The Anti-Kickback Statute, False Claims Act, Stark Law, Civil Monetary Penalty Law and Eliminating Kickbacks in Recovery Act “bear traps” have ravaged the health care industry for decades. Despite the carnage they have wrought, these bear traps are completely avoidable. Jim Nortz provides practical actions you can take to protect your firm from their bite.

In October 2013, Todd Clawson was riding high. He was National Sales Director of Advanced BioHealing, Inc. – a 350-person firm headquartered in Westport, Connecticut. At the time, BioHealing generated about $225 million in annual revenue by the sale of living skin grafts used to treat diabetic foot ulcers. Clawson managed 35 salespeople, earned a good salary and lived with his wife and two children in Eden Prairie, Minnesota.

Under Mr. Clawson’s leadership, sales increased by more than 1,600 percent. The company’s growth rate was so impressive, in 2011, Shire Pharmaceuticals acquired BioHealing for $750 million. Unbeknownst to Clawson and Shire at the time, the federal government had filed suit against BioHealing under seal and was investigating allegations by a whistleblower that the company was engaging in illegal marketing practices.

During the six years that followed, the United States and dozens of state governments filed five additional lawsuits against the company. In 2014, Clawson was fired. In 2016, he was arrested and charged with conspiracy to commit criminal conflicts of Interest, bribery and health care fraud. In February 2018, Clawson pleaded guilty to the charges.

Clawson appeared in federal court for his sentencing hearing a shattered man. He apologized emphatically to the court stating: “I am sick over my actions.” Breaking down, he said that he had abused his children’s trust, harmed his marriage and lost his job. He also observed, “greed is an ugly, ugly emotion.”

His attorney told the judge that Clawson now makes his living on the road selling corporate awards. He further explained that the Clawsons were forced to sell their home, have given up thoughts of retirement and are faced with the sad reality that they lack the resources to send either of their children to college.

Clawson was sentenced to a three-year term on federal probation.

So, what did Clawson do to justify such harsh punishment? To help increase BioHealing’s sales, Clawson:

- Hired health care professionals (HCPs) to speak about BioHealing products

- Paid HCPs to train BioHealing employees

- Paid HCPs to participate on an advisory board

- Gave gifts to HCPs

- Paid for HCPs’ meals

- Paid for HCPs’ trips

For those of you unacquainted with the Anti-kickback Statute (AKS), the False Claims Act (FCA), the Physician Self-Referral Law (aka the Stark Law), the Civil Monetary Penalties Law (CMP) or the Eliminating Kickbacks in Recovery Act (EKRA), you might be shocked that there were any criminal penalties at all levied for such relatively benign behavior. After all, most companies wine and dine clients, take them on fishing trips and golf outings, invite them to their expensive box seats in sports stadiums and engage in numerous other similar activities to win business. But the laws listed above criminalize and/or impose potentially massive penalties on individuals and firms in the health care industry who engage in such garden-variety marketing activities. I call these laws “bear traps” not just because their “bite” is so painful, but also because they have big, gaping jaws that catch the unwary.

Shire Pharmaceuticals is a case in point. Shire is a sophisticated, giant multinational corporation that likely never had any intention to violate the law but ended up paying a very heavy price for its BioHealing acquisition in 2011. As a consequence of Clawson’s marketing activities, in 2014, Shire sold BioHealing at a $640 million loss, paid a $350 million fine and entered into a five-year corporate integrity agreement.

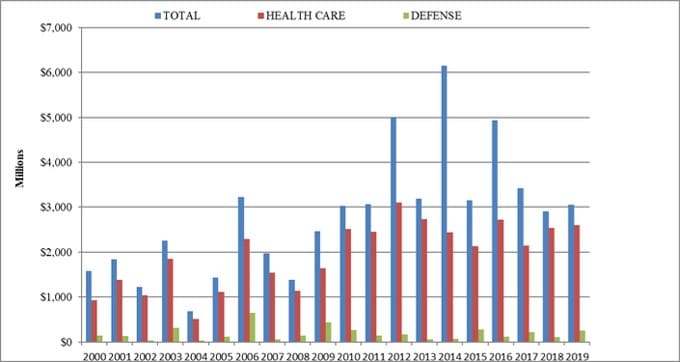

Sadly, Clawson and Shire are not alone. Johnson & Johnson, Pfizer, Novartis, Abbot Laboratories, Abiomed, Medtronic, Siemens, Boston Scientific, Zimmer and thousands of other health care companies and individuals have collectively paid tens of billions in fines for similar transgressions. As the graph of FCA enforcement actions below illustrates, the health care industry has been suffering from this “illness” for many years.

For nearly two decades, the vast majority of the federal government’s FCA recoveries came from the health care industry. In 2019, $2.6 billion (more than 85 percent) of the $3 billion in recoveries came from the health care sector, including providers, pharmaceutical companies and medical device manufacturers. Some of these enforcement actions were certainly the result of deliberate malfeasance by corporate executives who stepped over the line to boost sales, but many likely stumbled into one or more of the bear traps out of ignorance and/or inadequate internal controls.

To help you appreciate the challenges associated with managing these compliance risks, test your bear trap awareness by answering the following questions. (See the answers in the footnotes to each question.)

- Is it OK to pay a finder’s fee to an agent for bringing a health care company prospective customers where the fee is based on the resulting sales volume?[1]

- Is it OK for a biotech company to provide a product discount to an HCP or health care institution as payment for services?[2]

- Is it OK for a pharmaceutical company to create a nonprofit foundation and use it as a conduit to cover the copay obligations of Medicare patients taking their drugs?[3]

- Is it OK for a laboratory to pay a substance abuse clinic for referring drug testing to a laboratory?[4]

The answer to all of these questions is “no.” Sadly, as is illustrated in the footnotes associated with each of these questions, many health care companies and executives have paid dearly for their ignorance of the law or for gambling that they would not get caught. These are self-inflicted wounds that are completely avoidable.

Having been a compliance officer and a consultant serving multinational health care companies for more than 13 years, I’ve developed and implemented comprehensive compliance and ethics programs that have succeeded in helping my clients see and avoid the bear traps and that have withstood Department of Justice scrutiny.

In the five parts of this series that follow, I’ll provide practical guidance about how you can do the same for your company. In Part 2, I’ll discuss internal controls and two ineffective compliance strategies.

[1] Answer: No. In December 2015, Coloplast Corporation paid $3.6 million to settle allegations that Coloplast paid cash incentives to third-party sales personnel to induce them to refer customers to Coloplast products.

[2] Answer: No. Providing a product discount to an HCP or health care institution as payment for services would fall outside of the Anti-Kickback Statute Safe Harbor Regulations and potentially violate federal and state law.

[3] Answer: No. In December 2017, United Therapeutics Corporation paid $210 million in penalties and entered into a five-year corporate integrity agreement to resolve FCA liability for paying kickbacks to patients to induce them to use UT’s drugs because the foundation did not operate independently. Instead, the government concluded that the company used the foundation as a conduit to make improper payments to patients.

[4] Answer: No. On January 10, 2020, Theresa Meced plead guilty to an EKRA violation for arranging to get cash compensation from a laboratory in exchange for sending the lab drug testing business.