The life sciences industry relies on a complex, multinational supply chain that is increasingly subject to trade friction. Allison Raley and Mike Burke of law firm Arnall Golden Gregory explore two practical areas of focus — front-end visibility and post-entry cost recovery — that can yield substantial impact for life sciences firms.

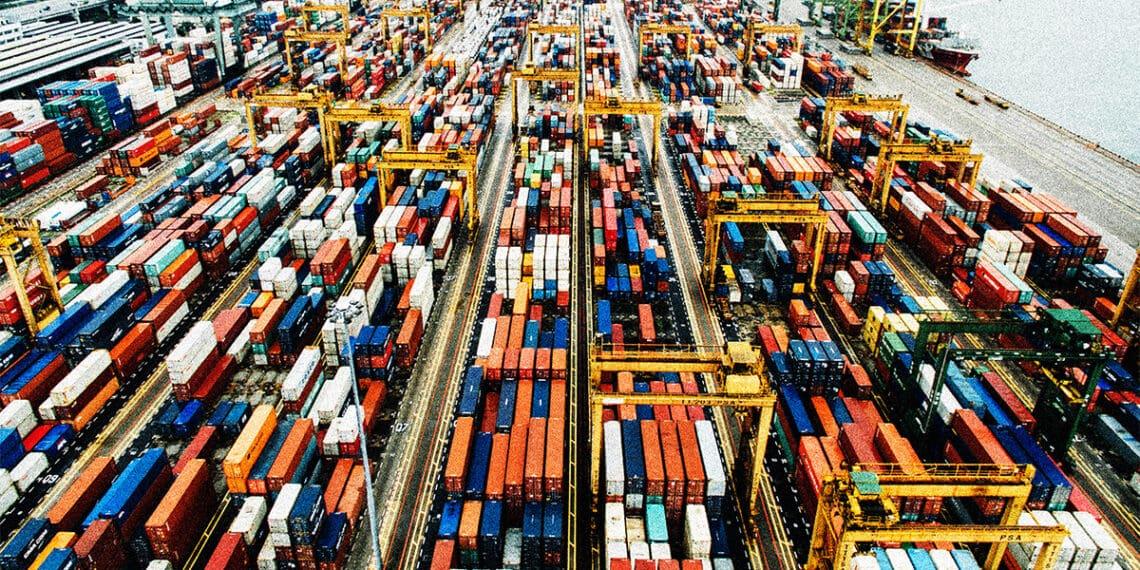

As US tariff policy continues to evolve in sometimes unpredictable ways, life sciences companies must confront mounting financial exposure and tariff risk. From active pharmaceutical ingredients (APIs) and biologics to lab instruments and medical devices, the industry depends on complex, multinational supply chains that are increasingly subject to trade friction.

Tariffs imposed under Section 301 (targeting Chinese-origin goods), Section 232 (steel and aluminum), so-called “reciprocal tariffs” and other statutory mechanisms have introduced sudden and significant cost burdens — often without corresponding contractual relief or pricing flexibility.

Given the long lead times, regulatory constraints and highly specialized nature of life sciences production, compliance professionals play a critical role in both margin preservation and operational resilience. As stewards of trade data, import documentation and regulatory defensibility, the compliance function can leverage both preventive and corrective strategies to identify and mitigate tariff.

Notably, two practical areas of focus — front-end visibility and post-entry cost recovery — can yield substantial impact.

Understand where tariff exposure exists

The first step in any effective mitigation strategy is to understand where tariff exposure resides. This begins with a comprehensive audit of your company’s import activity. In a sector defined by technical complexity and regulatory scrutiny, even seemingly minor classification or origin decisions can produce material financial consequences.

A few focal points should guide this assessment:

- HTS classification review: Accurate classification under the Harmonized Tariff Schedule (HTS) is foundational. Many pharmaceuticals, APIs and clinical trial materials may qualify for zero-duty or preferential treatment under Chapter 30, whereas misclassified intermediates or components can trigger duty rates ranging from 2.5% to 25%. A single misclassified input, especially in high-volume categories like sterile consumables or analytical equipment, can skew the landed cost structure and introduce future audit risk.

- Country of origin mapping: Determining origin is especially critical in the current enforcement climate as goods subject to Section 301 tariffs or flagged under the Uyghur Forced Labor Prevention Act (UFLPA) may face enhanced scrutiny or outright exclusion. Origin determinations under 19 C.F.R. Part 102 and Customs and Border Protection’s “substantial transformation” doctrine require detailed documentation and manufacturing insight. For instance, labeling an API manufactured in India as US origin without sufficient transformation could trigger both financial liability and reputational exposure.

