This piece was originally shared on the ACL Blog and is republished here with permission.

Even the way we are paid as auditors shows the world has changed.

Recently I spoke with a private recruiter who is among the best I’ve ever seen at placing high-caliber internal auditors in the best companies and departments. I was curious to better understand why it appears that internal audit salaries are relatively flat, yet I constantly hear from audit leaders that they can’t find people with the skills to innovate within their teams. My brain nearly exploded when this person replied… “Frankly no one in management truly needs the services of the traditional auditor anymore; what they need is for the promise of ‘big data’ to materialize.”

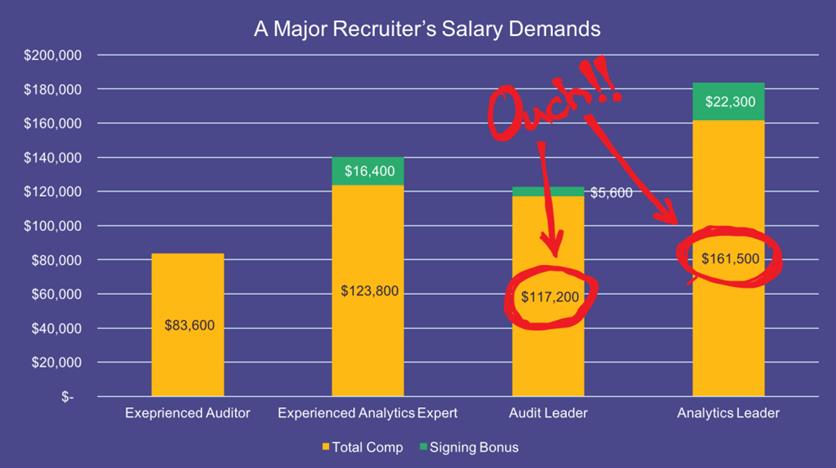

For literally 40 years now (over 10 years before the release of Microsoft Windows 1.0 and 20 years before the term “business intelligence” was commonly used), ACL has been pushing the audit-, risk– and compliance-oriented professions to embrace the power of data. However, it is only now that I am convinced the tide is crushingly shifting. When I further pushed this same recruiter, I was told that when they accept positions to fill from clients, they require that the employer be ready to pay a salary of $83,600 for an experienced auditor. However, when recruiting experienced analytics experts (whether for a data analytics team inside internal audit or elsewhere in the organization) they currently demand $123,800 in comp with a signing bonus between $10,000 and 20,000. Oh snap! When looking at leaders, it got even worse… audit leaders (managers and directors) pulling a demand of about $117,000 compared to a high-caliber analytics team leader at a striking $162,000 with a $20,000+ signing bonus.

What does this all mean?

Simple… traditional internal auditors simply are not valued as the trusted advisor of senior management on matters of risk—analytics experts with the business savvy to ask the right questions are. The traditional auditor is obsolete, and they generally don’t yet realize it.

Meaningful stories about every organization, whether in the commercial or public sector, are hidden in its data. Amongst those are stories about the effectiveness of internal controls, stories about the effectiveness of risk management, stories about the behavioral ethics and regulatory compliance, stories about the reliability of financial information and stories about the performance of the organization. Those who can uncover and re-tell those stories in meaningful ways are about to completely replace those who do a few interviews, complete a couple of checklists and test a few samples so they can effectively guess at pre-defined questions that they assume actually matter. There simply is no place for the traditional internal auditor, either at the table with management or at the table of the audit committee.

The data bots are coming!

Over the course of the industrial revolution, robots have systematically replaced workers in the manufacturing process. Over the course of the now quickly evolving data revolution, data bots will systematically replace knowledge workers in the audit, compliance and risk management process… bad news for the traditional internal auditor. In fact, a recent Handelsblatt article (Germany’s Wall Street Journal) actually predicted that accountants and auditors will be replaced by robots (data bots) faster than any profession on earth except tax advisors and telemarketers over the next 20 years. I recently had a corollary discussion with Renee Murphy, a lead analyst for GRC at Forrester and one of the smartest industry analysts I’ve ever met. Her full-time job is to look at the profession and technology trends to understand how organizations will optimize value in the future. One of her comments that most directly caught my attention was “even as an ex-auditor, I can tell you the traditional auditor is barreling toward obsolete and they generally don’t even realize it.”

Well with that happy outlook, what might we do now?

In part two of this post I will discuss the opportunity for a new breed of internal auditor.

Dan Zitting serves as Chief Product & Strategy Officer at

Dan Zitting serves as Chief Product & Strategy Officer at