In recent years, money services business (MSBs) have given rise to technological innovation, forcing changes in the way we use financial services. We have also seen an evolution driven by a boom of internet accessibility and mobile technology adoption, providing new and unprecedented opportunities for many companies in the U.S. and around the globe.

The Latin-American (LATAM) market is no exception to this growth. The widespread use of smartphone devices is impacting the mobile e-commerce industry, and these devices are becoming the primary tool used to access the internet. In 2014, there were approximately 270 million smartphones, and that number is expected to reach over 605 million by 2020 in the LATAM region.

Let’s not forget the importance of this geographic location as a corridor for the U.S. remittance industry. The World Bank reported that five countries (Mexico, Guatemala, El Salvador, Dominican Republic and Honduras) were included in the top 30 corridors in 2015 from the U.S., with a combined value of $42 billion. The U.S.–Mexico corridor topped the list, with an estimated $25 billion. Cross-border payments in LATAM continue to grow in importance, not only for the remittance industry, but for the e-commerce sector as well. A study conducted by Forrester indicated that Brazil, Mexico and Argentina are projected as the leading e-commerce markets in LATAM and will generate an estimated $47 billion by 2018. Another report estimated that from 2014 to 2020 carriers will invest approximately $193 million to support coverage, capacity and service quality.

AML Risks in LATAM

Nevertheless, before venturing into this area, it is important to understand the risks. While there are many to address, such as financial, currency fluctuation and an ever-changing political environment, arguably the most prominent are related to criminal activities. In particular, foreign corruption and money laundering.

In the past months, there have been a number of high-profile cases of bribery and corruption in LATAM.

The most recent and highly publicized example is the Panama Papers case, which exposed several public figures allegedly sheltering more than $11.5 million of wealth offshore. A different case involves the former Brazilian president, other politicians and executives, who allegedly used state-owned firms to facilitate kickbacks.

Money laundering is another evident threat to MSBs and operations in LATAM. It is difficult to overlook the magnitude of the illicit funds generated by drug trafficking and organized crime. These criminal organizations behave as legitimate multinational businesses operating with the most basic principles of business management. In essence, cartels utilize similar distribution practices through strategically placed units in a continent that geographically facilitates the trafficking of drugs and physical movement of illegal money.

This type of complex operations makes it challenging for businesses to distinguish the proceeds of illegal activity from that of hard-earned money, making MSBs vulnerable to narcotics-related money laundering. Accordingly, MSBs should remain vigilant and mindful of their BSA/AML responsibilities when conducting business in or considering entering the LATAM market.

Evaluate and Mitigate the Risks

In general, MSBs must understand what is legally required from their business and take a risk-based approach commensurate with their operations. Risk assessments are an important part of building effective compliance programs, and while there is no bulletproof method that can effectively identify all risks associated with the LATAM market, there are practical steps to create mitigating controls around them. The following are some of many elements that can help an MSB build the foundation for a risk assessment:

- Geographic/Jurisdictional Risk – MSBs should consider the reputation of the countries where they want to do business. Are the countries politically stable? What is the corruption perception risk? Do sanctions apply to any jurisdictions? Are the countries listed as high-risk and non-cooperative jurisdictions by FATF?

- Customer Risk –MSBs are susceptible to abuse in areas of money laundering, criminal and terrorist financing; thus, when working in LATAM, organizations need to exercise strong due diligence. MSBs should consider who will be the users of their products and services and evaluate the types of existing and prospective partnerships and/or joint ventures.

- Product Risk – MSBs should attempt to determine how their products and services may be used for illicit purposes, such as money laundering or human trafficking. They should also look for trends that may suggest inappropriate activity may be occurring in the market or has occurred for other players in the industry.

- Operational Risk – MSBs should understand the importance of developing and maintaining strong internal controls to deter the use of their services for illicit purposes. Fortunately, technology has also contributed in this field through the development of tools that can help measure risk, monitor risk exposure and create mitigating controls.

