In the first installment of this series, we summarized that banks appear willing to forego lending activities where returns are small and market presence cannot be justified.

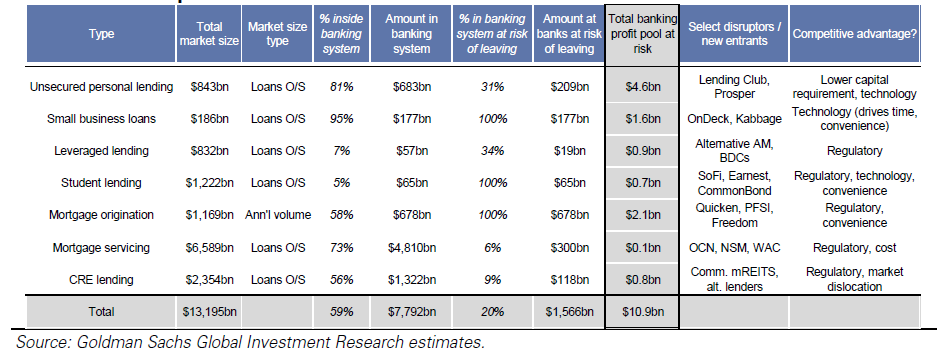

On the other hand, there are the non-traditional sources of funding. Comprised of financial technology firms, insurance companies and more recently, traditional credit users, such as private equity firms and asset managers. Some are growing so quickly that they are now considering an initial public offering or have already done so. While these non-traditional sources of funding currently represent a small portion of the greater $13 trillion loan industry which it targets, Goldman, Sachs and Co. estimates that in excess of $11 billion in profit is at risk of exiting the traditional banking industry as shown below:

Many point to eased regulatory oversight for non-traditional lenders creating this opportunity. They contend Dodd-Frank, Basel and the Consumer Protection Act subject traditional banks to a higher level of regulation which non-traditional banks are able to circumvent due to their operating models and size. However, regulation of non-traditional lenders has become an increasingly important topic as they continue to grow in size and evolve their operating models. The U.S. Federal Reserve System has already commented that it has concerns about what they call the “shadow banking system” and its risk potential. In preparation, non-traditional lenders are actively recruiting former regulatory officials in an advisory capacity to combat anticipated regulation (Social Finance – Arthur Levitt, Chairman of the SEC 1993-2011). Linedata sees increased regulation as inevitable as these organizations continue to grow in size. In fact, as of April 2015, four non-traditional lenders have been deemed systemically important under Dodd-Frank.

But the largest driver behind this shift is the fact that banks have done little, if anything, to combat it. Traditionally, banks have not been early adopters of technology. Core competencies of non-traditional bank lenders are cheaper operations and making the process easier for clients. It is this contention of being stuck in a legacy mindset that makes banks appear unresponsive and reluctant to change. However, banks are quick to point out what they consider to be fundamental flaws in the “shadow banking system” and in non-traditional lenders, often referring to them as “alternative lenders” and in doing so, implying they are not primary resources for capital.

Opponents of the “shadow banking system” have argued that non-traditional lenders are less regulated and the business in which they engage is riskier from the client’s perspective. To some extent, this challenge has merit. Regulation has not yet been fully enacted for non-traditional lenders, and as a result of their operating models, they are less capitalized with repurchase risk even if they do not hold loans on their balance sheet. This likely means that non-traditional lenders do not have “deep pockets” to absorb losses in the event of an economic downturn.

To be continued in the next installment…

Ron Meyer joined Linedata in 2010 and is a Senior Business Advisor for Capitalstream. He is responsible for directing the company’s credit-related systems initiatives and enhancing data governance and stewardship efforts.

With over 27 years of banking experience and a particular focus on commercial lending, Ron has worked in a multitude of lending positions including credit origination, administration, servicing and asset risk management. Prior to joining Linedata, Ron served as Vice President and Loan Operations Manager for AMCORE Bank N.A, and Vice President and National Operations Manager for Banco Popular.

Ron Meyer joined Linedata in 2010 and is a Senior Business Advisor for Capitalstream. He is responsible for directing the company’s credit-related systems initiatives and enhancing data governance and stewardship efforts.

With over 27 years of banking experience and a particular focus on commercial lending, Ron has worked in a multitude of lending positions including credit origination, administration, servicing and asset risk management. Prior to joining Linedata, Ron served as Vice President and Loan Operations Manager for AMCORE Bank N.A, and Vice President and National Operations Manager for Banco Popular.