Automated analysis of big data and new sentiment processing are opening doors for fraud investigators to home in on wrongdoing faster and with more discretion. Though still not a silver bullet, these pattern identification techniques have brought investigation techniques to a new level.

Corruption and fraud are on the rise, with corporate enforcement action and penalties reaching new heights. This trend has driven up the cost of doing business and added to the risk profile in conducting business globally. A recent survey reported that more than half of C-suite executives across the G20 say an increase in corruption is both likely and concerning in the coming year, and nearly 20 percent have already uncovered a rise in fraudulent activity within their organizations.

Corporations are starting to fight back against this trend with an increasing investment in artificial intelligence. Automation technology that can proactively detect and flag potentially suspicious activity across numerous communications platforms is starting to emerge, offering organizations and investigators a new method for deterring fraud and other instances of white-collar crime.

Recent Developments in Automated Fraud Investigation Technology

For example, in December, Microsoft announced an Anti-Corruption Technology and Solutions initiative to use AI to proactively prevent, detect and combat government corruption. Analytics developer Palantir is innovating on data intelligence and predictive analytics to help investigators recognize patterns of behavior across disparate datasets and gain insights into financial, identity and other types of fraud. The legal industry is also rapidly automating data analysis and research techniques.

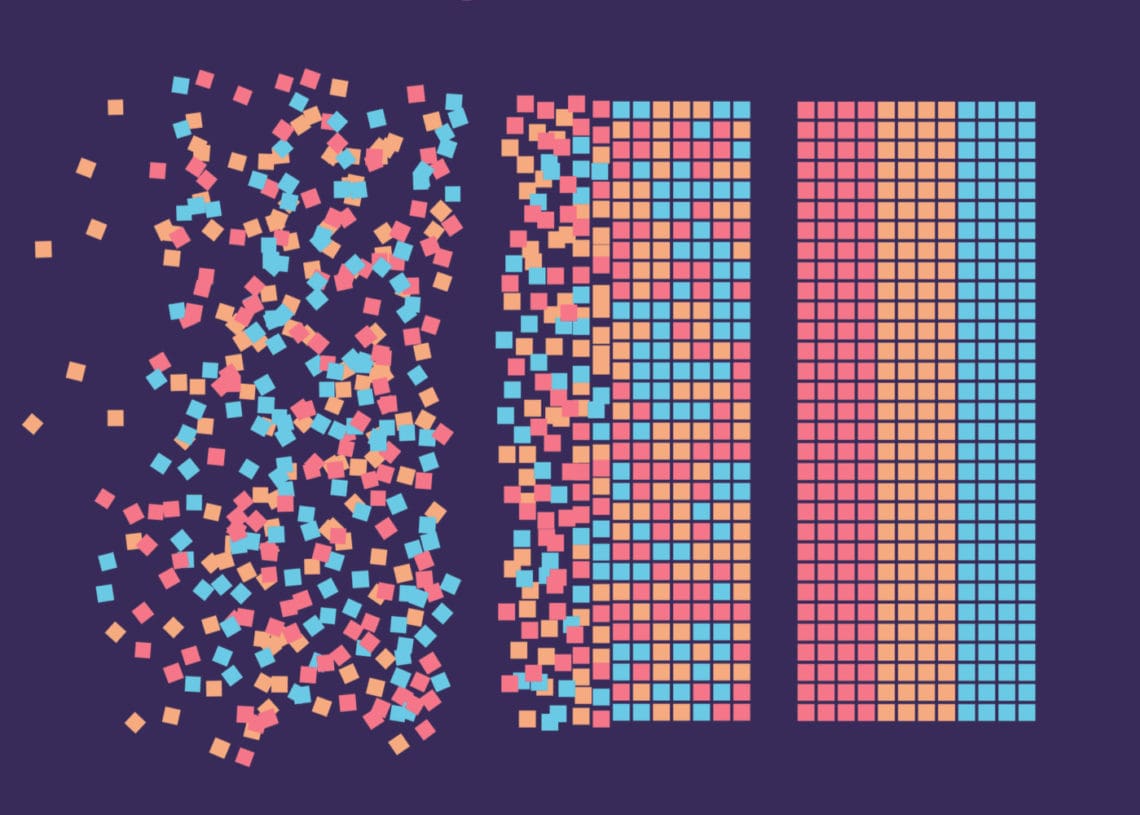

Bias and sentiment analysis tools, which look for the sentiment — positive, negative, neutral — of what’s being expressed in communications and search for repeated instances have advanced as well. Rather than traditional analytics models, which are trained based on keywords and statistical samples, the models within these tools have a built-in ability to detect patterns, so they can be applied to data in the wild for a wide range of purposes.

A New View of Evidence

My team has begun exploring the application of this type of analysis in fraud investigations, particularly in cases where the signals of fraudulent behavior are subtle. More broadly in the investigations field, researchers are testing the viability of sentiment analysis in accounting fraud and corruption uses cases — some using publicly available Enron emails as a way to validate the technology’s accuracy. Findings from these efforts have shown that sentiment analysis does indeed reveal red flags in the Enron dataset consistent with the scandal’s known series of events.

These developments signal a shift in how regulators, compliance teams and legal counsel may use AI and other forms of advanced analytics in future investigations to focus on patterns rather than a single smoking gun. This is significant considering that, in many cases, finding the “smoking gun” continues to be challenging, as the methods and platforms in which people communicate have evolved. Rather, investigators must now look for signs indicating a culture that encourages or permits corrupt activity. Likewise, patterns may reveal when certain teams or targeted groups within a corporation are engaging in borderline inappropriate behavior over time, so legal and compliance teams can investigate and deal with issues before they escalate into a violation.