The Domestic Regulatory Landscape

Understanding the regulatory environment is vital. Among the most important U.S. legislative and regulatory initiatives applied to international transactions are The USA PATRIOT Act, The Office of Foreign Assets Control (OFAC) and the Foreign Corrupt Practices Act (FCPA).

The USA PATRIOT Act covers a wide range of AML regulations compiled in 31 Code of Federal Regulation Chapter X. Here are some important sections to remember when conducting foreign business:

- Section 311 – Allows the U.S. Treasury to apply proportionate measures on countries or foreign financial institutions.

- Section 312 – Requires regular and enhanced due diligence for foreign correspondent accounts and private banking accounts for non-U.S. persons.

- Section 313 – Prohibits correspondent accounts for foreign shell banks

- Section 319(a) – Related to forfeiture from U.S. accounts

- Section 319(b) – Relates to correspondents’ accounts and foreign banks

- Section 326 – Relates to the establishment of customer identification program (CIP) commensurate with the institution’s size, location and type of business.

OFAC is a branch of the U.S. Department of the Treasury that administers and enforces economic and trade sanctions. OFAC prohibits U.S. citizens, permanent residents of the U.S. and U.S.-based businesses (including U.S. branches of foreign companies) from engaging in business or financial transactions with any party included on the OFAC’s Specially Designated Nationals (SDN) List.

The FCPA is a U.S. federal law that contains two provisions: (1) prohibits bribery to foreign officials to obtain or retain business or secure improper advantage and (2) addresses accounting transparency requirements for publicly traded companies.

The Foreign Regulatory Landscape

MSBs should also consider evaluating the foreign country’s AML regime, enforcement and supervision framework and international cooperation. When researching the international regulatory environment, it is recommended to consult a local legal firm to provide guidance and track changes in the country’s regulatory environment.

