Deloitte’s quarterly assessment of board focus finds that diversity, equity and inclusion subjects are a paramount concern for many companies across sectors. DEI beat out the ongoing response to COVID-19 and ESG for most entities.

Once each quarter, Deloitte’s Center for Board Effectiveness and the Society for Corporate Governance collaborate to produce the Board Practices Quarterly, a report based upon a brief survey of Society members on discrete topical issues.

The February 2021 issue of the Quarterly, based upon a survey conducted in December 2020, identified some of the key areas and trends expected to be on board agendas this year. While there are many items – such as strategy and risk – that regularly appear on agendas, this survey focused on new and emerging topics, as companies of all sizes and across industries continued to respond to the COVID-19 pandemic and other unanticipated events that unfolded during 2020. In particular, this survey sought greater insight on shareholder engagement, meeting agendas and disclosures around the topics of pandemic response and recovery and human capital management.

The Survey Respondents

The respondents were primarily corporate secretaries, in-house counsel and other in-house governance professionals. The overwhelming majority of the respondents – 91 percent – represented public companies, and the balance was made up of private company employees. In terms of company size, the breakdown of respondents was as follows[1]:

| Company Type | Category | Size |

| Public | 38% mega- and large-cap | >$10 billion market cap |

| 43% mid-cap | $2-10 billion market cap | |

| 19% small-, micro- and nano-cap | <$2 billion market cap | |

| Private | 45% large | >$1 billion revenues |

| 36% medium | $250 million-$1 billion revenues | |

| 18% small | <$250 million revenues |

The companies they represent are in the following industries:

| 33% | Energy, resources, industrials |

| 29% | Financial services |

| 26% | Consumer |

| 8% | Life sciences, health care |

| 5% | Technology, media, communications |

Key Findings – Anticipated Areas of Board Focus

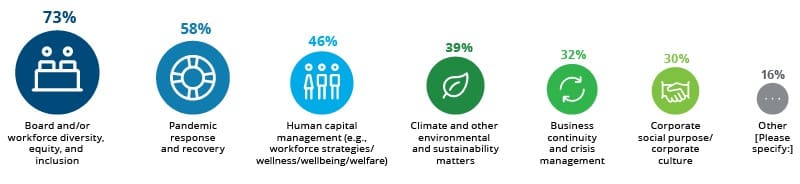

The findings indicate strong boardroom interest in topics arising out of and in response to the COVID-19 pandemic, along with a focus on a variety of social and environmental matters. Specifically, when asked to select the top three areas of interest, the responses were as follows:

- Board and/or workforce diversity, equity and inclusion – known as DEI – generated the most responses, with 73 percent of respondents reporting that the topic will likely be on their board agendas in 2021.

- After DEI, respondents most commonly identified pandemic response and recovery as a leading topic of board focus, at 58 percent.

- Nearly half – 46 percent – said their boards will focus on human capital management, including workforce strategies and well-being.

Other areas where respondents expect their boards to focus in 2021 include:

- Climate and other environmental sustainability matters (39 percent);

- Business continuity and crisis management (32 percent); and

- Corporate social purpose and culture (30 percent).

The areas of focus differed slightly for smaller-cap public companies and private companies. Both groups indicated that board and/or workforce DEI, pandemic response and recovery and business continuity and crisis management were likely to be the top three emerging or trending areas of board focus in 2021. But those responding on behalf of private companies identified pandemic response and recovery and business continuity and crisis management, respectively, as the top two focal areas by a large margin, suggesting that issues of basic business survival may be more top of mind for these companies. Comparatively, board and/or workforce DEI generated the highest response by a large margin among small-caps.

The areas of focus differed slightly for smaller-cap public companies and private companies. Both groups indicated that board and/or workforce DEI, pandemic response and recovery and business continuity and crisis management were likely to be the top three emerging or trending areas of board focus in 2021. But those responding on behalf of private companies identified pandemic response and recovery and business continuity and crisis management, respectively, as the top two focal areas by a large margin, suggesting that issues of basic business survival may be more top of mind for these companies. Comparatively, board and/or workforce DEI generated the highest response by a large margin among small-caps.

The survey indicates that these topics are not only likely to be the subject of future attention, but also are being addressed now. For example, 81 percent of respondents said their boards are discussing pandemic-related matters at every meeting, and 11 percent said that human capital matters are on every meeting agenda. In addition, 31 percent of respondents indicated that human capital management issues are on agendas annually.

