Peer-to-Peer (P2P) lending is a relatively recent financial innovation that has taken the lending market by storm and fueled financial inclusion. Tata Consultancy Services’ Sasidharan Chandran discusses P2P business models, associated risks and implications of the crowdfunding industry on the traditional banking setup.

Loan-based crowdfunding, also known as peer-to-peer (P2P) lending, has evolved as a disruptive force in lending in recent years. The U.S., U.K., Europe and China are the major markets for the crowdfunding industry. As per the Peer-to-Peer Finance Association (P2PFA), cumulative lending through P2P platforms globally will be a $150 billion industry by 2025. It is probably because of the 2008 financial crisis that we are witnessing a type of shadow banking practice taking the lending marketplace by a storm.

This article provides an in-depth analysis of the P2P business models, various aspects of risks and available risk management opportunities for the loan-based crowdfunding industry to embrace, concluding with implications for banks.

Crowdfunding Business Models

According to the International Organization of Securities Commissions (IOSCO), there are two overarching business models governing the peer-to-peer lending market: the notary model and the client-segregated account model.

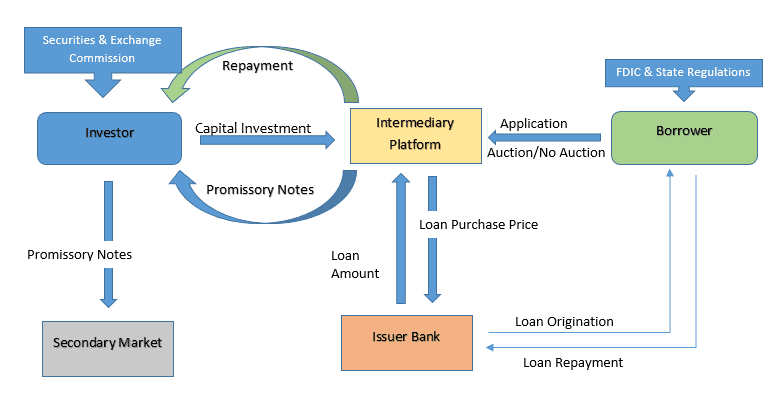

Notary Model

This is a peer-to-peer lending business model where the online platform acts as an intermediary between the investor and the borrower. A borrower visits an online platform and submits the completed application form for a loan. The borrower’s risk profile is analyzed using the loan-issuing bank’s underwriting guidelines, and the application is approved. The borrower’s loan requirements are usually listed on the platform’s website for investors to scrutinize and fund.

After obtaining sufficient investor commitments, the loan amount gets transferred to the borrower by the issuing bank. Once the loan is disbursed, proceeds from investors are used by the borrower to purchase the loan from the issuing bank. Investors who successfully bid the loan are technically issued a note by the platform for their value of the contribution. The notary model shifts the risk of loan nonpayment away from the originating bank to the investors themselves.

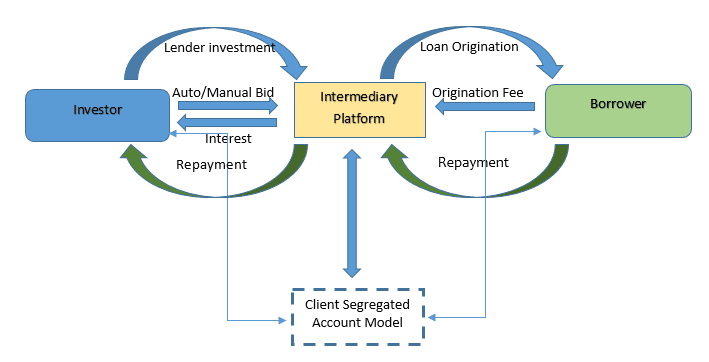

Client-Segregated Account Model

In this model, a contract is established with the help of an intermediary platform by matching the individual lender and the borrower. Lenders allocate their funds to individuals or businesses in one of the following ways.

- Automatic lending based on the platform’s random allocation method

- Manual bids for allocation based on the lender’s own judgment

Unlike the notary model, the issuing bank is not involved; funds are exchanged directly between the lender and the borrower.

The P2P platform allows funds from lenders and borrowers to be separated from an intermediary’s balance sheet and held through a legally segregated client account. The intermediary doesn’t have any claim over funds in the event of platform’s collapse.

Another business model called the “guaranteed return model” is widely practiced, but only in China. As the name suggests, lenders expect a fixed rate of interest on the invested amount. As per market reports, investor interest to practice this model is high, but less in demand from the borrower.

Risks Arising From P2P Business Models

1. Can you debit the impact of credit risk emanating from crowdfunding?

Impacted Business Models: Notary, Client Segregated Account Model, Guaranteed Return Model

The main risk factor associated with P2P lending platforms is that they are not obliged to make any payments to the lender if the borrower of the loan defaults. Lack of transparency in how loans have been categorized by grades (categorization ranges from low-risk/low-reward grades to high-risk/high-reward grades), categorization according to the creditworthiness of the borrower and inefficiencies in the credit risk scoring models/algorithms used by the lending platforms have casted doubts over the credit quality and rating of this unsecured lending industry.

