Under its new chairman, the Commodity Futures Trading Commission (CFTC) is leaning into its role as the regulator of prediction markets, but the agency appears to be wrestling some thorny questions for corporate leaders: What happens when someone with inside information places a big, suspiciously well-timed bet?

In his first public remarks since being sworn in as CFTC chairman in December 2025, Michael S. Selig announced this week that his agency would withdraw a proposed ban on political and sports-related event contracts — such as those recently in the news after the US capture of Venezuela’s president — and would draft new rules aimed at establishing “clear standards” for prediction markets.

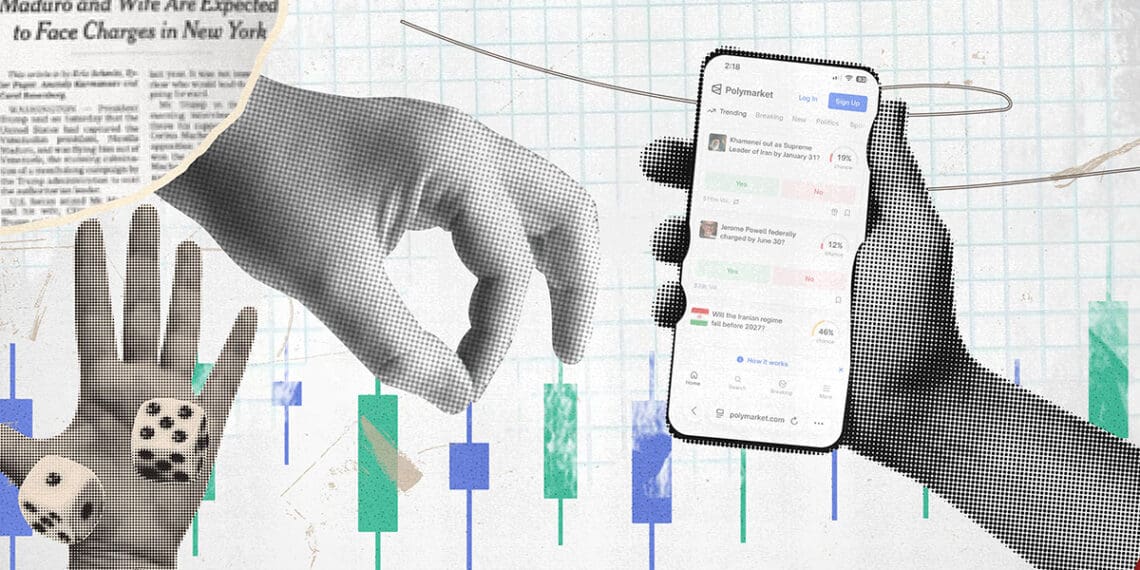

Selig embraced prediction markets’ role in facilitating “price discovery” and “aggregating dispersed information,” principles he described as deeply rooted in commodity futures trading history. But while Selig emphasized the CFTC’s commitment to “age-old principles, like investor protection, anti-fraud and anti-manipulation, and market integrity,” he did not offer specifics on how the agency might address scenarios like the $32,000 event contract purchased on Polymarket just hours before US military personnel captured Nicolás Maduro, which earned the trader an estimated $400,000 and which has drawn allegations that the trader could have taken advantage of inside information.

“Taken together, these statements leave observers unclear about what position the CFTC may ultimately take on insider trading-type behaviors,” Stephen Piepgrass, a partner in the Richmond office of Troutman Pepper Locke, told Corporate Compliance Insights. “That indicates to me that the CFTC itself is still grappling with this difficult question.”

‘If It Quacks Like a Duck’: Prediction Markets, Sports Betting & Insider Trading

An incredibly well-timed trade on a predictions market regarding the US capture of Venezuela’s president has catalyzed an ongoing conversation about the risks to corporate America of prediction markets, online gambling and prop betting. As CCI’s Jennifer L. Gaskin reports, the recent public scandals may be just a taste of what’s to come.

Read moreDetails‘CFTC is planting the flag’

Prediction markets are platforms where users can trade contracts tied to the outcomes of real-world events ranging from elections and geopolitical developments to corporate earnings and box office receipts. While platforms like Polymarket and Kalshi reject being classified as gambling or betting sites, many states have taken the position that they function as sports betting and should be regulated accordingly.

Selig’s remarks made one thing clear: The CFTC intends to be the primary authority governing these platforms, Piepgrass said, significant given ongoing legal wrangling with certain state regulators that have asserted they have the authority to regulate prediction markets as they would sports gambling.

Platforms like Kalshi have faced enforcement actions from state gaming regulators, while the regulatory status of Polymarket has remained unsettled despite a 2022 CFTC enforcement action that temporarily barred it from US markets.

“Chairman Selig’s remarks make clear that the CFTC is planting the flag as the preeminent and exclusive regulator of prediction markets,” Piepgrass said. “His statement is clearly intended to reassure market participants that event contracts are here to stay and that the CFTC intends to establish clear standards governing them.”

Selig directed staff to withdraw both the 2024 rule proposal that would have prohibited political and sports-related event contracts and a 2025 staff advisory that cautioned registrants about offering sports-related contracts due to ongoing litigation. He said the CFTC’s existing framework has failed market participants and called for new rulemaking to provide clarity.

The chairman also said he has directed staff to reassess the commission’s participation in pending federal court cases where jurisdictional questions are at issue, stating the CFTC has “the expertise and responsibility to defend its exclusive jurisdiction over commodity derivatives.”

Piepgrass said that language, combined with Selig’s withdrawal of the prior cautionary guidance about sports-related event contracts, signals the CFTC may be considering intervening in litigation over whether states can regulate these platforms as gambling.

“If that happens, it could shift the current direction of those cases significantly where state regulators have been heartened by recent victories in some federal courts,” Piepgrass said. “If the CFTC intervenes and asserts federal jurisdiction, that should carry great weight with the judges considering these issues and could shift the direction of litigation in many courts in favor of platforms like Kalshi that are on the legal front lines of those issues.”

The chairman also announced the CFTC would work with the SEC on a joint interpretation to draw clearer lines between commodity and security options and swaps, part of a broader coordination effort aimed at reducing regulatory fragmentation.