2020 was tumultuous to say the least. But between the COVID-19 pandemic, natural disasters, numerous ESG issues and more, what are the top concerns for directors as we head deeper into 2021? Dottie Schindlinger and Kira Ciccarelli of the Diligent Institute share insights from the latest research.

The pandemic has raised hard-hitting questions about the future of the workforce, the “S” in ESG, cyber risk management and a plethora of other issues. Meanwhile, racial justice protests in the United States have brought discussions of diversity, equity and inclusion to the forefront, calling for a deep and deliberate look at inequities in the workplace. To top it off, natural disasters increasing in size, severity and frequency have increased pressure on corporate leaders to take decisive action on climate change.

Following a year as monumental as 2020, what are some top concerns for directors as they look to move forward? What have they learned? What are boards prioritizing as we head into 2021? How will conversations surrounding ESG and DEI progress as the corporate world is called upon with increasing pressure to commit to action and make positive change? How has cyber risk evolved, and how will companies keep up? Diligent Institute’s latest research, conducted in partnership with Corporate Board Member, provides insight into the minds of directors and suggests where to look next for answers. In our most recent research, a few trends emerge:

- Growth and recovery are top of mind in 2021.

- Directors seek clear guidance on ESG.

- Boards are beginning to embrace diversity.

- Cyber risk and digital transformation are growing concerns.

Growth and Recovering from COVID-19 Are the Top Concerns for Directors in 2021

This year, Diligent Institute partnered with Corporate Board Member on the 18th annual edition of “What Directors Think,” a comprehensive director survey covering nearly every aspect of board governance, from overseeing company culture to risk management and much more. This year’s survey garnered responses from 400 U.S. public company directors across all sectors of the economy.

As we approach a full year of #COVID19 we asked directors how board #governance has been altered. Learn more about the changes they’re seeing in our latest Institute Report. https://t.co/aDWkeorHrP #moderngovernance pic.twitter.com/vcYRkIWAE7

— DIligent Institute (@DILInstitute) January 28, 2021

In “What Directors Think,” we learned that directors are focused on economic recovery and a return to growth. The survey, conducted from August to October 2020, showed directors moving out of crisis management mode and back to discussing growth strategies (including M&A), even though COVID-19 vaccines were still on the horizon at that point. When asked to choose agenda items for their next board meeting, the top two options were growth strategy/COVID-19 recovery at 74 percent of respondents. M&A opportunities and divestitures came in at 48 percent. Clearly, directors are looking for opportunities that have arisen out of the pandemic as we move into 2021.

On a related note, director confidence in the economy remains optimistic. In October 2020, Diligent Institute and Corporate Board Member launched a monthly pulse survey, the Director Confidence Index (DCI), which polls U.S. public company directors on their confidence in current and future business conditions, as well as their views on other topical matters.

Since we began fielding the survey, director confidence in the current and future economy has been on the rise, moving from a 6.6 to a 6.9 on our 10-point scale. Additionally, 73 percent of board members surveyed anticipate profit will increase over the next 12 months, and 75 percent anticipate increases in revenue.

Directors Seek Clear Guidance on ESG

Directors Seek Clear Guidance on ESG

Our research on the top concerns for directors underscores a growing and sustained board-level focus on ESG-related issues and a commitment to accountability. In Diligent Institute’s interview-based “Ask a Director” series, interviewees noted an increased focus on answering new questions, specifically surrounding the “S” in ESG. As a result of the pandemic, they reported spending a greater amount of time talking about human capital issues, such as employee safety, mental health and well-being where they had not done so in the past.

“When you think about enterprise risk management, human capital issues did not dominate the conversation as much as other topics. As a result of the pandemic, we are being forced to really address people issues, such as working from home, child care, home schooling, illness, financial burdens and mental health.” -Dawn Zier, Hain Celestial Group (Nasdaq: HAIN) and Spirit Airlines (NYSE: SAVE)

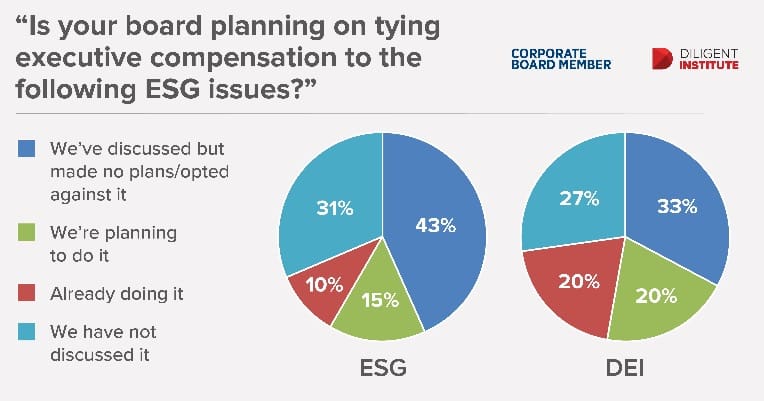

In our January edition of the DCI, we asked directors if their companies were planning on tying executive compensation to ESG or DEI goals. An impressive 40 percent were either considering tying executive compensation to DEI goals or had already done so. For ESG, this number was only 25 percent, demonstrating that while the majority of boards are discussing ESG issues (69 percent), they have yet to embrace setting specific accountabilities.

In the 2021 “What Directors Think” report, these sentiments were echoed. When asked how important it was to be a fair employer, 88 percent of respondents indicated that this was either extremely or very important for the board to oversee. When asked how important it was whether the company was acting as a good corporate citizen, 75 percent indicated that this was either extremely or very important for the board to oversee.

