As banks and financial institutions prepare for the end of LIBOR, the world’s most referenced interest rate, TCS North America’s Manoj Reddy addresses risk and uncertainty surrounding the coming change.

The LIBOR (London Inter-Bank Offer Rate) transition is less than 18 months away. The world’s most referenced interest rate benchmark will soon cease to exist.

The scenario for banks and financial institutions is nothing less than a battle zone; they are not only taking on new exposure because of the newer benchmark rates, but also challenged by migrating the existing instruments and exposures and continuing to have them on the books.

The business strategy will be largely driven by the liquidity of instruments referencing the alternate rates, the demand from their customers for the type of alternate reference rate (ARR) and the regulatory direction. Irrespective of business strategy, the technology must be nimble and agile enough to support the business needs: to be competitive, stay relevant and retain their customers.

System remediation is restricted to data or code changes in the impacted systems to ensure that the systems are adequately tested functionally and technically, as well to ensure zero business impact due to technical upgrades. Therefore, in the context of LIBOR transition, it is very important to get your systems battle ready for all possible artillery in the form of business scenarios. Remaining unscathed will require resilience.

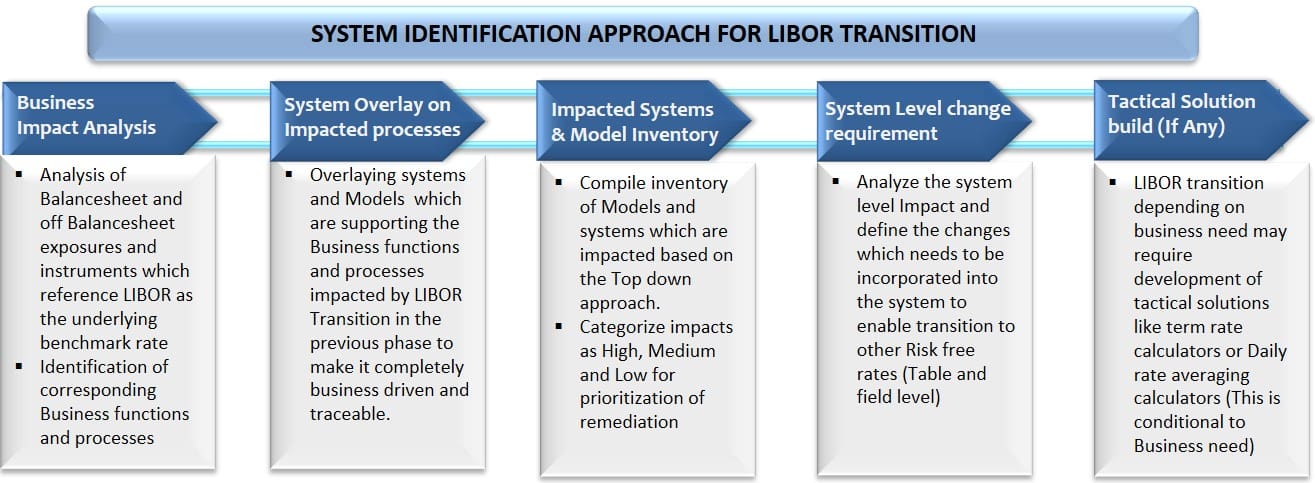

Identification of Systems for LIBOR Transition

To achieve a smooth LIBOR transition with minimal disruption, it is important to ensure that all impacted systems are identified and that the changes within these systems are well-analyzed and defined for remediation. It is highly recommended to use a top-down, business-driven approach to identify the systems in need of remediation ahead of the LIBOR transition. A bottom-up approach of code analysis and scanning for reference rates or LIBOR term rates is not recommended. Below is a high-level, recommended approach to identify systems requiring remediation.

Key Considerations in Systems Remediation

Key Considerations in Systems Remediation

1. Categorization of Systems

In addition to categorizing systems based on the severity of impacts, it is important to classify the identified LIBOR-impacted systems into third-party systems (vendor products) and in-house systems. This is critical, as there will be dependency on the timelines around which the vendor will upgrade their systems for alternate reference rates supporting the transition. This will become a key input into the overall LIBOR transition program planning, as well as the overall products and rates strategy. The business must be aware of the technology and system readiness to be able to continuously review the business strategy accordingly.

2. Market Data Availability and Ingestion

Though the alternate reference rate sourcing and dissemination of data for enterprise-wide consumption is likely to be on par with what it was for LIBOR, it is important to have a clear understanding of the types of rates (daily, averaged, term structure) and computations that need to be carried out in the run up to the LIBOR cessation date. Also, the required analysis and subsequent provisioning of the multiple rate options should be factored into the overall systems remediation efforts. It will not be a simple replacement of the LIBOR index type with the new rates, as the alternate reference rates are inherently different compared to the currently available LIBOR rates.

3. Model Remediations

Though systems are at the forefront of the technology remediation for the LIBOR transition, it is critical to understand that there will be upgrades needed for the statistical models as well. Predictive models that use LIBOR as an input and models that use LIBOR as a discounting rate will require remediation by way of alternate reference rates being ingested as a model input variable in place of LIBOR.

Also, it will be necessary to review the calibration of the statistical measures and weightages assigned to LIBOR as an input variable in the model algorithm. Given that LIBOR is inherently different in nature to the alternate rates, the degree of correlation of these alternate rates and the business impact due the substitution of these rates will need to be analyzed closely through parallel runs and gradually eased into production.

