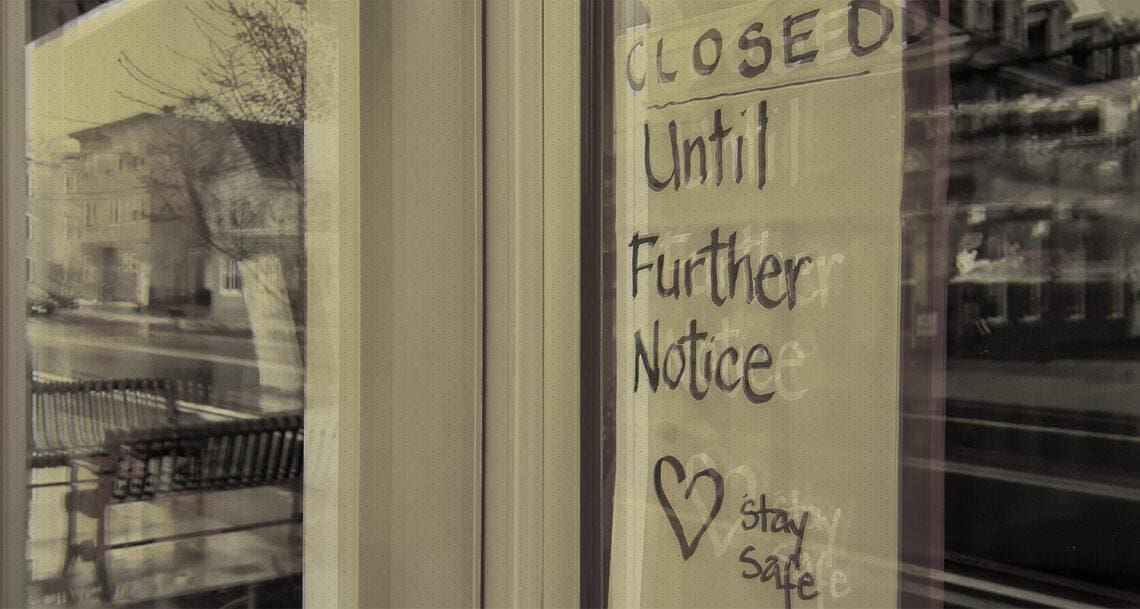

We’re nearing the three-year anniversary of widespread business shutdowns in the early days of the Covid-19 pandemic. In that short time, almost 2,400 lawsuits have been filed claiming businesses’ property insurance policies should cover losses companies endured while they were shuttered. From coast to coast, circuit courts have — uniformly — disagreed. Laura A. Foggan and Rachel A. Jankowski of Crowell & Moring take a deep dive into what courts have said about Covid-related business insurance claims and why the end of the lawsuit parade is likely in sight.

In the short span of three years, nearly 2,400 lawsuits have been filed over business interruption losses resulting from the Covid-19 pandemic, corresponding government orders and whether insurance coverage is provided for these losses. The number of cases filed on this issue in a short period is unusual — as is the consistency with which courts have responded. Both federal and state appellate courts have overwhelmingly upheld motions to dismiss these insurance claims.

While courts have overwhelmingly ruled for insurers, leading some policyholders to voluntarily dismiss their claims, other policyholders, seeking recovery for substantial economic difficulties brought on by the pandemic, continue to pursue insurance coverage in the face of increasingly difficult odds.

Last month, the U.S. Court of Appeals for the 3rd Circuit added its voice to the chorus of cases addressing Covid-19 coverage lawsuits and joined a now-unbroken sequence from the 1st Circuit straight through to the 11th Circuit in which each of these federal appellate courts have found Covid-19 claims do not meet the property coverage requirement of “direct physical loss of or damage to property.”

Did Covid Lead to a Lower HIPAA Fine?

Eye-popping fines over violations of the right of access portion of the federal HIPAA healthcare law aren’t exactly common, and a recent slate of fines and settlements show that most healthcare providers can avoid six-figure penalties by simply trying to do the right thing.

Read moreThis clear alignment of the federal appellate courts is striking, particularly in the uniformity of result reached by so many federal circuits in such a compressed period. Legal scholars and observers often point to a “split in the circuits” to argue that a question is unsettled in the law and merits further review. Here, the lack of any split among the federal circuit courts and the sheer number of circuits reaching the same conclusion is notable.

Moreover, nearly every state high court to address the issue agrees that Covid-19 claims do not involve “direct physical loss of or damage to property damage” under property insurance policies. Only the Vermont Supreme Court declined to uphold dismissal of a Covid-19 coverage claim on the pleadings, based on that state’s uniquely liberal pleading rules.

Below we summarize the state of the law, both at the state and federal levels.

1st Circuit: Legal Sea Foods, LLC v. Strathmore Insurance Co. and SAS International, Ltd. v. General Star Indemnity Co., both applying Massachusetts law, upheld dismissal of Covid-19 coverage claims based on the requirement that there be “some ‘distinct, demonstrable, physical alteration of the property’” to constitute “direct physical loss of or damage to property.” Both cases also held that the lack of a virus exclusion in the policy does not imply coverage for virus claims.

