Form 10-K or in any registration statement.

We expect that covered public companies (including compensation committees) will need significant lead time to prepare for the upcoming disclosures outlined below, especially with respect to determining the compensation “actually paid” to the principal executive officer (PEO) and other named executive officers (NEOs). The new disclosure will require companies to prepare valuations of historical equity awards and pension benefits as well as a “clear description” of how the compensation “actually paid” to the PEO and the other NEOs compares to the company’s cumulative total shareholder return (TSR), net income and the company-selected measure.

Summary of key disclosure requirements

Tabular disclosure

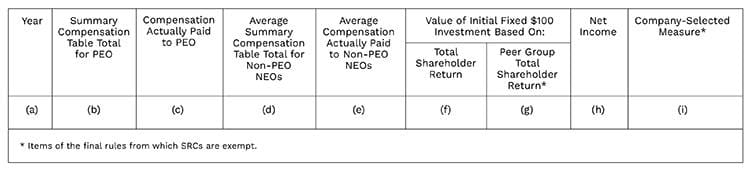

New Item 402(v) of Regulation S-K requires disclosure of executive compensation information and financial performance measures in the following tabular format:

Time periods and phase-ins

All reporting companies, except for SRCs, must provide pay versus performance disclosure for each of the company’s five most recently completed fiscal years. For companies other than SRCs, a phase-in period will allow the company to provide the information for three years in the first proxy or information statement in which it provides the disclosure, adding another year of disclosure in each of the two subsequent annual proxy or information statement filings that require this disclosure.

Total compensation from summary compensation table

A company must report the total compensation of its PEO (column (b)) and the average of the total compensation of its other NEOs (column (d)), in each case as reported in the summary compensation table.

Compensation ‘actually paid’

For purposes of columns (c) and (e), compensation “actually paid” is calculated by adjusting the total compensation reported in the summary compensation table by (i) deducting (x) the aggregate change in the actuarial present value of all defined benefit and actuarial pension plans and (y) the amounts reported in the “stock awards” and “option awards” columns of the summary compensation table, and (ii) adding back certain amounts relating to (x) the service cost and prior service cost for defined benefit and actuarial pension plans and (y) the fair value of equity awards (or change in fair value) measured as of specified dates depending on the grant date and the vesting status of the award at the end of the covered fiscal year.

TSR

TSR for the company (column (f)) and the peer group (column (g)) should be calculated in the same manner as under Item 201(e) of Regulation S-K except that the measurement period should coincide with the number of years reported in the table. For purposes of determining the TSR of the company’s peer group, the company must use the same index or issuers used by it for purposes of item 201(e)(1)(ii) of Regulation S-K or, if applicable, the peer group described in the company’s compensation discussion and analysis.

Net income

Companies must include their net income for the relevant fiscal years.

Company-selected measure

The company-selected measure is the measure the company believes represents the “most important financial performance measure” (that is not otherwise required to be disclosed in the table) used by the company to link compensation actually paid to the NEOs to company performance. The company-selected measure must be a financial performance measure, which means any measure determined and presented in accordance with the accounting principles used in preparing the company’s financial statements, any measures that are derived wholly or in part from such measures, stock price and TSR (although TSR may not be used as the company-selected measure because it is otherwise required to be disclosed in the table). As discussed further below, the company-selected measure may be a non-GAAP financial measure.

Location of disclosure and tagging

The SEC has given companies flexibility to determine the location in the proxy statement of the new disclosure. Companies will be required to use Inline XBRL to tag the pay versus performance disclosures.

Description of relationships

The new Item 402(v) also requires the company to provide a “clear description” (graphically, narratively or a combination of the two) of the relationship between (i) the compensation actually paid to its PEO and the compensation actually paid, on average, to its other NEOs and (ii) each of the financial measures disclosed in the table (the company’s cumulative TSR, the company’s net income and the company-selected measure), in each case over the five most recently completed years set forth in the table (subject to the transition rule and SRC requirements). The company also will be required to include a description of the relationship between the company’s cumulative TSR and its peer group cumulative TSR.

Tabular list of most important financial measures

The final rules require that covered public companies, other than SRCs, provide a tabular list of at least three, and up to seven, of their most important financial performance measures used to link executive compensation actually paid to company performance. For purposes of Item 402(v), “financial performance measure” means any measure determined and presented in accordance with the accounting principles used in preparing the company’s financial statements, any measures that are derived wholly or in part from such measures, stock price and TSR.

