Final update at 12:40 p.m. March 7

Two years after proposing rules requiring publicly traded companies to disclose their greenhouse gas (GHG) emissions and other climate risk-related details, the SEC on Wednesday adopted a scaled-back version of its original proposal that does not require controversial Scope 3 emissions reporting.

Passed by a 3-2 vote, the new rule will require covered entities to disclose a variety of details regarding climate-related risks, strategies and governance and, for some companies, information about material Scope 1 and Scope 2 emissions. Notably, the final rule eliminated a requirement to disclose Scope 3 emissions and exempts many types of companies from having to report emissions at all.

Since it was proposed in March 2022, the SEC’s proposal has received thousands of public comments, about 24,000, SEC Chairman Gary Gensler said during the agency’s Wednesday meeting, and was the source of a great deal of political backlash. A vote was initially expected in October before being delayed to April, with the agency issuing a public alert just one week before its March 6 meeting.

According to the rules passed Wednesday, subject to requirements to report “material” Scope 1 and Scope 2 emissions, assuming they are not otherwise exempted, are large accelerated filers and accelerated filers, which are filing categories determined by the value of stock in the hands of public investors. The original text of the rule would have required more companies to report their GHG emissions; a recent estimate by Ideagen indicates there could be more companies excluded than included, based on their analysis of audits of public companies.

“The SEC’s groundbreaking ruling is a historic step towards corporate transparency, mandating U.S.-listed companies to disclose climate-related risks, emissions and environmental strategies,” said William Theisen, CEO of EcoAct North America, a climate consultancy. “While this marks a significant milestone, the omission of mandatory Scope 3 emissions reporting is a disappointment, as this critical component in the climate puzzle remains voluntary.”

Scope 3 emissions, or indirect upstream and downstream greenhouse gas emissions, are estimated to account for as much as 95% of companies’ carbon impact.

Many observers had speculated that the agency’s plan to delay its vote to 2024 would allow it to align with new rules in the European Union and California, both of which require Scope 3 GHG emissions reporting. (California’s new law has since been hit with a lawsuit, though it remains in effect as of this writing.)

“California and the European Union’s CSRD still have Scope 3 reporting included, and while the timeline is longer, the need to prepare is still looming and will be growing steadily in the coming years,” said Mallory Thomas, a partner at Baker Tilly. “Other states, like New York and Illinois, have also followed suit. We expect to see more states impose their own regulations that will apply to both private and public companies.”

In addition to other regulatory regimes that may require Scope 3 emissions reporting, the question of materiality will demand a company’s attention to its downstream emissions, said Venable partner Adrienne Gurley, a former senior SEC counsel.

“Companies will maintain discretion as to what they consider material, but anything that has or is reasonably likely to have a material impact on its own business strategy, results of operations or financial condition is likely material and may trigger a disclosure obligation,” Gurley said. “So if an entity becomes aware of climate-related issues from a company along its supply chain, or even its end customer, they can’t just disregard it. They will have to decide whether that information is material, which is always important to the SEC when considering the information provided, or not provided, to investors.

Given that final rules were expected last year and in light of other emerging regulations in the U.S. and beyond, most companies affected by climate reporting requirements have spent months and years preparing for them, though how prepared they are varies by the organization. A survey by Workiva, an ESG software provider, found that about two-thirds of executives at surveyed organizations were concerned about being able to comply with new regulatory requirements.

“The decision to scale back certain aspects of the proposal, like Scope 3 emissions, should mean little for how organizations plan to execute their climate strategies,” said Nithya Das, chief legal officer of Diligent, a GRC software provider. “In addition, the requirement for issuers to disclose whether they have certain processes in place around climate, including scenario analysis and an internal cost of carbon, means that organizations with mature climate programs are likely to be more competitive.”

But while business groups may find compliance easier under the final rules, environmental groups criticized the agency’s decision to scale back its original proposal.

“This watered-down rule on climate risk disclosure is a departure from international norms and best practices,” a statement from Stop the Money Pipeline reads. “As regulators around the globe, including those in China and the European Union, advance their regulatory frameworks to include rigorous climate risk disclosures, the SEC’s proposed rule lags, jeopardizing the United States’ position in the global market.”

And the reliance on companies’ materiality assessments will dilute the rule’s efficacy, leaving investors in the dark about the climate risks and financial implications associated with their investments, said Jackie Fielder, co-director of Stop the Money Pipeline.

Environmental advocacy groups are not the only observers disappointed at the SEC’s final rules. Jason Britton is an adjunct professor of thematic investing at the College of Charleston School of Business and founder of Reflection Asset Management, a boutique wealth management firm specializing in thematic investing. He estimated that the exclusion of Scope 3 means that companies will be reporting only about 10% of emissions from their operations.

“Basically, their credit card receipts for gas and their utility bills. Nothing related to their product or service. So how much energy did Exxon use to pump and refine and transport the oil they took from the ground, but nothing about the burning of that oil. I’d say it’s like missing the forest for the trees, but I’m worried there won’t be any forest left.”

Though the final rules are considerably lighter than the SEC’s original proposal, complying with them will be a heavy lift for many organizations, especially for companies that have not previously gathered or disclosed ESG-related data, said Nancy Mentesana, executive director for the ESG practice of Labrador U.S., a communications firm focused on corporate disclosure documents.

“Public companies are already required to analyze the materiality of risks and their impacts, and many companies are already reporting their emissions, so for some this is only an incremental burden, whereas for others who aren’t as prepared, it will be a heavy burden. It largely depends on how mature the company is in their ESG journey.”

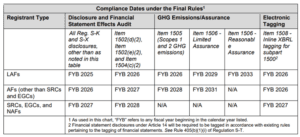

In addition to dropping the requirement that companies report their Scope 3 emissions, the rule also provides more time to file disclosures depending on filing status and content of the disclosure. Other modifications from the original proposal include:

- Adopting a less prescriptive approach to certain of the final rules, including, for example, the climate-related risk disclosure, board oversight disclosure, and risk management disclosure requirements.

- Qualifying the requirements to provide certain climate-related disclosures based on materiality, including, for example, disclosures regarding impacts of climate-related risks, use of scenario analysis and maintained internal carbon price.

- Eliminating the requirement to describe board members’ climate expertise.

- Eliminating the requirement for all registrants to disclose Scope 1 and Scope 2 emissions and instead requiring such disclosure only for large accelerated filers (LAFs) and accelerated filers (AFs), on a phased-in basis and only when those emissions are material and with the option to provide the disclosure on a delayed basis.

- Exempting smaller reporting companies (SRCs) and emerging growth companies (EGCs) from the Scope 1 and Scope 2 emissions disclosure requirement.

- Modifying the assurance requirement covering Scope 1 and Scope 2 emissions for AFs and LAFs by extending the reasonable assurance phase in period for LAFs and requiring only limited assurance for AFs.

- Removing the requirement to disclose the impact of severe weather events and other natural conditions and transition activities on each line item of a registrant’s consolidated financial statements.

- Focusing the required disclosure of financial statement effects on capitalized costs, expenditures expensed, charges and losses incurred as a result of severe weather events and other natural conditions in the notes to the financial statements.

Further reading: