Female Representation on Boards Remains Low, But Slowly Changing

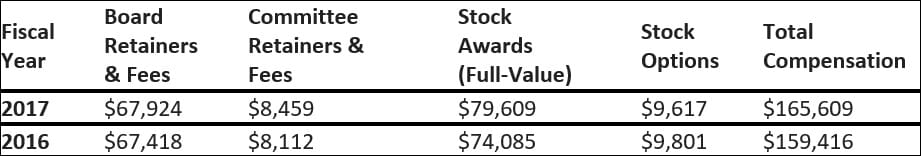

November 26, 2018 (CHICAGO) (BUSINESS WIRE) – Board director compensation at middle market companies rose four percent between fiscal years 2017 and 2016, according to a new report, The BDO 600: 2018 Study of Board Compensation Practices of Mid-Market Public Companies. Equity-based pay comprised 54 percent of board compensation packages, with companies favoring the use of stock awards over stock options. Pay from stock awards increased seven percent year-over-year.

The BDO USA, LLP, analysis of middle market companies expanded this year to include an assessment of board structure, term limits, the representation of women on boards and other issues. Among the key highlights:

- Average Board Size: Boards have an average of nine members, 81 percent of whom are independent directors.

- Median Board Fee: The median total fee for board members was $1.2 million; health care companies pay the highest median fee, while the banking industry pays the lowest.

- Stock Ownership Guidelines: Two-thirds of companies have director stock ownership guidelines. The average stock ownership value guideline is $298,119; energy companies report the highest average value.

- Women Gaining Ground (Slowly): Only 15 percent of companies overall report having a female director. Energy companies report the lowest percentage of women on their boards, but their numbers improved between 2016 and 2017.

“Institutional investors have stepped up pressure on companies to adopt stock ownership guidelines in recent years following high-profile corporate scandals,” said Tom Ziemba, a Managing Director in the Compensation and Benefits practice at BDO. “These guidelines are now a core governance principle in analyst assessments.”

“Board composition centered on diversity in thought and experience is becoming increasingly more important to the health of organizations. In the case of gender diversity, this is transcending well beyond voluntary best practices into legislated requirements in places like California,” stated Amy Rojik, National Assurance Partner and Director of BDO’s Center for Corporate Governance and Financial Reporting. “Many directors believe their board has room to grow on diversity, with still far too few using formal composition reviews to address the topic, and those companies may soon be left behind.”

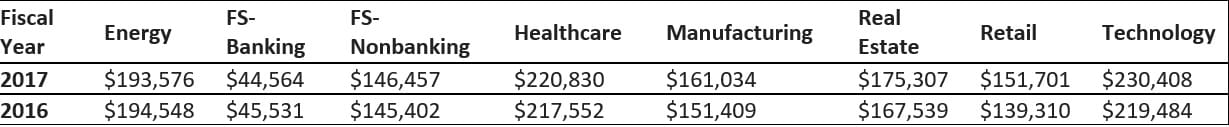

Industry Benchmarks Vary Dramatically

Board members’ total compensation levels differ dramatically from industry to industry. Technology and health care boards received the highest average pay among the eight industries analyzed; bank directors were paid the least, less than a quarter of what technology directors received.

The only two industry sectors in our analysis that reported a year-over-year decrease in director pay were the banking and energy industries. Retail directors experienced the largest bump in pay, up 9 percent over the year prior, attributed largely to an increase in committee retainers and fees (17 percent) and stock awards (18 percent). Manufacturing directors received the second largest increase in pay, up 6 percent from 2016. The average increase in pay across all industries was 4 percent.

“Industry trends are a critical benchmark for setting pay, especially among middle market companies,” added Ziemba. “But it’s important to look through a variety of lenses when determining pay to ensure you attract talented board members and can justify pay practices to analysts, investors and other stakeholders.”

*Material discussed is meant to provide general information and should not be acted on without professional advice tailored to your firm’s individual needs.

About the BDO 600: 2018 Study of Board Compensation Practices of Mid-Market Public Companies

The BDO 600: 2018 Study of Board Compensation Practices of 600 Mid-Market Public Companies examined the compensation practices of publicly traded companies in the energy, financial services – banking, financial services – nonbanking, health care, manufacturing, real estate, retail and technology industries. Companies in the six non-financial service industries in our study have annual revenues between $100 million and $3 billion. Companies in the two financial services industries in our study have assets between $100 million and $6 billion. Data sources include data provided by Salary.com and public company data collected from proxies and other sources.

About BDO’s Compensation and Benefits Practice

BDO’s Compensation and Benefits practice offers an experienced and dedicated team of professionals who operate nationwide to seamlessly provide a comprehensive array of services to address client needs. The BDO team provides tax, accounting and consulting services for all types of compensation arrangements, including cash and equity incentives, merger and acquisition related issues, employee stock purchase plans, qualified and nonqualified plan arrangements and other related services.

About BDO

BDO is the brand name for BDO USA, LLP, a U.S. professional services firm providing assurance, tax and advisory services to a wide range of publicly traded and privately held companies. For more than 100 years, BDO has provided quality service through the active involvement of experienced and committed professionals. The firm serves clients through more than 60 offices and over 550 independent alliance firm locations nationwide. As an independent Member Firm of BDO International Limited, BDO serves multinational clients through a global network of 73,800 people working out of 1,500 offices across 162 countries.

BDO USA, LLP, a Delaware limited liability partnership, is the U.S. member of BDO International Limited, a U.K. company limited by guarantee and forms part of the international BDO network of independent member firms. BDO is the brand name for the BDO network and for each of the BDO Member Firms. For more information please visit: www.bdo.com.