A new risk solution from Thomson Reuters is empowering financial institutions to create and maintain their inventory of model data using effective workflow management.

As model inventories have become more complex and widespread, the increase in regulatory oversight and governance has grown.

This means there’s pressure for modeling that allows firms to meaningfully quantify whether they have exceeded their risk appetite and have an efficient governance framework that reduces the risk of model misuse.

Model Risk Management, a solution on our Connected Risk platform, ensures that the full extent and status of the model inventory is visible at all times and that the right people are informed of upcoming deadlines and necessary actions.

That organization is provided with a flexible approach to model governance, tailored to meet internal policies and evolving regulator requirements.

The solution helps senior managers understand the modeling being used and explain it to regulators and the board.

Regulatory pressure

Model Risk Management was released last month, following on from the launch of Regulatory Change Management, which is also available on Connected Risk.

Model Risk Management provides structure and a best practice approach to creating and maintaining model inventory, while delivering a simple, yet powerful approach to governance.

The solution allows for the capture of on-the-go updates and additions to the model inventory with real-time reporting to regulators, committees and cross-risk functions.

Model risk has become a focus for a growing number of financial and insurance institutions globally.

This reflects increasing regulatory pressure from:

- Comprehensive Capital Analysis and Review

- Fundamental Review of the Trading Book

- Targeted Review of Internal Models

- International Financial Reporting Standard 9

- Supervision and Regulation Letter 11-7

- Basel III

A number of these regulations require an inventory that provides a holistic understanding of how each of the models in the business is derived, validated and applied.

Discover a connected approach to the regulatory change management process

How does it work?

Model Risk Management enables institutions to evidence a robust, clear and holisticmodel governance framework for internal and external stakeholders that accommodates global regulatory requirements with greater flexibility.

Use a robust enterprise risk manager and framework to navigate management challenges

This solution ensures all model risk reporting is in one place and contains all critical information, enabling teams to:

- Track all models, across all risk thematics, using a single inventory store, helping to reveal any potential redundancy and duplication within the inventory.

- Indentify model issues and track through to resolution.

- Add supporting documentation to demonstrate methodology and results.

- Implement a robust end-to-end model governance process.

- Have a faster response to regulatory changes that impact your models.

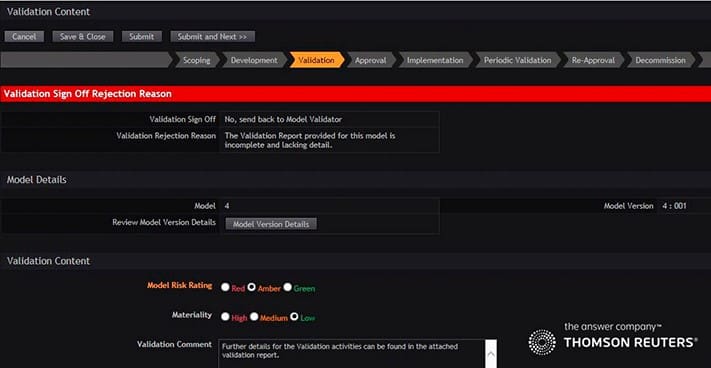

An example screenshot of a Workflow Update in Model Risk Management

Connected Risk platform

Thomson Reuters Connected Risk is a software platform that enables firms to gain greater insight into the risks they are exposed to and what actions they need to take.

Through standardized, tailorable and automated processes, organizations can make informed decisions with greater ease and efficiency and achieve a focused view of their audit, risk and compliance landscape.

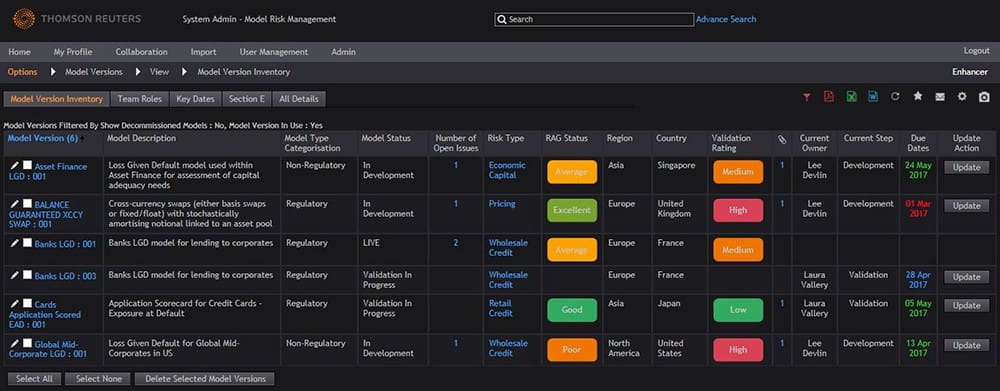

An example screenshot of the Model Inventory in Model Risk Management

This is achieved by integrating all critical risk data from disparate sources to provide teams with a dashboard view of the organization’s risk profile.

They can benefit from a high level overview of risks across all areas, and drill down further to view risk information in granular detail. This helps to meet both the individual and collective needs of the organization.

This post was written by Gareth Evans, Managing Director, Enterprise Risk Management Technologies, Thomson Reuters.