Addressing SEC and Investor and Other Stakeholder Concerns

While pandemic response and human capital management have been the subject of interpretations and formal rulemaking by the Securities and Exchange Commission (SEC) during the last year – thus commanding public companies’ attention – human capital and some of the other topics discussed above have been on the agendas of investors and other stakeholders for far longer. These stakeholders have let it be known, through their stewardship and other activities, that they expect boards to be engaged on these issues and priorities.

It should come as no surprise that some investors want to engage on these topics. In particular, 34 percent of the respondents say their major investors are asking to communicate directly with management regarding pandemic response and recovery. Twenty-eight percent report that they have received similar requests regarding human capital management. And while the majority say their companies have not received shareholder requests to communicate with the board and/or management on either topic, it will be interesting to see if that changes over time – including with respect to matters such as business continuity and crisis planning.

The SEC has emphasized the need for public companies to provide robust disclosure on pandemic response and human capital management subject to company-specific materiality. In response to these calls, as well as investor and other stakeholder pressures, nearly 80 percent of the public company survey respondents said their companies expected to increase disclosures related to human capital management, and 34 percent had already increased disclosure on pandemic-related issues. In addition, two-thirds of the public company respondents indicated that they were considering increased disclosure regarding board skills and other qualifications pertaining to human capital management, and one-third mention skills related to pandemic matters. In both cases, this represents an acknowledgment of the impact of board composition on effective oversight of a wide variety of challenges.

Where Does the Buck Stop?

As is the case with many board responsibilities, companies have adopted different approaches to board oversight structure for new and emerging topics. This is reflected in the survey results, as 96 percent of respondents say their board is responsible for overseeing pandemic response and recovery, while only 41 percent say their board is responsible for overseeing human capital management. Compensation committees more often have oversight duties related to human capital, according to 70 percent of participants.

Responsibility for liaising with boards or board committees on emerging areas also varies. The survey results indicate that responsibility for pandemic response and business continuity and crisis management is the responsibility of the CEO, while the chief human resources officer is responsible for advising the board on human capital management issues and board and/or workforce DEI issues in 85 percent and 76 percent of responding organizations, respectively. Twenty percent of the survey respondents say responsibility for keeping the board apprised of pandemic response and recovery rests with chief risk or compliance officers or their equivalents, and 26 percent of the chief risk or compliance leaders have responsibility for acting as liaison to the board on business continuity and crisis management.

Summing It Up

While the survey indicates that boards and management teams are approaching new and emerging issues in different ways, there seems to be a strong consensus that these issues call for, and need to get, attention at the highest levels of many companies.

[1] Throughout this article, percentages do not add to 100 percent due to rounding.

Robert Lamm is an Independent Senior Advisor for Deloitte LLP’s Center for Board Effectiveness and a leading member of the

Robert Lamm is an Independent Senior Advisor for Deloitte LLP’s Center for Board Effectiveness and a leading member of the  Natalie Cooper is a Senior Manager with Deloitte LLP’s Center for Board Effectiveness. In her role, Natalie works with boards of directors of public, private and nonprofit organizations to help them understand leading practices, trends and governance issues impacting their role and responsibilities. She also contributes to the development of the Center’s Dbriefs webcasts and the Board Practices Quarterly. Natalie graduated from the University of Texas at Austin with a BS in corporate communications and received an MBA from the University of Houston, Bauer College of Business.

Natalie Cooper is a Senior Manager with Deloitte LLP’s Center for Board Effectiveness. In her role, Natalie works with boards of directors of public, private and nonprofit organizations to help them understand leading practices, trends and governance issues impacting their role and responsibilities. She also contributes to the development of the Center’s Dbriefs webcasts and the Board Practices Quarterly. Natalie graduated from the University of Texas at Austin with a BS in corporate communications and received an MBA from the University of Houston, Bauer College of Business. Randi Val Morrison is the Senior Vice President of Communications, Member Engagement and General Counsel at the Society for Corporate Governance. In her role, Randi oversees all member and external print and online communications and assists with strategic plan development and implementation. As the Society's General Counsel, she also advises the organization on issues concerning its legal rights and obligations. Randi received a BA in Political Science from Washington University in St. Louis and a Juris Doctor from Washington University in St. Louis School of Law.

Randi Val Morrison is the Senior Vice President of Communications, Member Engagement and General Counsel at the Society for Corporate Governance. In her role, Randi oversees all member and external print and online communications and assists with strategic plan development and implementation. As the Society's General Counsel, she also advises the organization on issues concerning its legal rights and obligations. Randi received a BA in Political Science from Washington University in St. Louis and a Juris Doctor from Washington University in St. Louis School of Law.