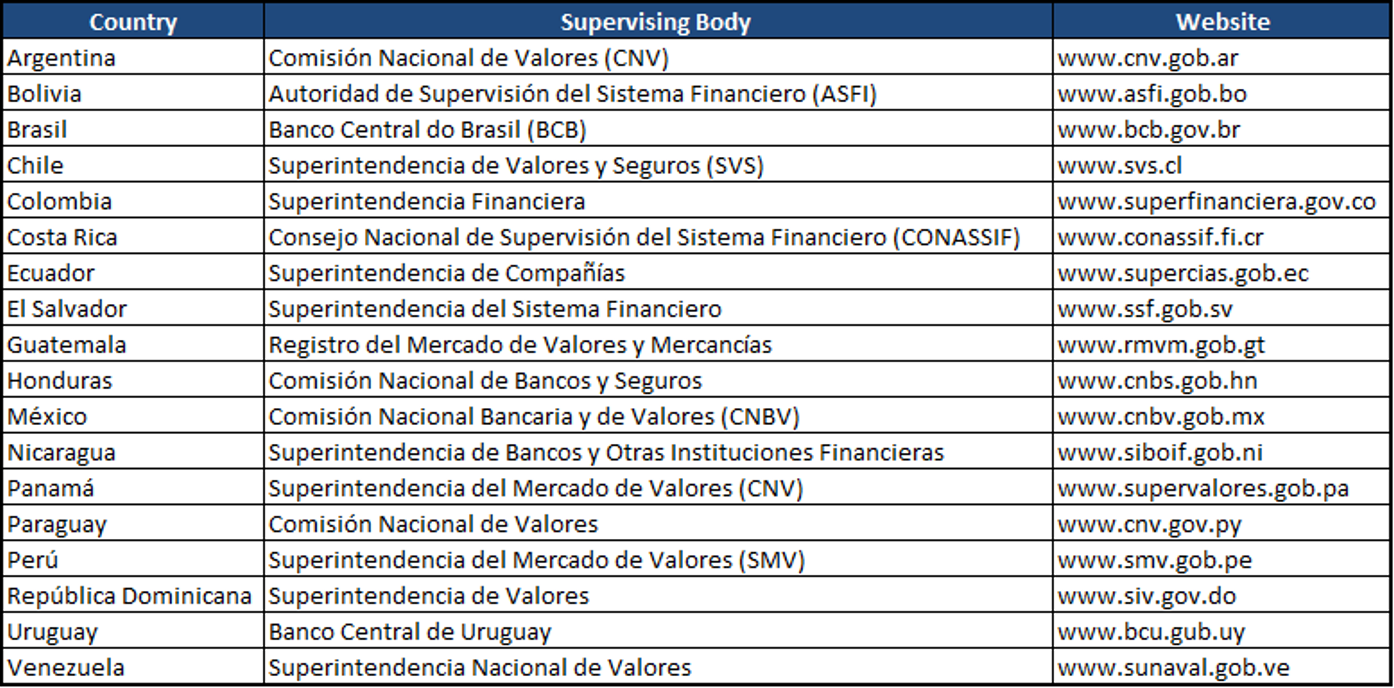

The following table provides the names and website of several LATAM regulating authorities:

Also, there are many resources to organizations that provide quantitative indicators on the country’s rankings relating to corruption and money-laundering. The following sources provide research papers, industry reports and other data that can help:

- Transparency International – Dedicated to curbing corruption, Transparency International conducts surveys of business people, political analysis and the general public to determine perception of corruption.

- Financial Action Task Force (FATF) – An intergovernmental organization dedicated to combating money laundering.

- Grupo de Acción Financiera de Sudamérica (GAFISUD) – Financial Action Task Force on Money Laundering in South America

- Caribbean Financial Action Task Force (CFACTF)

E-commerce and mobile technology will continue to transform financial services. The cross-border remittance industry is already experiencing a transition from the traditional brick-and-mortar model to mobile platforms. These robust payment structures are also becoming critical for companies in achieving a competitive advantage.

Arguably, we are in the beginning of a financial technological revolution. The proliferation of mobile devices and the fast adoption rate in LATAM is giving consumers considerable power when evaluating and comparing alternative financial services. Hence, MSBs must rethink their strategy as new markets emerge due to these technological disruptions and new firms enter this sector.

While the forecasts look promising for MSBs, these opportunities will also bring challenges and create additional AML risks for the industry. Money laundering and other criminal activities will likely continue to be a burden to the industry; therefore, MSBs must build an effective AML program and remain familiar with the regulatory environment. MSBs should also have an understanding of foreign norms and enforcement of laws impacting their operations and consider the broader social, political and economic stability in the countries where they operate.

Despite the challenges in LATAM, there is enthusiasm for this market. International organizations are devoting attention toward the determent of crimes through efforts supported by technological innovations, data availability and guidance for best practices. If MSBs mitigate their risks creatively and effectively, they will capture a traditionally profitable market providing opportunities for the emergent digital payments and mobile money sectors.

Omar Magana, CAMS, is a Senior Compliance Professional with Chartwell Compliance. He has over 15 years of experience in domestic and foreign regulatory environments and has worked in the money services business industry for over 10 years.

Prior to joining Chartwell, Omar worked for one of the largest money transmitters in the country, Sigue Corp, where he held various positions in the compliance department. He played a key role in enhancing and building the back-end process of the AML systems designed to assist in the monitoring and reporting functions, as well as in the development of the government sanctions program.

For more information please visit

Omar Magana, CAMS, is a Senior Compliance Professional with Chartwell Compliance. He has over 15 years of experience in domestic and foreign regulatory environments and has worked in the money services business industry for over 10 years.

Prior to joining Chartwell, Omar worked for one of the largest money transmitters in the country, Sigue Corp, where he held various positions in the compliance department. He played a key role in enhancing and building the back-end process of the AML systems designed to assist in the monitoring and reporting functions, as well as in the development of the government sanctions program.

For more information please visit