U.S.-Specific Findings Include 28 Percent Decrease in FINRA Penalties

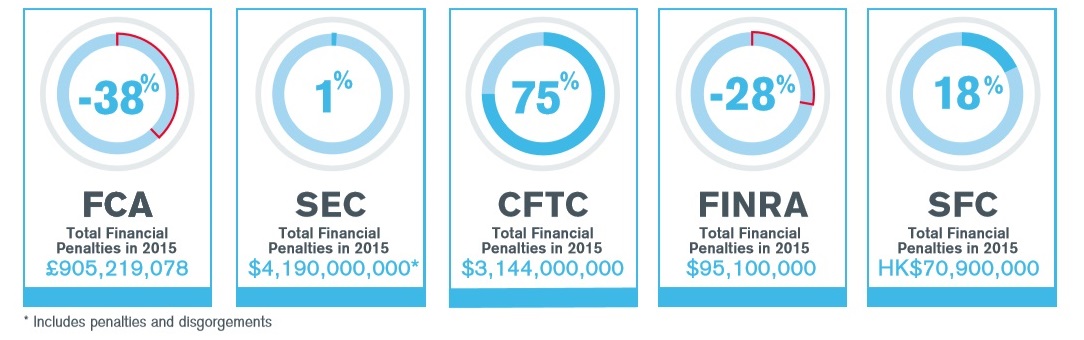

September 19, 2016 (New York) – Duff & Phelps, the premier global valuation, corporate finance and regulatory services advisor, today announced the release of the Global Enforcement Review 2016 report, which provides analysis and commentary on global enforcement trends in the financial services industry. From a global perspective, total financial penalty amounts increased 5.3 percent on average in 2015 across five key global regulators: the U.K.’s Financial Conduct Authority (FCA), the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), the Commodity Futures and Trading Commission (CFTC) and Hong Kong’s Securities and Futures Commission (SFC).

Key findings from U.S.-based regulators include the following:

- Total fines levied by FINRA decreased 28 percent to $95.1 million. This represents the second largest drop among the five regulators studied.

- The SEC saw aggregate total financial penalties (inclusive of penalties and disgorgements) remain basically flat at $4.19 billion – representing a 1 percent increase, while the CFTC fines increased to $3.14 billion – an increase of 75 percent. The considerable increase at the CFTC was in part due to the regulator enforcing new powers granted under the Dodd-Frank Act including anti-spoofing and anti-manipulation authorities and the prosecution of LIBOR and Forex exchange benchmark rate cases.

- Among all U.S. regulators, the SEC led the way in using a data-driven approach in cases involving complex insider trading activity. This approach was used, for example, to identify an adviser who was disproportionately allocating profitable trades to favored accounts. It is also noteworthy that investments in big data and key IT infrastructure activities are included in the SEC’s request of over $1.7 billion for its 2017 budget.

- With respect to whistleblower actions, disclosures to the SEC rose to 3,923 in 2015 – an 8.4 percent increase from the prior year. The SEC paid out $38 million in awards to eight whistleblowers over the course of 2015. As of August 30, 2016, the regulator has issued awards totaling more than $100 million over the past five years to whistleblowers.

Monique Melis, Managing Director within Duff & Phelps’ Compliance and Regulatory Consulting practice and global service line head of Regulatory Consulting, commented: “U.S. regulators continue to be keenly focused on individual wrongdoing and insider trading cases, an area in which they have earned considerable success. Data-driven approaches and new technologies are playing a meaningful role in this respect, as they provide new tools and tactics for regulators to detect and prosecute such cases. These kinds of enforcement actions advance two clear objectives for regulators, regardless of jurisdiction: they punish individual bad actors, and [they] send a powerful deterrent about the need for organizations to build and maintain a culture of compliance.”

Global Findings

Key findings across international jurisdictions include the following:

- In the United Kingdom, the FCA posted £905.2 million in total fines for 2015 – a 38 percent decrease compared to the prior year as the body concluded investigations into LIBOR manipulation.