- Tariff engineering opportunities: Strategic adjustments to product composition, packaging or assembly can yield lower-duty outcomes without compromising regulatory status. This may involve importing fully assembled diagnostic kits instead of individual reagents or modifying product configurations to qualify under a different subheading. CBP rulings, such as NY N320740 (2021), offer valuable guidance on lawful tariff engineering, particularly for bundled devices and test systems.

- Free-trade agreements (FTA) and preferential program utilization: Life sciences companies sourcing from jurisdictions like Canada, Mexico, Israel or Singapore may benefit from duty-free treatment under agreements like USMCA or the Israel Free Trade Agreement. To capitalize on these opportunities, compliance teams must ensure that vendor-supplied certificates of origin meet documentation standards and that sourcing records support eligibility. Particularly for inputs with regional value content thresholds or transshipment concerns, proactive country-of-origin tracking is essential.

These strategies should not be siloed within trade compliance. They require coordinated input from procurement, logistics, regulatory affairs and supply chain planning. Regular training on classification standards, FTA eligibility criteria and documentation requirements can reduce the likelihood of costly post-entry errors and strengthen your position should CBP initiate a focused review.

Leverage post-entry and refund mechanisms to reduce financial impact

While front-end tariff strategy is crucial, companies that treat duties as fixed costs are leaving money on the table. For life sciences importers, two underused mechanisms — post-summary corrections (PSCs) and duty drawback — offer meaningful opportunities for duty recovery and margin preservation, even after the point of entry.

Both tools require internal alignment and robust documentation systems, but when implemented effectively, they provide material financial benefit and demonstrate a high level of regulatory maturity.

Correcting the record: PSCs

Under 19 C.F.R. §§ 141.61 and 143.23, importers may file a PSC electronically through CBP’s ACE system any time prior to liquidation, typically within 300 days of entry. This allows companies to correct key data points, such as HTS classification, country of origin and declared value, or retroactively claim preferential treatment under an FTA.

These corrections are especially valuable in life sciences, where technical goods often face classification ambiguity and supply chain adjustments may outpace broker recordkeeping. For example, a US-based pharmaceutical importer initially declared sterilized active ingredients from Singapore under HTS code 2916.39.1500, incurring a 6.5% duty. A post-entry audit determined the correct classification was 3004.90.9230 — duty-free under Chapter 30. By filing PSCs for 60 entries, the company recovered over $900,000 in overpaid duties.

To maximize the value of PSCs, companies should implement structured post-entry reviews within 60 to 90 days of entry; engage brokers with ACE reporting capability; and maintain audit-ready documentation, such as certificates of analysis, manufacturing specs and regulatory filings. This reduces duty exposure and minimizes the risk of CBP penalty actions during audits or focused assessments.

Turning waste into recovery: duty drawback

In contrast to PSCs, which correct past entries, the duty drawback program provides forward-looking recovery. Authorized under 19 U.S.C. § 1313 and administered through 19 C.F.R. Part 190, drawback allows importers to recover up to 99% of duties, taxes and fees on goods that are exported, destroyed or used in the manufacture of exported items.

This is especially relevant for life sciences companies managing product returns, excess clinical inventory or goods destroyed due to sterility failures or temperature excursions. It also applies to contract manufacturers and distributors exporting US-made finished products that incorporate imported materials.

One diagnostics company, for example, imported reagents from Germany to produce Covid-19 test kits, then exported surplus inventory to Latin America. By documenting the link between import entries, bills of material and export records, the company qualified for manufacturing drawback and recovered more than $1.2 million in paid tariffs.

Even broader refund opportunities exist under substitution drawback (§ 1313(j)(2)), which permits claims for commercially interchangeable goods — such as standard reagents, test vials or packaging materials — used in similar products across domestic and international markets. As long as the items fall under the same eight-digit HTS classification and documentation supports their interchangeability, duties paid on imports can be refunded based on exports of equivalent items.

Successful drawback programs require:

- Clear tracking of import and export records.

- Documented manufacturing or destruction processes.

- Filing claims electronically through ACE.

- Retention of all supporting documentation for at least five years.

In some cases, a CBP-approved drawback contract is advisable, particularly when destruction or complex bill-of-material relationships are involved.

Strategic compliance as a margin lever

While PSCs and drawback serve different functions — one remedial, the other recuperative — they share a critical feature: They reward companies that have invested in accurate trade data, cross-functional coordination and systems-level visibility. For life sciences organizations navigating rising input costs, regulatory pressure and global trade disruption, these tools are not optional — they’re essential levers for operational agility and financial stewardship.

Compliance professionals are uniquely positioned to lead this effort. By identifying overpayments, recovering refundable duties and preventing classification or origin errors, the compliance team can deliver direct financial value while reinforcing regulatory integrity. In an era where tariffs are increasingly used as policy levers, the ability to adapt and respond is not just strategic — it is imperative.

Allison Raley

Allison Raley Mike Burke

Mike Burke