This piece was originally shared on Thomson Reuters’ blog and is republished here with permission.

As compliance officers continue to complain of regulatory fatigue, a major annual survey reveals that few expect the burden to diminish in the coming year.

The sheer volume and scope of regulatory change, coupled with concerns about the personal liability of compliance managers, has made the regulatory landscape increasingly hard to navigate.

Download the Cost of Compliance 2016

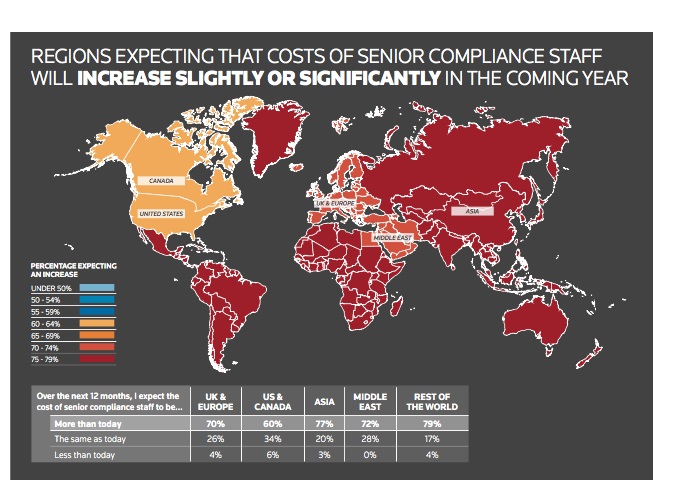

With no apparent let-up in the pace of change, the scarcity of skilled compliance personnel is forcing firms to do more with less and to consider options such as outsourcing as well as the increased use of technology.

With no apparent let-up in the pace of change, the scarcity of skilled compliance personnel is forcing firms to do more with less and to consider options such as outsourcing as well as the increased use of technology.

Thomson Reuters has just published the findings of its seventh annual Cost of Compliance survey. Seen as an important voice for compliance practitioners, the survey involved more than 300 financial services firms worldwide, including some of the largest systemically important institutions.

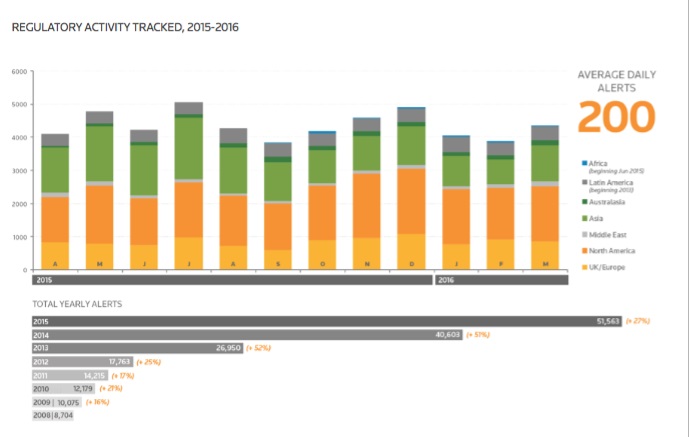

The results show that 69 percent of firms are expecting regulators to publish even more information in the coming year, with 26 percent expecting significantly more.

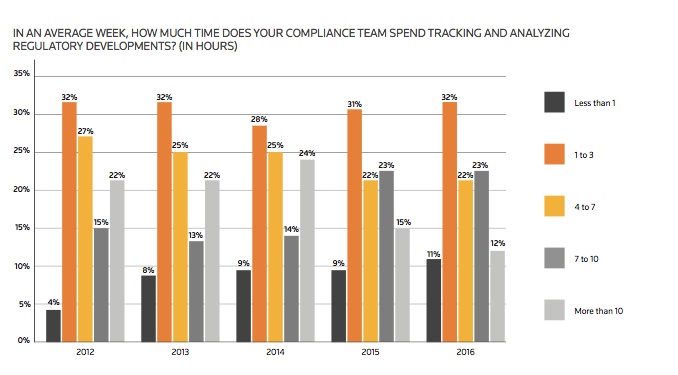

More than a third of firms continue to spend at least a whole day every week tracking and analyzing regulatory change — representing a considerable commitment of resources.

Watch the video — Expert advice on the Cost of Compliance 2016 from Reuters Content Solutions

Harnessing technology

It could be argued, though, that while regulation is generally perceived as a cost to institutions, it also offers opportunities.

Financial services institutions should be ready to exploit new business possibilities, such as crowdfunding, and appreciate that governing a commercial enterprise that demonstrably protects investors is better for the business and profit margins in the long term.

Regulatory-tracking technology makes life easier to some extent, but compliance professionals still have to identify the resources they need, as well as learn to use them, analyze the results and keep the technology adaptable to the business as it grows.

Ensuring that technology works as intended requires policies, procedures, testing and controls. Since the compliance remit has expanded to include not only customer data protection but cybersecurity concerns, these financial technology instruments become worrisome when connected to networks.

Technology that enables compliance professionals to meet their obligations on sanctions-screening, anti-money laundering and Know Your Customer are already integral components of anti-fraud business protocols.

Best practices

Going beyond these obligations, technological advancements are also helping compliance professionals keep their business colleagues in step with rules and laws by reviewing emails, trade blotters and positions, fee and expense allocations and marketing documents.

Choosing such tools, hiring outside vendors, training personnel on using them and verifying where the tools report to means some human judgment is integrated into their determinations and consumes resources. Not using them, however, can put companies behind the competition and at a disadvantage in proving to regulators they are taking all possible steps to meet regulatory imperatives.

The tools help document these efforts, offering transparency internally to the board, shareholders and investors, and providing compliance executives important documentation of their vigilance. They also help businesses take new mandates and industry best practices and turn them into policies and procedures.

Managing risk

As the Cost of Compliance report notes, three-quarters of firms are expecting the focus on managing regulatory risk to rise this year.

A significant area of concern for firms is managing the risk posed by their own personnel and business suppliers. The most careful hiring practices, sound vendor contract provisions, ongoing training, workflow monitoring and anonymous whistleblower hotlines cannot ensure a business will not face conduct risk issues.

They are a solid base, though, upon which to develop a continuous conversation about the company’s intolerance for behavior that runs counter to its policies and procedures.

This is a conversation that the board and executive team should lead, with supervisors reinforcing the concepts at a department level through incentives and significant penalties for non-adherence.

The cost of compliance is high, but the cost of investigations, enforcement, tumbling share values and tarnished public images — the cost of noncompliance — is often higher.

Investments in compliance pay off because compliance is integral to the business.

The report’s authors would like to thank Julie DiMauro (Twitter, Julie_DiMauro), a writer for the Thomson Reuters Regulatory Intelligence subscription service, for authoring this blog post.

Julie DiMauro is a regulatory intelligence and e-learning expert in the GRC division of Thomson Reuters Regulatory Intelligence. Follow Julie on Twitter

Julie DiMauro is a regulatory intelligence and e-learning expert in the GRC division of Thomson Reuters Regulatory Intelligence. Follow Julie on Twitter