I’ve got some really good news that may or may not surprise you: In business, good guys not only finish first, but way ahead of the pack.

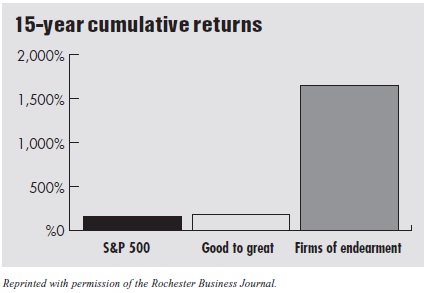

In their book “Conscious Capitalism,” Raj Sisodia and John Mackey compare the financial performance of the S&P 500 and Jim Collins’ “Good to Great” companies with “firms of endearment,” whose distinguishing characteristic is that they practice “conscious capitalism.” The 15-year cumulative returns were 157 percent, 177 percent and 1,646 percent, respectively.

Before I describe the four tenets of conscious capitalism, you should know that the firms practicing it are not mythical companies from another planet. They are corporations we know and interact with on a regular basis, including 3M, Starbucks, Wegmans, UPS, Honda, Costco, LL Bean, Southwest, CarMax, Trader Joe’s and Commerce Bank. You should also know that conscious capitalism is not “corporate social responsibility” and is distinguishable from related business models like “natural capitalism,” the “triple bottom line,” “shared-value capitalism” and “creative capitalism.”

Before I describe the four tenets of conscious capitalism, you should know that the firms practicing it are not mythical companies from another planet. They are corporations we know and interact with on a regular basis, including 3M, Starbucks, Wegmans, UPS, Honda, Costco, LL Bean, Southwest, CarMax, Trader Joe’s and Commerce Bank. You should also know that conscious capitalism is not “corporate social responsibility” and is distinguishable from related business models like “natural capitalism,” the “triple bottom line,” “shared-value capitalism” and “creative capitalism.”

According to Mackey and Sisodia, “A good business doesn’t need to do anything special to be socially responsible. When it creates value for its major stakeholders, it is acting in a socially responsible way. Collectively, ordinary business exchanges are the greatest creator of value in the entire world. This value creation is the most important aspect of business social responsibility.”

This way of looking at business is a significant departure from the many movements like corporate social responsibility, which start with the premise that the underlying structure of business is flawed and needs to be changed. Instead, conscious capitalism begins with the premise that free-enterprise capitalism is fundamentally good, but can and should evolve to fully realize its potential.

Conscious capitalism is grounded in four tenets: higher purpose, stakeholder integration, conscious leadership and conscious culture and management.

Higher Purpose

Conscious businesses have a higher purpose. This means they have taken the time to find answers to basic questions like “Why do we exist?” and “What is the contribution we want to make?” According to Mackey and Sisodia, a firm that does this well will create the “magnet” that holds the organization together; attracts the right team members, customers, suppliers and investors; and aligns them in a common cause.

Such a definitive statement about the difference your firm is trying to make in the world has the added advantage of giving energy and relevance to a company and its brand. Examples of “higher purpose” include:

- Disney—to use our imaginations to bring happiness to millions.

- Southwest Airlines—to give people the freedom to fly.

- Charles Schwab—a relentless ally for the individual investor.

Stakeholder Integration

Instead of looking for trade-offs between stakeholders, conscious businesses look for synergies. They consciously look for ways to make all key stakeholders better off and get all of their interests aligned in the same direction.

This paradigm shift, from looking at business as a “zero-sum” game to a “positive-sum” game, recognizes that at its core, business is a highly collaborative activity. By consciously seeking ways to run a business in a manner that benefits employees, suppliers, customers, shareholders, the environment and the communities in which they operate, companies maximize the energy, creativity, loyalty and engagement of all those who are participating in the commercial activities and interactions that are the life blood of every for-profit enterprise.

Conscious Leadership

Mackey and Sisodia describe conscious leaders as “strong individuals who possess exceptional moral courage and are able to withstand constant scrutiny and criticism from those who view business in a more traditional, narrow manner. Above all, conscious leaders view themselves as trustees of the business, seeking to nurture and safeguard it for future generations, not to exploit it for the short-term gains of themselves or current stakeholders.”

This is a pretty high bar and may strike some as describing a mythical corporate superhero rather than a flesh-and-blood person. However, I think it is self-evident that business professionals can optimize their effectiveness by aspiring to become “conscious leaders.”

Conscious Culture

According to Mackey and Sisodia, a conscious culture has seven important attributes: trust, accountability, caring, transparency, integrity, loyalty and egalitarianism. Although a more expansive discussion of these attributes is beyond the scope of this column, I suspect most people would agree that companies with these qualities likely have some significant advantages over companies that lack them. As Peter Drucker once said, “Culture eats strategy for breakfast.” Leaders must focus getting their culture right in order to effectively implement any strategy.

I don’t think it is particularly surprising that companies practicing the four tenets significantly outperform both the broader stock market and Collins’ “Good to Great” companies. By consciously doing business in a manner consistent with these tenets, such firms reduce their enterprise risks, recruit and motivate the best people and earn the trust and loyalty of key stakeholders. What Mackey and Sisodia have done is provide a road map for us to follow to achieve these ends, not only maximizing profits over the long term, but giving meaning and purpose to our work.

If you are interested in learning more about conscious capitalism and how you might bring these ideas to your company, I’d recommend Mackey’s and Sisodia’s book. I also recommend that you join the Rochester chapter of Conscious Capitalism, whose website is www.meetup.com/Greater-Rochester-Chapter-of-Conscious-Capitalism.