In recent years, the number of people and businesses falling victim to fraud has increased at an alarming rate. As technology continues to improve, fraudsters are finding new and creative methods to continue their work.

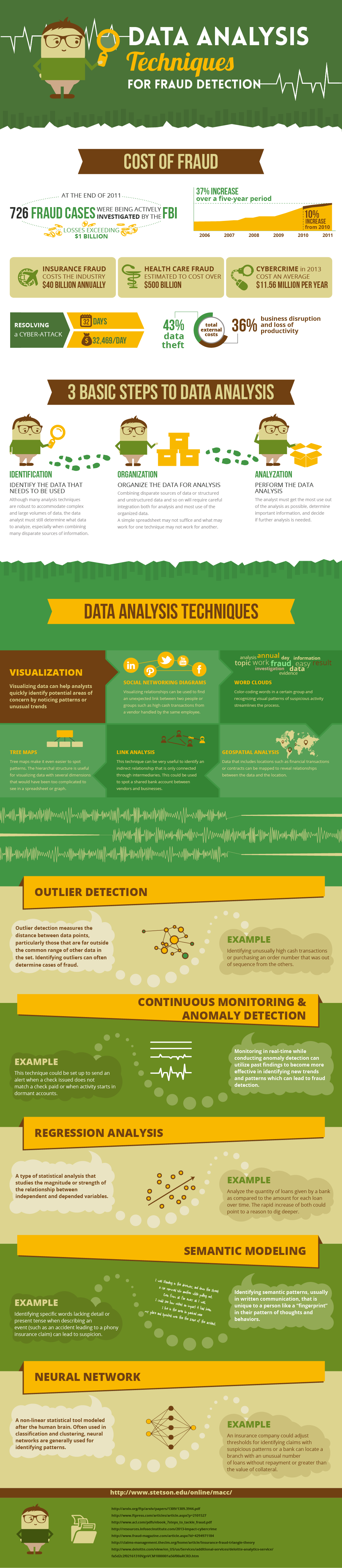

Fraudulent practices targeting businesses are growing at an alarming rate and are costing industries billions of dollars. In the insurance industry alone, $40 billion per year is lost as a result of fraud. The theft of money is not the only culprit; 36 percent of total loss due to fraud is directly related to business disruption and loss of productivity.

- Health care fraud estimated to cost over $500 billion.

- Cyber crime in 2013 cost an average $11.56 million per year.

Fraud prevention requires innovative solutions that can both fight fraudulent practices and protect individuals and businesses from disruption and loss of productivity.

Here are some ways in which data analysis can be the solution to address this problem:

Three Steps to Data Analysis

- Identification — identifying the data that needs to be used.

- Organization — organizing data for analysis.

- Analysis — performing data analysis.

Data Analysis Techniques That Can Help

- Visualization — help analysts identify potential areas of concern.

- Social networking diagrams to find unexpected links between two people or groups.

- Word clouds to recognize visual patterns of suspicious activity.

- Tree maps to make it easier to spot patterns.

- Link analysis to identify an indirect relationship connected through intermediaries.

- Geospatial analysis to map relationships between data and location.

To learn more about how data analysis can be utilized for fraud detection, check out the infographic below, brought to you by Stetson University’s online Master of Accountancy Program.