When companies merge or acquire, stakeholders usually expect that the whole will be greater than the sum of its parts. Unfortunately, the facts tell a different story. One plus one does not equal three, and too often it moves shareholder returns to the wrong side of zero. A once-exceptional organization can quickly take a turn toward mediocrity, or worse.

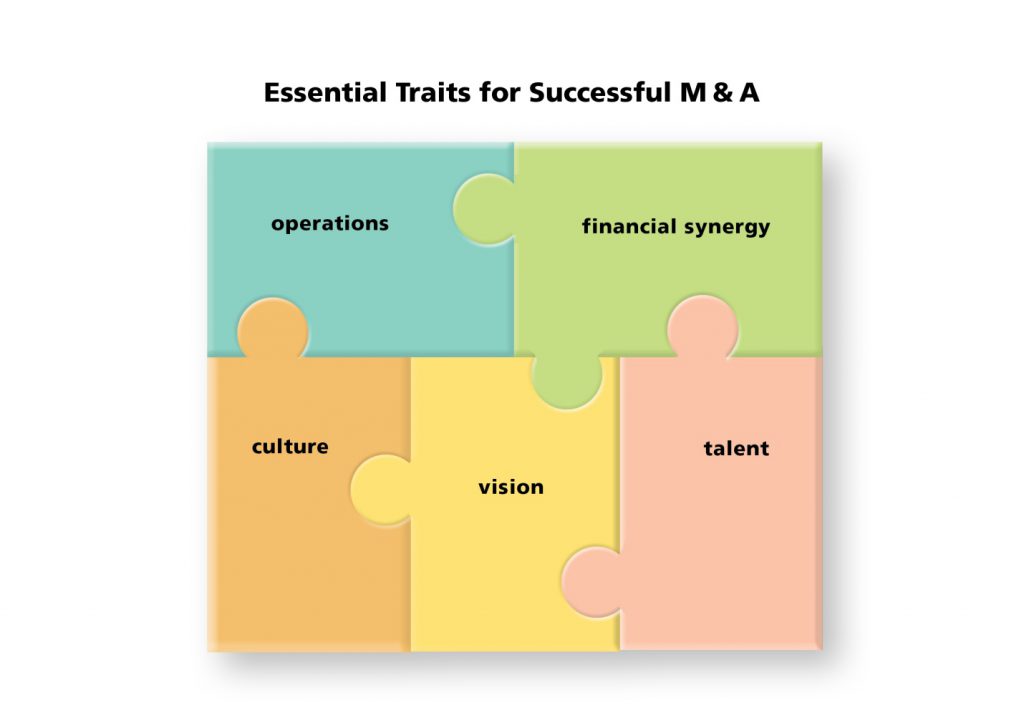

Study after study puts the failure rate of mergers and acquisitions between 70 and 90 percent, which analysts have tried to explain by analyzing the characteristics of deals that worked and those that didn’t. That’s a start, but that only informs decision-makers about the features of the deals that caused them to fail or prevented failure. It doesn’t truly get to the core of the cause/effect relationships among planning, evaluating and integrating the Five Essential Traits for Successful M & A’s: vision, financial synergy, operations, culture, and talent. To understand how The Five Essential Traits for Successful M & A solve the puzzle, think of a deal you are considering. Then, score this deal from 1 to 4 for each of the statements below

Rank each on a scale of 1 to 4

1=Totally Disagree, 2=Disagree, 3=Agree, 4= Totally Agree

Vision

- We have a clear strategic objective for doing this

- Our desire to grow goes beyond cost-savings and defensive moves.

- We clearly understand what is achievable in light of market and industry trends.

- We have widespread agreement about our goals.

- We have tied our short-term goals to our long-term vision.

Financial Synergy

- We know how they make money.

- We know how our investors will measure success of this deal.

- We have a plan to make money quickly after the deal.

- We have a clear picture of their financial situation.

- We have a plan for integrating our financial systems.

Operations

- We know what we have to do to retain their key customers.

