Hong Kong (May 23, 2017) – Ninety-three percent of respondents to the EY Asia-Pacific (APAC) Fraud Survey 2017 say they want to work for a compliant organization but are confused about what’s expected of them because compliance policies lack clarity and are inconsistently delivered. This is leading to calls from employees for corporate policies combating fraud, bribery and corruption to be simplified to help ensure employees fully understand them and comply accordingly.

The EY APAC Fraud Survey 2017, Economic uncertainty/Unethical conduct: How should over-burdened compliance functions respond? surveyed 1,698 employees from large businesses in 14 Asia-Pacific territories.

The awareness about the dangers of fraud, bribery and corruption directly contrasts with employees’ understanding of what is and what isn’t allowed within an organization’s compliance protocols. The survey found that employee frustration with discrepancies and inconsistencies of how compliance programs are executed creates major stumbling blocks to managing effective compliance programs and bringing fraud, bribery and corruption under control.

The desire to work for an ethical organization is strong; more than two-in-five (44 percent) say they would accept a lower salary if it meant working for an ethical employer.

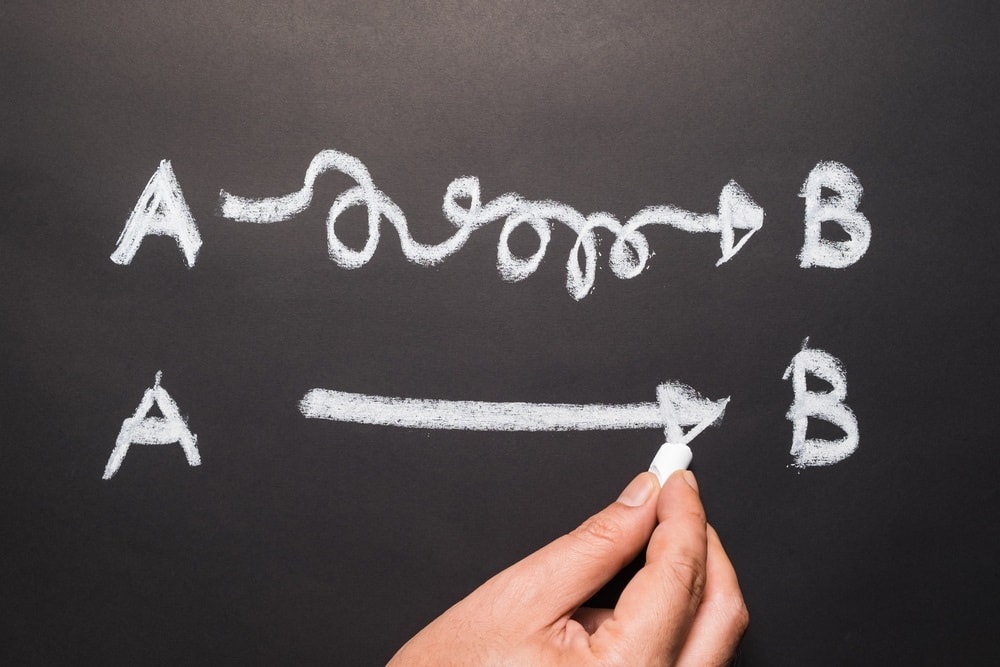

Eighty-five percent of survey respondents want their organization’s corporate compliance policies to be simplified and localized to make them more understandable. Specifically, they think existing policies are too long and use unnecessarily complex language or legal jargon. Thirty-nine percent say their organization’s code of conduct in its current format has little impact on how employees actually behave.

Chris Fordham, EY Asia-Pacific Leader, Fraud Investigation & Dispute Services, says: “Employees are demanding absolute clarity and anything short of that impacts morale, hiring, retention and overall business performance. Corporates need to simplify their compliance protocols to help ensure employees follow them.”

Whistleblowing hotlines not being used by employees

Sixty-one percent of respondents say they have a whistleblowing hotline within their organization. But when it comes to reporting unethical acts, employees are reluctant to use the existing internal whistleblower hotlines as they do not trust their organization will protect their anonymity or follow-up with proper remedial actions. Nearly a third (28 percent) say they would prefer to use external law enforcement hotlines and social media channels to report misconduct instead.

Fordham says: “It’s encouraging that more companies in Asia-Pacific now have whistleblower hotlines. But we’re concerned that employees don’t have enough faith that their reports will be handled confidentially or that these reporting mechanisms will result in proper follow-up and punishment for the guilty parties.”

Managing millennials: conflicting values are ‘a wake-up call for businesses’

The survey offers key insights into the apparent conflicting attitudes of millennials toward fraud, bribery and corruption. Nearly half (49 percent) of respondents think that their senior management would ignore unethical behavior to achieve corporate revenue targets resulting in employees justifying wrongdoing. More than any other age group, millennials stood out as feeling justified in participating in a variety of ethically questionable behaviors.

The survey also finds that millennials are more inclined to justify offering cash payments to win or retain business (38 percent vs. 27 percent for all other age groups). Millennials are also more inclined to justify offering entertainment (46 percent vs. 31 percent for other age groups) or personal gifts (43 percent vs. 29 percent for other age groups) to win deals to help a business survive, and would even be willing to extend monthly reporting periods (40 percent vs. 31 percent for other age groups) to meet financial targets.