A financial performance measure need not be reported in the company’s financial statements. If the company provides a non-GAAP financial measure, it must disclose how the measure is calculated from the company’s audited financial statements. Disclosure of the non-GAAP measure is not otherwise subject to item 10(e) of Regulation S-K or Regulation G.

Further, companies are permitted to include non-financial performance measures in the list, if such measures are among their most important performance measures and the company has disclosed at least three (or fewer, if the company only uses fewer) most important financial performance measures. If fewer than three financial performance measures were used by the company to link compensation actually paid to the company’s NEOs for the most recently completed fiscal year to company performance, the list must include all such measures that were used.

SRCs

SRCs are subject to scaled disclosure requirements. Initially, SRCs may provide only two years of pay versus performance disclosure. Following the first year of disclosure, SRCs may provide pay versus performance disclosure for only their three most recently completed fiscal years. In addition, an SRC is not required to (i) report peer group TSR or a company-selected measure in the pay versus performance table, (ii) provide a tabular list of the most important financial performance measures or (iii) make certain adjustments related to defined benefit and actuarial pension plans when calculating compensation “actually paid.” Finally, an SRC will be subject to the Inline XBRL tagging requirement beginning with the third filing in which it provides pay versus performance disclosure.

Practical considerations

Companies should begin planning and preparing immediately in order to be well-positioned to make the required disclosures in next year’s proxy statements:

Compensation committee

Given the compensation committee’s role in reviewing (and in many cases, approving) disclosure of executive compensation information, a company should engage its compensation committee early in the process. For example, the compensation committee will need to be involved in identifying the company-selected measure and in selecting the appropriate performance measures utilized for the three to seven “most important” financial performance measures for the tabular list.

The task of identifying the company’s most important measures may be difficult due to the nuanced ways in which companies determine and approve compensation. Also, there could be a disconnect between the required disclosure and the compensation committee’s actual process for evaluating and approving executive compensation. The compensation committee should consider whether any additional voluntary disclosures would be appropriate and useful to investors for purposes of explaining the relationship between executive compensation and company performance.

Calculation of executive compensation actually paid

Companies should begin collecting information and running calculations based on historical data currently available. Companies may also consider the need to engage third parties to assist with valuations or other calculations that the company does not ordinarily prepare. For example, companies will be required to determine the fair value of equity awards as of various dates, in order to calculate the changes in fair value that are components of compensation “actually paid.” At this time, companies can get a head start by running fair value calculations as of the prior fiscal year-end (or Dec. 31, 2021, for calendar-year companies) as well as vesting date fair values for any awards that vested during the year.

This exercise will also be instructive in determining whether existing internal controls and processes over the valuation of stock awards, including the assumptions used in determining fair value, are sufficient, or if new controls or processes need to be implemented. Calculating compensation “actually paid” also involves deducting the change in the actuarial present value of pension benefits and then adding back the pension service cost for the year and, in the case of any plan amendments (or initiations), the associated prior service cost (or deducting any associated credit). Again, it is likely that the company does not already run such calculations on a regular basis, so it is important to prepare in advance to ensure the necessary information is available for disclosure in a timely manner.

Narrative and/or graphical description of relationships

In addition to the tabular disclosure, new Item 402(v) requires a company to use the information in the table to provide a clear narrative, graphical, or combined narrative and graphical description of the relationships between compensation “actually paid” and the financial measures required to be disclosed in the table (the company’s cumulative TSR, net income and the company-selected measure). Item 402(v) provides flexibility as to the format in which the company presents the descriptions of the relationships.

Companies should begin working on this disclosure now, as this disclosure is likely new and not contained in the historical compensation discussion and analysis because the compensation committee may not use the measures required to be disclosed in the pay versus performance table to determine NEO compensation. Further, as an initial matter, a company must evaluate whether narrative, graphical or a combination of narrative and graphical disclosure is the appropriate format.

Conclusion

As the new rule will require substantial new disclosures beginning in the 2023 proxy season, it is important for companies to begin discussions with their compensation committees and to ensure they are collecting the information required in order to comply with the new rule. Drafting disclosures that describe the relationship between the compensation “actually paid” and the financial measures required to be disclosed in the table will take time to prepare. Additionally, companies should begin mocking up the required table for historical years to better understand what information is necessary and to give them time to address any interpretive questions that arise.

Rosebud Nau

Rosebud Nau Alexandria Pencsak

Alexandria Pencsak