Boards today are facing increased scrutiny about who exactly is sitting in the boardroom. Some critics say board members are too old, they’ve served for too long, and there’s not enough diversity in the boardroom. Even some directors believe boards need a refresh: 39% of directors polled in our 2015 Annual Corporate Directors Survey believe a fellow board member should be replaced, up from 31% in 2012.

Institutional investors are pushing for change. Some have been taking a tougher tone on the importance of board composition, which could impact proxy voting decisions. Others are filing shareholder proposals for proxy access to nominate their own director candidates. Also, looming for many companies and boards is the threat of a shareholder activist campaign.

Directors with very long tenures or who lack deep industry knowledge may make easy targets for activist investors. Some activists may go after perceived governance weaknesses as a means to gain support from other institutional investors concerned about board composition. While shareholder activists may have a variety of goals in mind when targeting a company, activists will often seek board seats at investee companies.

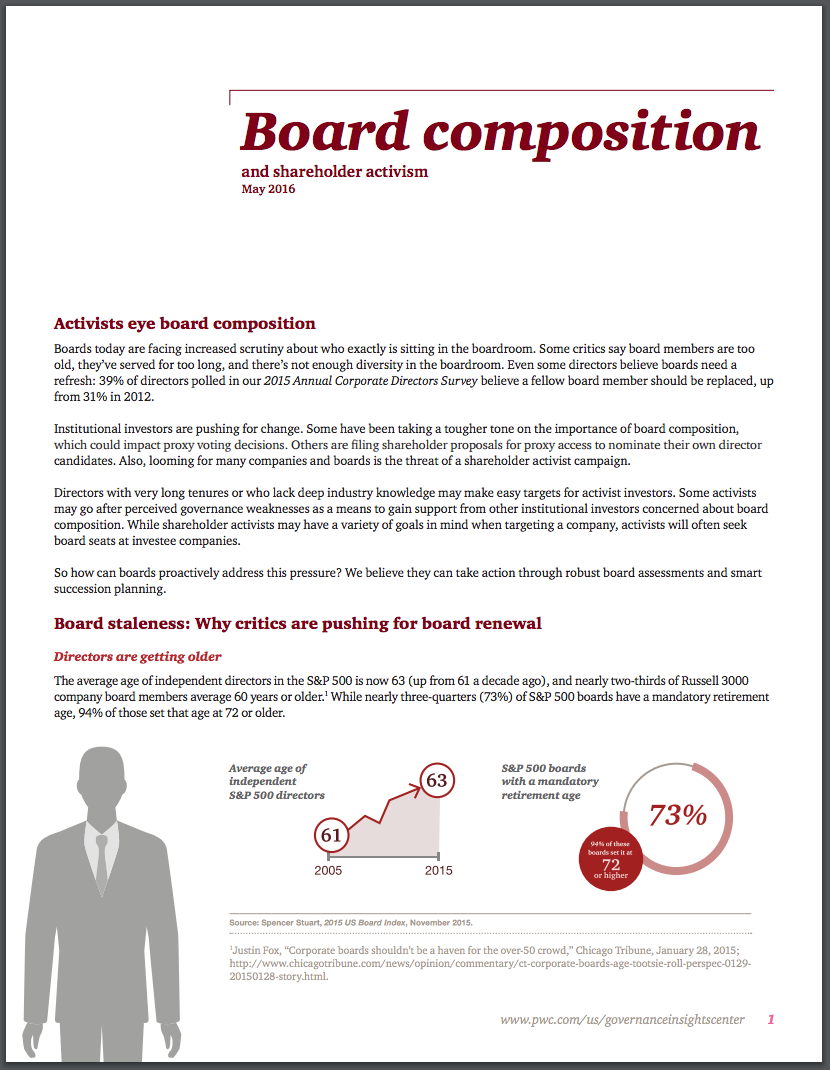

So how can boards proactively address this pressure? We believe they can take action through robust board assessments and smart succession planning.