- In Hong Kong, the SFC reported an 18 percent increase in aggregate penalties to HK$70.9 million, which was driven by several large single fines.

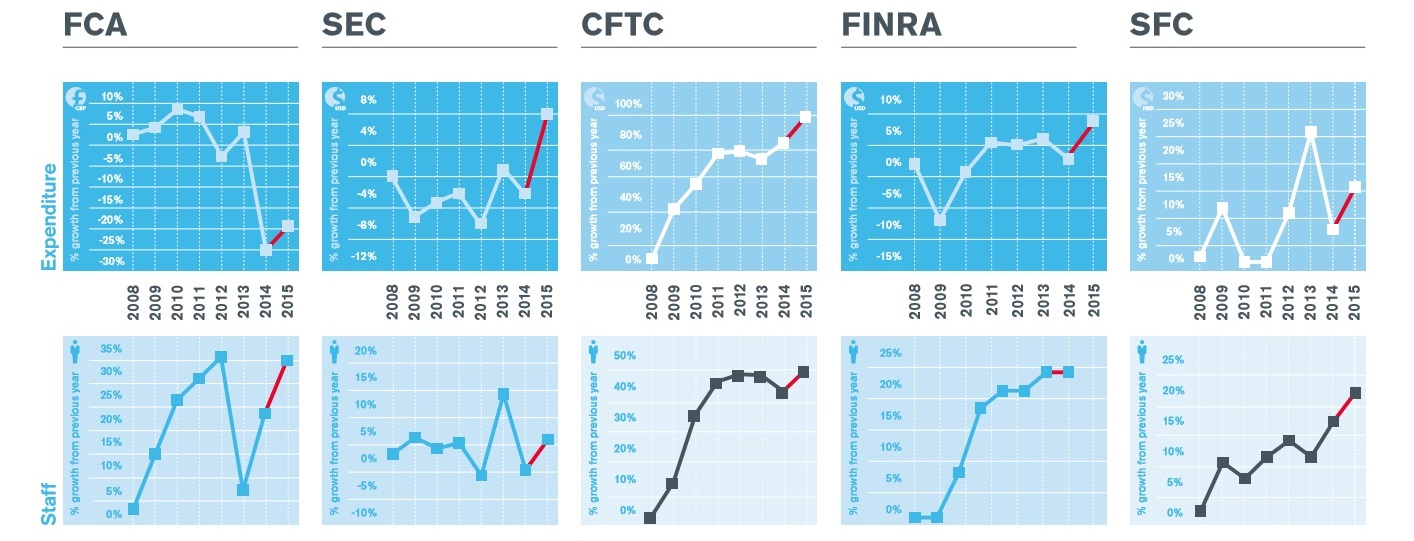

- The increasing use of data in enforcement actions also has a global component, with a corresponding impact on the slowdown of expenditure and hiring by financial regulators. Across the FCA, CFTC, SEC, FINRA and SFC, expenditure rose by 9.7 percent on average over the last fiscal year, while staff numbers increased 5.5 percent. This contrasts with the double-digit growth at many of the regulators in previous years.

Figure A: Change in Total Financial Penalty Amount from 2014 to 2015[1]

Figure B: Annual expenditure and Staff Growth Rates by Regulator[2]

Figure B: Annual expenditure and Staff Growth Rates by Regulator[2]

Methodology

Methodology

In compiling the report, Duff & Phelps studied data released by the U.K. FCA, the U.S. SEC, the U.S. CFTC, the U.S. FINRA and the SFC of Hong Kong published in 2015 and recent years.

About Duff & Phelps

Duff & Phelps is the premier global valuation and corporate finance advisor with expertise in complex valuation, dispute and legal management consulting, M&A, restructuring and compliance and regulatory consulting. The firm’s more than 2,000 employees serve a diverse range of clients from offices around the world. For more information, visit www.duffandphelps.com.