2nd Circuit: 10012 Holdings, Inc. v. Sentinel Insurance Co. applied New York law to affirm the dismissal of an art gallery’s Covid-19 business interruption claim, holding that “‘direct physical loss’ and ‘physical damage’ … do not extend to mere loss of use of a premises, where there has been no physical damage to such premises; those terms instead require actual physical loss of or damage to the insured’s property.”

3rd Circuit: In Wilson v. USI Insurance Service LLC, the 3rd Circuit weighed in under Pennsylvania and New Jersey law, affirming that “the loss of use of a property’s intended business purpose is not a physical loss of property” covered by property insurance policies. The 3rd Circuit also found no coverage under civil authority provisions because the complaints did not allege “a property other than the insured premises was damaged or suffered a physical loss or that an action of a civil authority prohibited access to the insured premises because of loss or damage to another property.”

4th Circuit: Uncork & Create LLC v. Cincinnati Insurance Co. affirmed the dismissal of a creative events business’s Covid-19 business interruption claim under West Virginia law. Dismissal was appropriate because “neither the closure order nor the Covid-19 virus caused present or impending material destruction or material harm that physically altered the covered property requiring repairs or replacement so that they could be used as intended.”

5th Circuit: Terry Black’s Barbecue, LLC v. State Automobile Mutual Insurance Co. held under Texas law that claimed losses due to the suspension of dine-in services during the Covid-19 pandemic were not covered as direct physical loss of or damage to property. (See also La. Bone & Joint Clinic, LLC v. Transp. Ins. Co., applying Louisiana law and concluding that treating loss of use as physical loss or damage “would render the adjective ‘physical’ meaningless” and would be “at odds” with the period of restoration provision.)

6th Circuit: Santo’s Italian Café LLC v. Acuity Insurance Co. applied Ohio law to find that the lost business income sustained did not constitute “direct physical loss of or damage to property” under the policy. The court noted that the restaurant was not tangibly destroyed, nor was the owner “tangibly or concretely deprived of” the restaurant. Estes v. Cincinnati Insurance Co. affirmed a dismissal under Kentucky law, holding that “‘physical loss’ would convey to the ‘average person’ that a property owner has been tangibly deprived of the property or that the property has been tangibly destroyed.”

7th Circuit: Sandy Point Dental, P.C. v. Cincinnati Ins. Co. affirmed the dismissal of Covid-19-related business interruption losses under Illinois law because government restrictions on the “intended use” of the insured properties “unaccompanied by any physical alteration” do not constitute direct physical loss. The court further held that the virus’s “impact on physical property is inconsequential: deadly or not, it may be wiped off surfaces using ordinary cleaning materials, and it disintegrates on its own in a matter of days.”

8th Circuit: Oral Surgeons, P.C. v. Cincinnati Insurance Co. held under Iowa law that lost business income and extra expense sustained from the Covid-19 pandemic and the related government-imposed restrictions did not constitute direct “accidental physical loss or accidental physical damage.” Applying Missouri law in Monday Restaurants LLC v. Intrepid Insurance Co., the court found no “physical loss” was alleged and declined to decide whether a virus exclusion applied because the plaintiff must first state a covered claim. (See also Torgerson Props., Inc. v. Cont’l Cas. Co. Minnesota law, and Rock Dental Ark. PLLC v. Cincinnati Ins. Co., Arkansas law.)

9th Circuit: Mudpie, Inc. v. Travelers Casualty Insurance Co. of America, applying California law, rejected efforts to convert claims for purely economic losses into claims for physical loss or damage to covered property. The court also found that the virus exclusion barred coverage. (See also Kara McCulloch DMD MSD PLLC v. Valley Forge Ins., Washington law, and Levy Ad Grp. v. Fed. Ins. Co., Nevada law.)

10th Circuit: Goodwill Industries of Central Oklahoma, Inc. v. Philadelphia Indemnity Insurance Co. affirmed dismissal of a nonprofit organization’s Covid-19 business interruption complaint because government shutdown orders did not cause a direct physical loss under Oklahoma law. Additionally, the virus exclusion precluded coverage. (See also Sagome, Inc. v. Cincinnati Ins. Co., Colorado law.)

11th Circuit: Gilreath Family & Cosmetic Dentistry, Inc. v. Cincinnati Insurance Co. interpreted Georgia law and affirmed dismissal of a dentist’s Covid-19 business interruption claim. The policyholder “alleged nothing that could qualify, to a layman or anyone else, as physical loss or damage.” (See also SA Palm Beach, LLC v. Certain Underwriters at Lloyds London, Florida law, and Dukes Clothing, LLC v. Cincinnati Ins. Co., Alabama law.)

Besides the unbroken chain of rulings from the 1st Circuit to the 11th Circuit in the federal appellate courts, the state supreme courts that have addressed Covid-19 coverage claims almost all agree there is no property coverage for losses incurred due to the interruption of business due to the pandemic.