In the 2021 “What Directors Think” report, these sentiments were echoed. When asked how important it was to be a fair employer, 88 percent of respondents indicated that this was either extremely or very important for the board to oversee. When asked how important it was whether the company was acting as a good corporate citizen, 75 percent indicated that this was either extremely or very important for the board to oversee.

However, there did seem to be a slight disconnect between the importance directors placed on ESG issues and how well they believed they were able to oversee them. When asked about their success measuring and reporting on E, S and G elements, directors were less confident in their ability to measure and report on the environmental and social aspects of ESG — two major issue areas for 2021 and beyond.

Boards are Beginning to Embrace Diversity

As a result of the unprecedented nature of the pandemic, directors are prioritizing flexibility and adaptability in decision-making. Our conversations with directors revealed that many seek to obtain this flexibility through the incorporation of more diverse perspectives in the boardroom.

“We need to be nimble, agile … And that’s where flexible and diverse directors are valuable. They will think about contingencies and planning for scenarios that we might not anticipate today.” -Phyllis Campbell, JPMorgan Chase & Co. (Pacific Northwest), SanMar, US-Japan Council and Allen Institute

Our findings from “What Directors Think” are consistent with this shift in mindset. Half of surveyed directors say that the events of 2020 have heightened their boards’ awareness of the need for diversity and inclusion. We also asked which attributes were the top concerns for directors to have in their board’s next member, and the results were eye-opening: Racial, gender and background diversity all outranked CEO experience for the first time ever in the survey’s 18-year history.

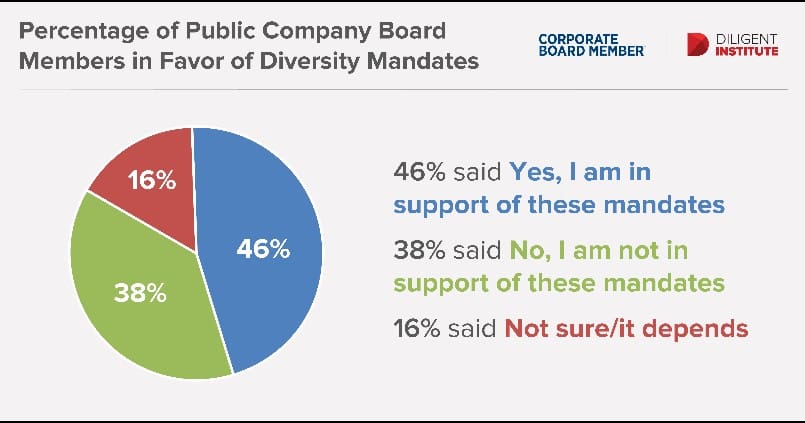

Similarly, in our December 2020 edition of the DCI, we asked respondents about diversity mandates in light of the recent NASDAQ ruling. We found that nearly half (46%) of surveyed directors indicated support for diversity mandates: a landmark shift away from previous sentiment. By contrast, a 2019 Corporate Board Member poll found that only 24% approved the diversity mandate in California requiring gender diversity for all public company boards headquartered there.

Cyber Risk and Digital Transformation are Growing Concerns

Cyber Risk and Digital Transformation are Growing Concerns

In March 2020, the unexpected pivot most U.S. companies had to make to entirely remote work meant that their cybersecurity structures and practices were tested as never before – and many were found wanting. By April, the FBI warned there had been a four-fold increase in cybercrime in just the first month of the lockdown. Even as corporations adapted to virtual governance and discovered some unforeseen benefits along the way, cyber security and digital transformation also figured among the top concerns for directors going forward.

In “What Directors Think,” we asked respondents about the items they would put on their next board meeting agendas, and disruptive technologies and innovations was the fourth most popular option, exceeded only by COVID recovery, M&A and capital allocation. Meanwhile, cyber risk was in the top five issues keeping directors up at night, falling right behind heavy-hitters like the economy, pandemic, political landscape and regulatory environments.

Meanwhile, directors also listed digital transformation as the second-most important internal element for their company’s success in 2021, following cash reserves. Yet, when we asked which issues were the most challenging for directors to oversee, new technologies and innovation topped the list at 42 percent of respondents, while cybersecurity came in third with 37 percent.

Taken together, these findings indicate directors recognize the importance of digital transformation and cybersecurity, but find their boards lacking in technological expertise.

“We had not looked enough at cybersecurity, which became a much greater risk with everyone working from home. It also showed me that many of the kinds of people on boards today are no longer the best people to manage current risk horizons. Eighty to 90 percent of board members are out of their depth with cybersecurity.” -Sonia Villalobos, Telefonica Vivo, LATAM Airlines and EcoRodovias

Questions for Your Board

- Is your company properly positioned for recovery and growth in 2021? How might vaccine timelines and ongoing intermittent shutdowns affect your company’s success this year?

- How is your company responding to increased pressures around ESG? What goals and metrics make the sense for your organization to embrace and monitor?

- How can you ensure that your diversity goals maintain importance and focus in 2021? What can your board do to ensure diversity remains an imperative from the top down?

- Does your board have a sufficient handle on digital transformation and cyber risk? How will your board gain the necessary expertise to ensure these issue areas receive the required attention?

Dottie Schindlinger is the Executive Director of

Dottie Schindlinger is the Executive Director of  Kira Ciccarelli is the Lead Researcher at the Diligent Institute, the modern governance think tank and research arm of Diligent Corporation. In her role, Kira works to conduct and provide high-level modern governance research to inform director decision-making and identify best practices.

Kira Ciccarelli is the Lead Researcher at the Diligent Institute, the modern governance think tank and research arm of Diligent Corporation. In her role, Kira works to conduct and provide high-level modern governance research to inform director decision-making and identify best practices.