4. Tactical Solutions

Given the uncertainty around the availability of term rates and the difference between the look and feel of the LIBOR rates and the ARRs, the option of building an in-house ARR calculator should be considered as well. This is based on the principle that – given the uncertainty – it will be much easier to manage changes to the ARR computation method in a central engine that disseminates the output for consumption to the various systems using reference rates than to make these changes in all the systems every time there is a change in the ARRs until things stabilize. Though this can be viewed a tactical solution, this is not recommended to be part of the long-term strategic plan. The volume and complexity of a bank or financial institution needs to be considered before adopting this tactical solution.

5. Historical Data

LIBOR has been in use for the last 40 years, whereas ARRs like SOFR (Secured Overnight Financing Rate) have been only in existence for two years now. So, the historical observations required for SOFR to be used in place of LIBOR is lacking. Banks and FIs will need to use either a proxy like federal funds rates or advanced analytical approaches to build up sufficient history for SOFR to be used similarly to how LIBOR is used today in the various risk, finance and front-office predictive and valuation models.

6. Contract Management

Banks and FIs may have contract management systems across varying degrees of technical maturity. However, given the significance of the LIBOR transition and the impact it will have on the payments your customers or counterparties will make to banks and FIs, it is important to ensure there is a robust solution in place. It is recommended that technologies based on artificial intelligence and robotic process automation could be leveraged for reviewing and analyzing some of the standard contracts with an adequate amount of manual quality checks and assurance.

For some of the more complex syndicate loans or derivative contracts, extensive manual analysis and review is put in place with technology only playing a supporting role. The reason for this is that any miscommunication with the customer regarding the newer reference rate can potentially raise transparency issues and lead to conduct risk issues.

Key Considerations in Testing the Impacted Systems

Systems remediated as part of the LIBOR transition program require a comprehensive and focused approach to testing. It is not a simple change of a reference data from rate A to rate B. Rather, there are a number of moving pieces; complexity is only increased due to the inherent differences between the nature of LIBOR and ARRs. It is important to ensure the highest levels of assurance to business users to ensure the systems they use in the run up to and following the LIBOR transition have been thoroughly put through the grind and tested for all business scenarios.

1. Functional Focus

It is imperative to bring in a strong functional focus to the LIBOR testing efforts. In addition to testing the data integration and data ingestion layers for the new reference data being fed into the systems and the corresponding UI changes, the testing must also focus on whether the right rate was applied to the right loans and for the right tenor, along with the validation of the derived fields in the systems. It is highly recommended that LIBOR testing not be seen as technical testing and that functional experts from the corresponding domains be included to ensure a good functional coverage for LIBOR testing.

2. ARR Calculation Testing

Though in principle LIBOR transition is a change of benchmark reference rates, given the differences in the inherent nature of these rates, almost all of the global ARRs are daily rates, and there are various recommended methods (simple average, compounded average, shifts, lags, etc.) to make them more applicable to exposures where LIBOR has been used extensively in the past. For the purpose of functional testing, it is recommended that testing teams build an ARR calculator in a spreadsheet or any other tactical solution to ensure it can used across the enterprise to test systems that are being upgraded for computing the variants of ARRs.

3. Regression Testing

As part of the testing efforts for the LIBOR transition program, adequate planning and efforts need to be factored in for the regression testing of the overall system. Most of the systems will undergo API-level, UI-level and computation-level upgrades, so it is important to factor the regression testing efforts into the overall LIBOR testing plan for the system and also at the program level. For instance, we will need to validate the accrued interest field as part of all of our test cycles, though the specific logic to compute accrued interest may not have changed.

4. Factoring in the Progressing Complexity

The current testing challenges and focus for LIBOR are more around testing the application of the base rates to the newer deals. However, as we move along in the LIBOR transition journey, as adjustment spreads and waterfall models for rate and spread applicability are defined by the industry bodies for migrating loans, the testing is going to get more intense and functionally more intricate. There will be ongoing releases for system upgrades as the industry gains clarity and as sufficient liquidity is built in to ARRs. Thus, it is important to understand and appreciate that the LIBOR transition will be a progressive effort up until the time of LIBOR cessation and until all existing loans have been migrated to signal a successful transition.

Conclusion

The LIBOR transition is evolving, and with every passing day, the complexity is increasing. In such a dynamic scenario, the systems remediation approach and the assurance to business users must be agile and constantly reviewed, adjusted and even improvised based on the need of the hour.

In an era of financial protection for the consumer and heightened conduct risk, it is important that technology does not fail banks and FIs, making them vulnerable to customer complaints and subsequent regulatory actions. Their systems will need to have resilience and endurance to weather the ensuing 18 months. With respect to systems, the battle of the LIBOR transition has just begun.

Manoj Reddy is the Head of BFSI Risk & Treasury Practice at TATA Consultancy Services with an experience of more than 18 years in the areas of financial services, IT, and business consulting. Reddy has led several risk & regulatory consulting and implementation engagements for financial firms globally. He has provided both Regulatory and Strategic Business solution to his customers over the last decade primarily in CCAR, Basel, Liquidity Risk and Enterprise Risk management and is currently leading TCS efforts in North America with respect to providing Business & technology solutions to BFSI customers in the Treasury & Risk Management space.

Manoj Reddy is the Head of BFSI Risk & Treasury Practice at TATA Consultancy Services with an experience of more than 18 years in the areas of financial services, IT, and business consulting. Reddy has led several risk & regulatory consulting and implementation engagements for financial firms globally. He has provided both Regulatory and Strategic Business solution to his customers over the last decade primarily in CCAR, Basel, Liquidity Risk and Enterprise Risk management and is currently leading TCS efforts in North America with respect to providing Business & technology solutions to BFSI customers in the Treasury & Risk Management space.