Overcoming the Effect of P2P Credit Risk

Performing Scenario/Sensitivity Analysis

On the lines of stress testing, industry regulators could possibly define scenario/sensitivity analysis and establish a common framework for the P2P industry to consistently compare and stress assess the credit quality of assets it holds. The results of the testing could be used for developing early warning signals and also for contingency fund planning to meet any situation arising out of emergencies.

Reducing Too Much Reliance on Traditional Means of Decision-Making

Market place lenders must move away from having complete reliance only on traditional risk metrics, such as FICO scores, and explore the use of alternate sources of data, such as social credit scoring. This will help them to serve borrowers with limited credit history and also keep loan “charge-off” rates under control.

2. How Does Conduct Risk Surface in Crowdfunding?

Impacted Business Models: Notary, Client Segregated Account Model, Guaranteed Return Model

The fast-growing crowdfunding industry has been a breeding ground for conduct risk. Lender and borrower, brought together by an online market place, experience a high possibility of friction between them due to information asymmetries.

Predatory Borrowing – A borrower looking for funds may conceal his poor credit rating and may over-quote his risk appetite to avail excess credit by convincing the lender.

Predatory Lending – Being an online marketplace, financially unsophisticated borrowers may not be aware of the financial options available and fall in line with the choices provided by the platform lender.

How Can the P2P Industry Address Conduct Risk?

- Undertake an assessment to understand the maturity levels of various conduct risk components, identify root causes and perform remediation.

- Head off risk at the prospect stage. Marketplace lenders could use case management or rule engine-based flagging to identify high conduct risk borrowers at the onboarding stage.

- Embrace risk culture that promotes compensation linked to consumer satisfaction.

- Use AI/machine learning to predict high conduct risk transactions/incidents before they happen.

3. “Step-in Risk” Stemming From P2P Shadow Banking

Impacted Business Models: Notary

The top P2P marketplace lenders in the world are funded by partner banks. A closer look at some of the P2P annual reports confirms this arrangement.

Applying the BCBS definition of “step-in risk” to the P2P notary business model, there is a strong case of “step-in risk” on a partner or issuer bank if the online marketplace lender goes through a period of financial crisis.

4. The P2P Platform is Not Without Exposure to Fraud Risk

Impacted Business Models: Notary, Client Segregated Account Model, Guaranteed Return Model

Crowdfunding platforms are subject to the same level of risk as any other credit-providing financial institution and faces threat of money laundering, identity theft, terrorist financing and data theft.

Strengthening KYC norms, enhanced due diligence and machine-learning-based analytics for customer screening to identify risk patterns and prevent fraudulent activities are some ways to mitigate fraud risk.

The Impact on Banks Due to the P2P Lending Industry

- Banks have started viewing P2P lending services as complementary, not as competition. Banks in the U.S. and U.K. have plans to set up their own P2P platforms or work with existing platform lenders to make credit available to consumers who do not fit into or qualify for the traditional model of lending. One of the ways is with the help of social credit scoring using information gathered from social data, the applicant’s community and the applicant’s financial behavior.

- Banks have the regulatory requirement to hold a considerably large amount of capital compared to P2P platforms. Having said this, when a bank partners with a P2P platform for a notary model of lending, banks do not have to devote much capital since they behave more like a pass-through agent of funds, but “step-in risk” remains.

- Growth, easy accessibility and the availability of loans at competitive rates in the P2P industry could result in a situation where safe borrowers belonging to the traditional banking industry shift to P2P platforms. This, in turn, could ultimately make banks lend to less creditworthy borrowers.

- On the cost front, because P2P is a completely online-driven lending model, there is no necessity to run a traditional bank branch and incur other legacy overheads. Banks that are currently focusing on optimization and rationalization to cut costs could emulate and carry out the best practices of the P2P lending model by going digital and transform customer experiences through the intelligent use of data and analytics.

With the alternate modes of lending gaining prominence because of convenience, creativity and technological growth, P2P lenders are here to stay, widening their areas of services and offering tough competition to the traditional lending setup.

Also from Sasidharan Chandran: 6 Steps to Minimize Conduct Risk

Sasidharan Chandran is an experienced banking and financial services risk management consultant currently serving in the Risk and Regulatory Compliance Practice at Tata Consultancy Services Ltd. His risk consulting experience revolves around credit risk, conduct risk, BCBS 239, Basel regulatory programs, forbearance and non-performing exposures reporting and digital initiatives.

Sasidharan Chandran is an experienced banking and financial services risk management consultant currently serving in the Risk and Regulatory Compliance Practice at Tata Consultancy Services Ltd. His risk consulting experience revolves around credit risk, conduct risk, BCBS 239, Basel regulatory programs, forbearance and non-performing exposures reporting and digital initiatives.