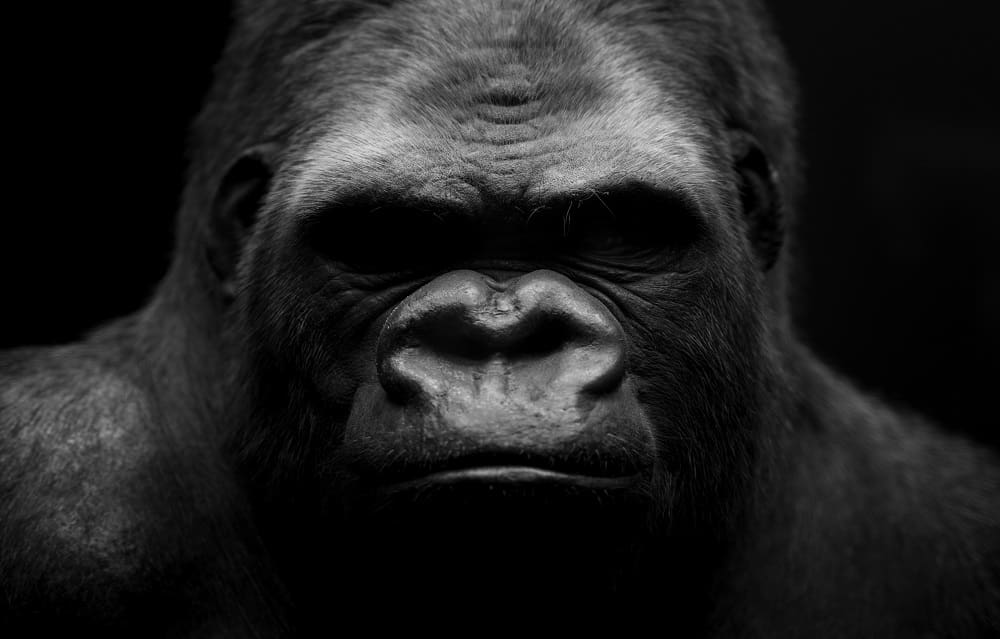

Legislators signed the California Consumer Privacy Act (CCPA) into law in 2018 with the goal of protecting the sensitive data of state residents. Saalex Corps’ David Stills explores how this 800-pound regulatory gorilla may dominate the U.S. data security and privacy jungle.

“Like it or not, the 800-pound gorilla usually sets the standard,” says Daya Nadamuni, a senior strategist at Adobe Systems. If she is correct, the CCPA might be laying the groundwork for new federal privacy legislation. Let’s examine how this California law is already affecting businesses across the country.

How are businesses affected?

Under the CCPA, all companies with at least $25 million in annual revenues, whether they are headquartered in California or not, are affected if they gather personal data of at least 50,000 consumers or collect more than half of their revenue from selling personal data. These businesses must understand what constitutes private data, locating and securing such personal information and even policing their vendors to ensure that they are compliant. Only half of U.S. businesses expect to be compliant by the deadline of January 1, 2020, according to a recent PwC survey.

Essentially, businesses must disclose the data they collect, the purpose of collecting that data and what third parties use it. They must also make available transportable copies of consumers’ data upon their request, as well as provide opt-out rights and deletion options.

How do we become compliant?

The first step businesses need to take is to assess data processing, storage and protection procedures in order to identify any areas for potential breaches. This might involve all departments inventorying their applications that house personal data and mapping how data is transmitted across shared or collaborative environments. It might also involve implementing new data integration tools such as Tableau or Microsoft Power BI to connect disparate and siloed data.

If businesses are not already following a cybersecurity plan such as ISO 27001 or NIST, they need to ensure data at rest is encrypted to reduce the risk of a data breach. Finally, they must train employees to handle their customers’ personally identifiable information (PII).

Besides having a CCPA plan and process in place for handling consumer data, businesses need to be able to document, demonstrate and prove their plan works. The cost of noncompliance is just too great. Aside from the financial penalties, a business could also lose customers if it cannot provide the peace of mind that consumer data is protected and secure.

Many businesses are employing managed security systems providers that can employ complex IT tools to identify and organize collected data while providing consumers with easy access to delete or modify it.

What’s the cost of noncompliance?

Faced with penalties that could potentially put them out of business, many small and medium-sized businesses still lack the in-house IT expertise to implement the necessary controls and reporting capabilities to comply with the CCPA. While some estimate the cost of compliance to be in the six-figure range, the penalties for noncompliance can add up just as quickly. Fines and penalties for civil suits are up to $7,500 per violation and for class action suits are up to $750 per consumer per incident or in actual damages (whichever is greater).

Companies should be gearing up now to accommodate this regulatory 800-pound gorilla, because they are required to provide a consumer data dating back from the previous 12 months, even though the law goes into effect January 1, 2020. Another motivation to prepare for CCPA is that businesses will be in a better position should it become the blueprint for a national privacy data policy.

While the U.S. currently provides protective regulations regarding health, financial and children’s data privacy, it has yet to legislate broader protection and security measures for other personal data. Several states are attempting to enact bills similar to the CCPA, and congressional representatives are rumored to be drafting federal legislation. However, it would take lawmakers months to sort out the gritty details of a national data security policy. Like it or not, California’s 800-pound gorilla may set the standard for data dominance across this country’s digital jungles.

David Stills is Director of IT Operations at Saalex Corp. David has over 30 years of experience in information technology leadership and consulting and has a wealth of expertise, with strengths in leveraging technology to meet aggressive goals, governance and policy, budget management and cost containment, as well as a vast technical background.

David joined Saalex in April of 2015 and became the Director of Information Technology for both Saalex Solutions and SaalexIT. He currently serves as the principal advisor for IT to exceed expectations throughout the enterprise. Prior to this role at Saalex, David served as the Director of IT for a real-estate development company and before that, as the CEO of an IT services company.

David is also a U.S. Army protected veteran who served his country for 10 years. He continues to give back to the community as a member of the CareerSource Brevard‘s IT Workforce Consortium and the Space Society for Information Management. He also supports the Eastern Florida State College’s Xcel-IT Grant and the CareerSource Brevard’s American Promise Grant. David holds the Certified Government Chief Information Officer (CGCIO) designation from the Florida Institute of Government.

David Stills is Director of IT Operations at Saalex Corp. David has over 30 years of experience in information technology leadership and consulting and has a wealth of expertise, with strengths in leveraging technology to meet aggressive goals, governance and policy, budget management and cost containment, as well as a vast technical background.

David joined Saalex in April of 2015 and became the Director of Information Technology for both Saalex Solutions and SaalexIT. He currently serves as the principal advisor for IT to exceed expectations throughout the enterprise. Prior to this role at Saalex, David served as the Director of IT for a real-estate development company and before that, as the CEO of an IT services company.

David is also a U.S. Army protected veteran who served his country for 10 years. He continues to give back to the community as a member of the CareerSource Brevard‘s IT Workforce Consortium and the Space Society for Information Management. He also supports the Eastern Florida State College’s Xcel-IT Grant and the CareerSource Brevard’s American Promise Grant. David holds the Certified Government Chief Information Officer (CGCIO) designation from the Florida Institute of Government.