Financial Services

How to Safeguard Your Firm from Regulatory Action

A recent SEC settlement with Interactive Brokers underscores the need for true commitment to compliance. Guidepost Solutions’ Megan Prendergast Millard offers four takeaways from Interactive Brokers’ AML scandal. Too often in companies across the financial services sector, the financial commitment to the compliance department does not keep pace with the rate of business growth. Interactive Brokers Group – which provides...

MiFID II: What’s Next for Firms

MiFID II was designed to provide more protection to investors and greater transparency in Europe’s biggest capital markets. Now, two years in, what has been the impact? Fenergo’s Edel Brophy discusses fines, the affect the pandemic has had and how to navigate the changing regulatory landscape. The Markets in Financial Instruments Directive (MiFID II) is a legislative framework introduced by...

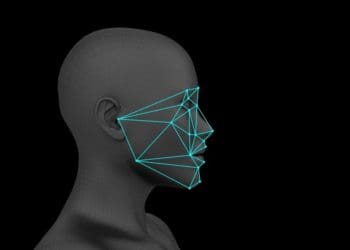

Evolution of Dynamic Biometrics: Disrupting the Fraud Prevention Landscape

In the last six months, practically everything has gone digital, creating a mountain of new digital data for fraudsters to mine. Sujata Dasgupta discusses the rise in dynamic-biometrics-based identity verification, the next step in fraud prevention for the financial services industry. The world today is powered by digital technologies, from financial services to health, entertainment, education, travel and e-commerce –...

The OCC Guidance for Cryptocurrencies

The OCC’s latest guidance on cryptocurrency marks a major step forward. Brandi Reynolds explains what Interpretive Letter 1170 means for banks and the benefits it promises for the world of cryptocurrency. On July 22, 2020, the Office of the Comptroller of the Currency (OCC) established Interpretative Letter 1170, which clarifies the national banks’ authority to provide custody services of cryptocurrency...

How the EU Can Usher Its Financial Firms into the Modern Era

Behavox’s Alex Viall explores differing views toward adopting cloud-hosted software by financial services companies in the U.S and EU. Alex examines regulatory and cultural differences, predicts consequences, and suggests an alternate path forward for an industry always striving to remain competitive. Over the past decade, software-as-a-service (SaaS) solutions have become all the rage. Or so you would think. Closer scrutiny...

Anti-Money Laundering in the Time of COVID-19

The COVID-19 pandemic has left financial institutions to face many of the same AML risks as pre-pandemic, but now under largely different circumstances. LexisNexis Risk Solutions’ Leslie Bailey examines what these organizations must do now to effectively weather the storm. The COVID-19 pandemic left financial institutions (FIs) without a blueprint. FIs must now grapple with the challenge of navigating their...

OCC Issues Guidance on Safekeeping, Custody of Cryptocurrency

Justin Daniels and Matthew White of Baker Donelson discuss the OCC’s recent interpretive letter on cryptocurrency and the associated permitted activities for regulated banks and financial institutions. Late last month, the Office of the Comptroller of the Currency (OCC) issued an interpretive letter clarifying that national banks and federal savings associations are authorized to provide safekeeping and custody services for cryptocurrency. This...

The AMLCO, Reputation Risk and AML Scandals

Gustavo Fideney and Alvaro Ruiz Ostos conclude a two-part series with a discussion on the role of the anti-money laundering compliance officer, the critical need to mitigate reputation risk and some of the scandals that have built the current AML compliance landscape. Click to read Part 1, Anti-Money Laundering in Financial Services: A Primer. Third Line of Defense – The...

Anti-Money Laundering in Financial Services: A Primer

While AML and CFT aren’t necessarily simple matters, training on these topics can be made overly complex. Compliance pros Gustavo Fideney and Alvaro Ruiz Ostos offer a more accessible interpretation. Webinars On AML: Harsh Times Everyone talks about how important anti-money laundering (AML) and combating the financing of terrorism (CFT) efforts are, but it's very hard to find a down-to-business...

Getting Your Systems Battle-Ready for the LIBOR Transition

As banks and financial institutions prepare for the end of LIBOR, the world’s most referenced interest rate, TCS North America’s Manoj Reddy addresses risk and uncertainty surrounding the coming change. The LIBOR (London Inter-Bank Offer Rate) transition is less than 18 months away. The world’s most referenced interest rate benchmark will soon cease to exist. The scenario for banks and...

Balancing Compliance and Customer Demands in the Post-Pandemic Banking World

One of the main challenges for banks and financial institutions is gaining and maintaining customer trust – especially during turbulent times. SunTec’s Madhur Jain discusses what FIs need to do to manage compliance while meeting customers’ evolving needs. Today’s customer landscape is rapidly evolving, and the rate of change is accelerated exponentially by the current market disruption. Financial institutions are...

Implementing FINRA’s Best Practices for Remote Work in a Pandemic

FINRA’s guidelines in a recent regulatory notice address a host of concerns around compliance while employees work from home. Smarsh’s Robert Cruz discusses what firms should be doing to address the latest FINRA guidance. FINRA, the government-authorized nonprofit organization that oversees broker-dealers in the securities industry, recently issued a regulatory notice on how to manage a remote work environment during...