Yet these findings mark a strong contrast with millennials’ results when asked whether they would want to work for an unethical business or organization. Eighty-three percent say they would look for a new job if their organization was involved in a major fraud, bribery or corruption case.

Fordham says: “This is a wake-up call for businesses about the need to invest in more education and leadership by example. On the one hand, millennials feel it is okay to behave unethically in some situations. Yet on the other hand, they take a strong stand against working for an unethical business. This discrepancy needs to be addressed early and quickly to help ensure businesses hire and retain the best young talent, who will form their future workforce.”

Asia-Pacific awash with naiveté over the scale of cyber threats

Nearly half (47 percent) of the survey respondents say there’s no particular company policy controlling how staff use personal devices for work-related activities at their organizations. This creates new vulnerabilities for organizations with almost half (49 percent)of respondents agreeing that they conduct business using their personal mobile devices, despite they may have been issued with a work mobile device, and 39 percent recognize that there are risks associated with using personal devices for work.

Jack Jia, Partner, Fraud Investigation & Dispute Services, Ernst & Young Advisory Services Limited, says: “Asia-Pacific is awash with naiveté over the scale of cyber threats. Companies often think these threats are all external, but ignore the very real threats posed internally. The current safeguards are inadequate in repelling criminals, including rogue employees who are intent on stealing personal data, intellectual property or even a company’s cash. Designing and enforcing policies regarding the use of personal devices for work-related activities would help mitigate the risk of internal threats and cyber attacks.”

Appendix

Ethics

| I want to work for a company with a strong compliance culture | ||

| Asia-Pacific | Mainland China | Hong Kong |

| 93% | 94% | 96% |

| I would be willing to earn slightly less in order to work for an ethical company | ||

| Asia-Pacific | Mainland China | Hong Kong |

| 44% | 48% | 48% |

Clarity and consistency

| I would make changes to my organization’s compliance policy for it to be more understandable | ||

| Asia-Pacific | Mainland China | Hong Kong |

| 85% | 90% | 87% |

| Our code of conduct has little impact on how people actually behave | ||

| Asia-Pacific | Mainland China | Hong Kong |

| 39% | 35% | 31% |

| I feel most comfortable to use anonymous law enforcement channels and social media avenues when whistleblowing | ||

| Asia-Pacific | Mainland China | Hong Kong |

| 28% | 41% | 31% |

| Our senior management would ignore unethical behavior to achieve corporate revenue targets | ||

| Asia-Pacific | Mainland China | Hong Kong |

| 49% | 57% | 45% |

Millennials

| I feel it can be justified to offer cash payments to win or retain business if it helps a business survive in an economic downturn | ||

| Millennials | Other age groups | |

| Asia-Pacific | 38% | 27% |

| Mainland China | 29% | 18% |

| Hong Kong | 30% | 34% |

| I feel it can be justified to offer entertainment to win or retain business if it helps a business survive in an economic downturn | ||

| Millennials | Other age groups | |

| Asia-Pacific | 46% | 31% |

| Mainland China | 53% | 42% |

| Hong Kong | 35% | 29% |

| I feel it can be justified to offer personal gifts or services to win or retain business if it helps a business survive in an economic downturn | ||

| Millennials | Other age groups | |

| Asia-Pacific | 43% | 29% |

| Mainland China | 51% | 37% |

| Hong Kong | 32% | 29% |

| I feel it can be justified to amend financial reports to provide a more positive outlook on results if it helps a business survive in an economic downturn | ||

| Millennials | Other age groups | |

| Asia-Pacific | 27% | 18% |

| Mainland China | 24% | 17% |

| Hong Kong | 27% | 19% |

Cyber threats

| My organization does not have any policies against using personal devices for work-related activities | ||

| Asia-Pacific | Mainland China | Hong Kong |

| 47% | 46% | 48% |

| I conduct business using my personal mobile device, even though my organization provided me with a work mobile device | ||

| Asia-Pacific | Mainland China | Hong Kong |

| 79% | 92% | 92% |

Source: EY Asia-Pacific Fraud Survey 2017, Economic uncertainty/Unethical conduct: How should over-burdened compliance functions respond?

About EY

EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com.

This news release has been issued by EYGM Limited, a member of the global EY organization that also does not provide any services to clients.

About EY’s Fraud Investigation & Dispute Services (FIDS)

Dealing with complex issues of fraud, regulatory compliance and business disputes can detract from efforts to succeed. Better management of fraud risk and compliance exposure is a critical business priority — no matter the size or industry sector. With more than 4,500 fraud investigation and dispute professionals around the world, EY provides the analytical and technical skills needed to quickly and effectively conduct financial and other investigations, as well as gather and analyze electronic evidence. Working closely with you and your legal advisors, we will assemble the right multidisciplinary and culturally aligned team, and bring an objective approach and fresh perspective to challenging situations, wherever you are in the world. And because we understand that you require a tailored service as much as consistent methodologies, we work to give you the benefit of our broad sector experience, our deep subject matter knowledge and the latest insights from our work worldwide.

About the Survey

Between November 2016 and February 2017, our researchers — the global market research agency Ipsos — conducted 1,698 interviews with employees of multinational corporations and domestic companies in 14 APAC territories: Australia, mainland China, Hong Kong, India, Indonesia, Japan, South Korea, Malaysia, New Zealand, the Philippines, Singapore, Taiwan, Thailand, Vietnam. The interviews were conducted online in local languages on an anonymous basis covering a mixture of company sizes, job roles and industry sectors.