ESG issues are taking systemic tolls on companies and sectors alike. These will only continue to mount. With ESG now in the mainstream, Allianz’s Shanil Williams details a few of the most pressing sources of risk.

As ESG increasingly influences investment decisions, that sway is carrying over more and more into risk management. Directors’ duties in many jurisdictions are already under growing scrutiny, and this will only deepen given tightening regulatory frameworks. Questions and clarity about who is responsible for ESG topics on the company board will not just be a matter of “nice to have,” but essential if the duties of directors are considered to be adequately fulfilled in the future. Such topics need to be right at the heart of company decision-making.

‘Bad News’ In the Spotlight

The directors and officers (D&O) insurance market has already seen some significant challenges in recent years – particularly regarding increased claims frequency and severity. One of the reasons for this has been a significant shift in this environment from traditional financial statement- or reporting-related litigation, such as bankruptcy or fraud, to so called “event-driven” or “bad news” litigation. This can often result in significant securities or derivative claims from shareholders, especially if the “bad news” causes a share price fall or a regulatory investigation.

Increasingly, such incidents can involve ESG issues. If it is not handled or disclosed appropriately by the company or board, it can result in “bad news” in their market, “bad news” for the company share price and “bad news” in the form of regulatory and legal action. ESG topics pose a significant D&O risk for companies and their insurers.

Topics to Watch

Climate Change Actions

Although ESG represents a much broader topic than just climate change, incorporating issues such as social mobility, diversity, business and human rights and sustainable and social investment, the climate change topic is very much at the forefront of people’s minds. Much of the litigation seen to date has been around disclosure – companies and boards failing to adequately disclose the material risks of climate change. For example, there have been a number of recent lawsuits in the U.S. following wildfires alleging companies did not disclose the changes in the environment that were leading to more wildfire activity, and, subsequently, how this could negatively impact the business. Companies’ boards of directors have a vital duty to ensure solid corporate climate responsibility with appropriate reporting and due diligence.

DEI at the Board Level

Over the past year, there has been a big uptick in shareholder-derivative board diversity litigation, particularly in the U.S. These cases typically allege there has been a failure in the fiduciary duties of directors given the inadequate level of diversity on the board or in management positions. A number of studies show diversity brings better risk management and financial performance to a board. Companies in the top quartile for gender, ethnic and cultural diversity on their executive team are “25 percent more likely to have above-average profitability than companies in the fourth quartile,” according to McKinsey & Company.

Pollution and Environmental Disasters

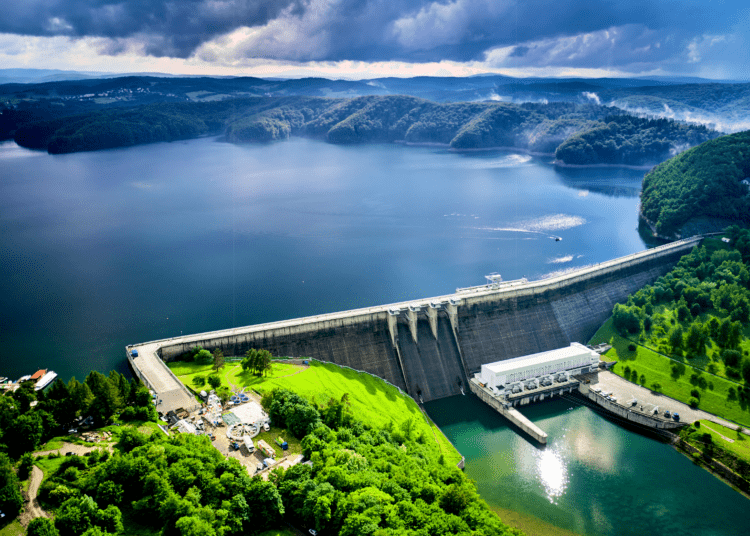

In the aftermath of events such as the collapse of a dam or an oil spill impacting an ecologically sensitive area, the boards of impacted companies are increasingly being questioned about whether they had adequate risk management processes in place to prevent such incidents from occurring and how aware they were of the possibility of them happening.

Greenwashing Claims

Incidents of companies providing misleading information in order to present a more environmentally friendly and responsible public image have already been the subject of litigation in the U.S., and crackdowns by regulators are imminent. In the U.K., the Financial Conduct Authority has developed a set of principles to tackle concerns over false claims. The Task Force on Climate-Related Financial Disclosures, the Securities and Exchange Commission (SEC) in the U.S. and European supervisors are also looking at this issue.

CEO Pay

Executive compensation is another hot topic, particularly for investors. Norway’s $1.1 trillion sovereign fund – one of the world’s largest – is just one that has developed active stewardship of management compensation proposals in the companies it invests in, amid concerns about opaque pay. At the same time, a growing number of companies are looking at linking CEO or director-level remuneration to climate/ESG-related targets, such as greenhouse gas reduction.

Cybersecurity

Cybersecurity is fast becoming one of the most important ESG-related topics, particularly in terms of the sustainability of a business. Determining the company’s cyber-resilience is increasingly important for investors, while assessment of potential cyber exposures should be an essential part of any M&A process, given the number of large data breaches and the possibility that an acquiring firm could be liable for incidents predating the merger. The 2018 Marriott breach, which resulted in a more than $20 million regulatory fine for the hotel group, was traced to an intrusion in 2014 at Starwood, a hotel group it acquired in 2016.

Compliance and Liability Mitigation: Best Practices

A crisis represents the real test of governance. And for many companies the pandemic has proven to be a huge learning curve with the board having to be at the center of the company’s crisis management response. One positive change to emerge is a recognition of the increasing need to monitor, manage and report on a wider range of potential risks than before, including nonfinancial topics. This could result in many companies being better positioned for the advent of new disclosure regimes around ESG risks.

Companies and their boards can benefit from conducting internal due diligence around their decision-making processes and determining any potential risk areas. For example, the prospect of climate change litigation risk increases the more there is a discrepancy between what a company does and says internally and what it does and says externally (even further, to the extent to which any public statements or actions of the company might contravene a legally binding framework).

Engaging with ESG matters is crucial. It is important not only that ESG is on the board agenda a few times per year, but that a company embeds sustainability topics and thinking into the whole organization. Beyond internal steering, it is also crucial for the board to acquire appropriate skills and understand the external requirements in order to be successful in the long term.

It’s Not Just About Governance

ESG is not just about governance issues. From the insurer’s perspective, there are also opportunities, such as helping organizations to improve their ESG capabilities, given its own initiatives and its experience in observing ESG best practice across many different industry sectors. At the same time, ESG information can also help to improve the underwriting process, to the benefit of insurers and companies alike.

Shanil Williams is Global Head Financial Lines at

Shanil Williams is Global Head Financial Lines at