- Our business models are compatible.

- We understand their competitive advantage and driving forces

- We agree about how to integrate products and services.

- We understand what our key customers will want from this deal.

Talent

- We have set criteria for choosing which people will be chosen for the new organization.

- We have a commitment from key players that they will stay.

- We agree about how the new company will be run and by whom.

- We have clear lines of accountability for each function.

- We have developed a succession plan for key positions.

Culture

- We agree about how each step of the deal will be communicated to employees and stakeholders.

- We have decided how fast things will happen.

- We have made a strong commitment to change.

- We have seen evidence that we have compatible risk tolerance.

- We see evidence that key decision-makers share core values.

90-100 – Deal

Congratulations! It’s a deal. Obviously you have done your due diligence and carefully analyzed both the pros and cons of going forward.

80-89 Maybe Deal

You probably feel pretty good about the opportunity and may be tempted to think you should go ahead. Before you take the plunge, however, think about the tendency of people to be over-confident. If you are over-confident by even 5%, what will that mean? You are far better off challenging yourself now than wishing you had done so later.

70-79 Risky Deal

At these levels you need a very good price to ensure you can address issues you aren’t seeing now. If you do a deal you know is risky and pay a “fair” price, it could be a disaster. Meanwhile, you’re tying up money that could have been used elsewhere.

Below 70 – No Deal

No explanation needed here. It is tempting when you’re “close” to start rationalizing away concerns. Some shores are reserved for shipwrecks. Don’t let it be yours.

Recent history has taught some hard lessons about M & A’s—one of the most salient being that many, if not most acquisitions should never have happened. The second lesson indicates that the first lesson might be moot if the parent had done more and better positioning for the acquisition. Only after senior leaders have aggregated the relevant data should they begin the arduous journey of setting criteria, considering targets, evaluating these targets vis-à-vis the criteria, and negotiating deals. Only then can they accurately answer the question, “Deal or no deal?”

Dr. Linda Henman is one of those rare experts who can say she’s a coach, consultant, speaker, and author. For more than 30 years, she has worked with Fortune 500 Companies and small businesses that want to think strategically, grow dramatically, promote intelligently, and compete successfully today and tomorrow. Some of her clients include Emerson Electric, Boeing, Avon and Tyson Foods. She was one of eight experts who worked directly with John Tyson after his company’s acquisition of International Beef Products, one of the most successful acquisitions of the twentieth century.

Linda holds a Ph.D. in organizational systems and two Master of Arts degrees in both interpersonal communication and organization development and a Bachelor of Science degree in communication. Whether coaching executives or members of the board, Linda offers clients coaching and consulting solutions that are pragmatic in their approach and sound in their foundation—all designed to create exceptional organizations.

She is the author of Landing in the Executive Chair: How to Excel in the Hot Seat, The Magnetic Boss: How to Become the Leader No One Wants to Leave, and contributing editor and author to Small Group Communication, among other works.

Dr. Henman can be reached at

Dr. Linda Henman is one of those rare experts who can say she’s a coach, consultant, speaker, and author. For more than 30 years, she has worked with Fortune 500 Companies and small businesses that want to think strategically, grow dramatically, promote intelligently, and compete successfully today and tomorrow. Some of her clients include Emerson Electric, Boeing, Avon and Tyson Foods. She was one of eight experts who worked directly with John Tyson after his company’s acquisition of International Beef Products, one of the most successful acquisitions of the twentieth century.

Linda holds a Ph.D. in organizational systems and two Master of Arts degrees in both interpersonal communication and organization development and a Bachelor of Science degree in communication. Whether coaching executives or members of the board, Linda offers clients coaching and consulting solutions that are pragmatic in their approach and sound in their foundation—all designed to create exceptional organizations.

She is the author of Landing in the Executive Chair: How to Excel in the Hot Seat, The Magnetic Boss: How to Become the Leader No One Wants to Leave, and contributing editor and author to Small Group Communication, among other works.

Dr. Henman can be reached at