Connecticut: The Connecticut Supreme Court found no coverage for alleged business losses from the Covid-19 pandemic in Hartford Fire Insurance Co. v. Moda, LLC. The court said the policyholder’s losses “did not result from any tangible physical alternation” to its property, and the virus’s presence on the property does not constitute physical loss or damage. (See also Conn. Dermatology Grp. v. Twin City Fire Ins. Co.)

Delaware: The Delaware Supreme Court affirmed a decision holding that a pollution and contamination exclusion barred coverage for pandemic-related business losses in APX Operating Co. v. HDI Global Insurance Co.

Iowa: The Supreme Court of Iowa in Wakonda Club v. Selective Insurance Co. of America and Jesse’s Embers, LLC v. Western Agricultural Insurance Co. held that loss of use does not constitute “direct physical loss of or damage to” covered property.

Maryland: In a unanimous decision in Tapestry, Inc. v. Factory Mutual Insurance Co., the Supreme Court of Maryland found no coverage for Covid-19 losses because the “physical loss or damage” provision covers “tangible, concrete, and material harm to the property” or “deprivation of possession of the property” and not “functional loss.”

Massachusetts: Verveine Corp. v. Strathmore Insurance Co. concluded the insured did not plausibly allege “direct physical loss of or damage to” covered property based on the presence of an “evanescent” virus that may be addressed through simple cleaning. “[D]irect physical loss of or damage to” property “requires some ‘distinct, demonstrable, physical alteration of the property.’”

Ohio: The Ohio Supreme Court in Neuro-Communication Services, Inc. v. Cincinnati Insurance Co. held that “direct physical loss” or “damage to property” does not include the general presence of the coronavirus in the community, its presence on items in a building, nor the presence of a person infected with the virus.

Oklahoma: In Cherokee Nation v. Lexington Insurance Co., the Oklahoma Supreme Court held a Native American tribe’s losses were not covered, noting that implementation of Covid-19 mitigation measures at its properties “constitute[d] measures to stop the spread of the virus from one person to another, not repairs to or replacement of damaged or lost property.”

South Carolina: In Sullivan Management, LLC v. Fireman’s Fund Insurance Co., the South Carolina Supreme Court unanimously held that neither the presence of the coronavirus nor corresponding government orders prohibiting indoor dining fall within the policy’s language of “direct physical loss or damage.”

Washington: The Washington Supreme Court in Hill & Stout, PLLC v. Mutual of Enumclaw Insurance Co. held “[i]t is unreasonable to read ‘direct physical loss of … property’ in a property insurance policy to include constructive loss of intended use of property.”

Wisconsin: The Supreme Court of Wisconsin in Colectivo Coffee Roasters, Inc. v. Society Insurance said “the presence of Covid-19 does not constitute a physical loss of or damage to property because it does not ‘alter the appearance, shape, color, structure, or other material dimension of the property.’”

Vermont: In Huntington Ingalls Industries, Inc. v. Ace American Insurance Co., the Vermont Supreme Court said under Vermont’s “extremely liberal” pleading standard it would leave it to the experts and evidence “to evaluate the validity of insured’s novel legal argument before dismissing th[e] case.” It is the only state supreme court to allow a Covid-19 coverage claim to survive a motion to dismiss on the pleadings.

Conclusion

The 1st, 2nd, 3rd, 4th, 5th, 6th, 7th, 8th, 9th, 10th, and 11th Circuits now have lined up unanimously to hold property insurance does not encompass economic losses from Covid-19-related business interruption claims. That same unanimity is reflected in the rulings by nearly all state supreme courts, with the single exception of Vermont. More than 800 decisions from state and federal courts of all levels nationwide reflect a strong consensus across the country that Covid-19 business interruption losses are not insured property damage.

Both the number of lawsuits filed on these coverage issues in a short time and the extent of single-minded agreement of judges in forums across the country are unusual. The Covid-19 pandemic prompted a flood of coverage litigation in a short period, including multidistrict litigation, purported class actions and 2,300-plus cases in federal and state courts.

Courts responded in unison, reflecting overwhelming judicial agreement that no coverage exists. If a “split in the circuits” is the talisman of whether there is a disputed issue requiring authoritative resolution, here there is none. Not only is there no split, there is a notable lack of any disagreement from the 1st Circuit straight through to the 11th Circuit, and nearly all state high courts also agree.

This unanimity suggests the end is near for litigation seeking to recover under property insurance policies for Covid-19 business interruption losses.

Laura A. Foggan is a partner in Crowell & Moring’s Washington, D.C. office and chair of the firm’s insurance/reinsurance group. In addition to her litigation and counseling work, Laura represents insurers and reinsurers in arbitrations, as well as alternative dispute resolution (ADR) and mediation proceedings.

Laura A. Foggan is a partner in Crowell & Moring’s Washington, D.C. office and chair of the firm’s insurance/reinsurance group. In addition to her litigation and counseling work, Laura represents insurers and reinsurers in arbitrations, as well as alternative dispute resolution (ADR) and mediation proceedings.

![]()