A matter my team investigated serves as a good example of how patterns have become more relevant than a single piece of evidence in fighting white-collar crime. In this case, a staffing company was under investigation for the suspicion that it was inflating revenue figures. The investigation never resulted in one email or document that confirmed the allegations, but our team did find a series of problematic emails that showed financial officers putting pressure on local offices to perform better. This clue served as a springboard for interviews with the custodians involved, which ultimately uncovered corroborative information that some of the company’s executives were permitting a culture of pressure that may have pushed employees at various branches to consider methods of increasing revenue that were outside of acceptable accounting guidelines.

Proactive Fraud Detection

Traditionally, most investigations follow the workflow of allegation, identify relevant data, collect, review and analyze, then form conclusions. While this approach is tried and true, emerging x-factors — such as the growing volume and diversity of data and devices, distributed evidence, data privacy regulations and the rise of cryptocurrency — are complicating investigators’ ability to conduct comprehensive fact finding quickly, discreetly and efficiently.

Utilizing AI to improve standard investigations workflows and detect problematic or corrupt behavior as it is occurring may provide legal, compliance and investigatory teams with critical insights in real time, as well as ways to mitigate emerging challenges. I believe we’re nearing a point where in-house counsel will have the option to adopt platforms and technology to help flag data, communications and other activity that requires a closer look as part of a robust fraud and corruption prevention strategy. The evolution of AI is exciting for digital forensic investigators and is on the cusp of bringing the field closer to real-time and in-situ fact finding and risk mitigation.

That said, it is important to remain aware of the technology’s limitations. For example, in one recent case, a court ruled that anomalies found using analytics and presented as evidence did not demonstrate plausibility to the extent needed to award the relief sought. This example serves as a reminder that irregularities identified using AI and analytics are not always the signal of wrongdoing. Rather, the technology should be leveraged as one of many tools investigators and compliance professionals can use to identify and mitigate potential issues.

Once proven out and widely available, these advancements have the potential to significantly drive down the time, cost and complexities of dealing with large data volumes and the technical diversity of data in the wild. With the severity and incidence of fraud and corruption on the rise worldwide, it’s more important than ever before for legal and compliance teams to integrate technology alongside experienced practitioners to take proactive action in the face of escalating risks.