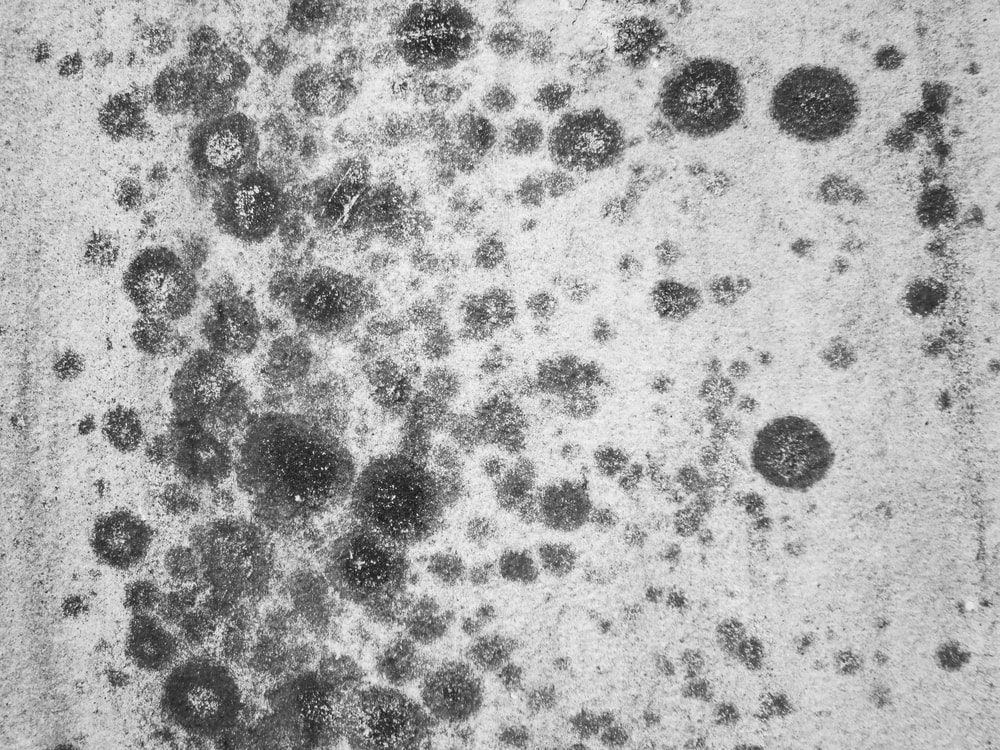

Are losses caused by the presence of, or exposure to, mold or fungus in a building covered by liability insurance? That question has never been easy to answer, and at the end of 2015, the Texas Court of Appeals added further complication to the already confusing structure of mold insurance law in America.

In a case titled In re: Liquidation of Legion Indemnity Company, the Director of Insurance in the State of Illinois was acting as liquidator for Legion Indemnity Company. The liquidator asked the court to disallow a claim by 23 governmental employees who had obtained a judgment against a construction company in a negligence action related to bodily injury the employees suffered from exposure to toxic mold during the course of their construction employment. Claimants sought to collect their judgment from the insurance company under a comprehensive general liability policy issued by Legion. Legion had been placed in liquidation prior to the claims for judgment being entered, so claimants filed a claim against the liquidator.

In the policy at issue, the insurance did not cover losses arising from either “contamination” of the environment by a pollutant or on account of a single, continuous or intermittent or repeated exposure to any “health hazard.” The policy defined the term “contaminant” to mean any unclean, unsafe, damaging, injurious or unhealthful condition arising out of the presence of any pollutant, whether permanent or transient, in any environment. The policy further defined “health hazard” to mean any chemical, alkaline, radioactive material or other irritants or any pollutant or other substance, product or waste product, where the fumes or other discharges or effects therefrom, whether liquid, gas or solid or gaseous are determined to be toxic or harmful to the health of any person, plant or animal.

The liquidator recommended that the claim be denied based on the exclusionary language in the policy and the trial court agreed. The Texas Court of Appeals, however, held that the terms “mold,” “fungi” or any similar wording are listed neither in the exclusion nor in the definition of the relevant terms. The liquidator contended that the insurance company issued a broad policy to exclude mold from coverage and it did not have to enumerate the specific terms mold or fungi in the exclusion. The Court held that the alleged intent to exclude mold-related claims was not clearly stated in the exclusion.

The Court distinguished two earlier Texas decisions, Lexington Insurance Company v. Unity/Waterford-Fair Oaks, Ltd. and American Equity Insurance Company v. Castle Maine Farms, Inc. In Lexington Insurance, the exclusion provided that the policy did cover loss or damage resulting from, contributed to or made worse by contaminants or pollutants. The policy definition of contaminants and pollutants included “bacteria, fungi, virus or other hazardous substances.” Since mold is fungi the Lexington Court held that the loss caused by mold to several floors of an apartment complex was excluded from coverage. In the American Equity Insurance case, the policy provided there was no coverage for loss which would not have occurred but for the release or escape of pollutants. The policy defined pollutants as any “solid, liquid, gases or thermal irritants or contaminants including smoke, vapor, soot, fumes, acids, alkalizes, chemical and waste.” The Court concluded the exclusion applied because the discharge from the salt water disposal pipe line was liquid waste. The Court also noted that salt water was a contaminant when it was introduced accidentally onto property that was not meant to receive it. The Court also examined another Texas decision, Hirschhorn v. Auto-Owners Insurance Company. The Hirschhorn Court determined that bat guano was a pollutant under a pollution exclusion. The Court stated that bat guano was “waste” within the meaning of the pollution exclusion because a reasonable person would understand it to be waste.

These decisions are difficult to reconcile. One clear rule seems to provide that if a pollution exclusion specially mentions mold, fungi or bacteria, mold damages will be excluded from coverage. If the exclusion does not specifically and expressly identify mold, fungi or bacteria as excluded, the coverage question is murkier. Mold and bacteria are present in practically every building in America. The broad exclusions that explicitly list fungi and bacteria apply to any species or amount of those contaminants, in theory. Because exclusions are silent on type or amount, any detectable fungi or bacteria could technically trigger the full exclusion. Courts may be wary of imposing such an exclusion for such a common condition. In other words, the bottom line is this: if there is an exclusion to your CGL policy that specifically mentions mold or bacteria, you are out of luck with respect to coverage for the costs of repairing mold damage or claims by individuals that mold has adversely affected their health. If your policy does contain a pollution exclusion, though, that exclusion in itself may not be cause for despair. You may have coverage for mold claims — it will require a careful analysis of the policy terms and the development of coverage law in your jurisdiction.

A frequent lecturer and author on diverse environmental issues,

A frequent lecturer and author on diverse environmental issues,