London (April 28, 2016) – Nearly 70 percent of anti-money laundering professionals have strengthened their company’s training and monitoring processes to address the risk of ISIS terrorist financing and recruitment, according to a joint survey by Dow Jones Risk and Compliance and the Association of Certified Anti-Money Laundering Specialists (ACAMS).

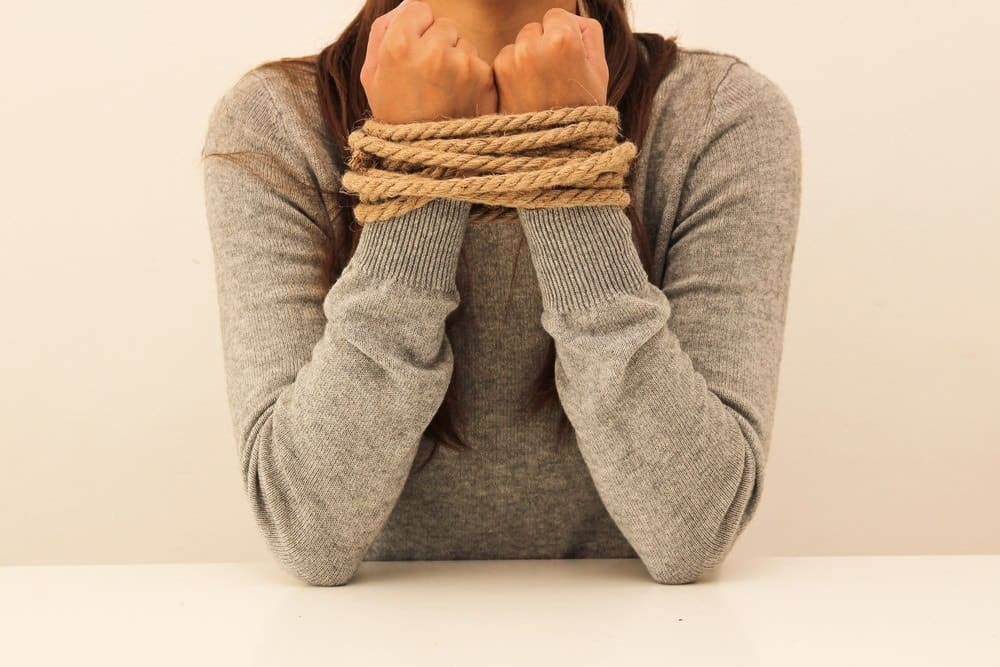

With the migrant crisis continuing to escalate, a similar proportion said they had taken steps to guard against human trafficking and smuggling, with two-thirds (63 percent) modifying their anti-money laundering training and a further 58 percent updating the criteria used for transactions monitoring.

The annual survey – answered by over 800 compliance and anti-money laundering professionals – is designed to assess the current regulatory environment and the impact of new regulation on the way companies work.

Joel Lange, Managing Director of Dow Jones Risk and Compliance, said, “Our annual report shows how the evolution of financial crime has increased the complexity and scope of the challenge facing anti-money laundering professionals. Against a backdrop of increasing regulatory and operational pressures, businesses are taking the threat of ISIS and human trafficking very seriously.

“Human trafficking is clearly top of mind for compliance professionals – not just because of its connection to money laundering and financial crime, but also due to increased focus on identifying it as part of growing global supply chain regulation, including the Modern Slavery Act in the United Kingdom.”

John Byrne, CAMS, ACAMS Executive Vice President, said, “The AML community continues to be challenged by regulatory expectations and this report shows the result of the current environment with 40 percent of our respondents having exited a business line or segment for reasons related to regulatory uncertainty or perceived inability to manage risk. The report proves that so-called ‘de-risking’ needs to be addressed now.”

In 2016, 60 percent of anti-money laundering professionals cited increased regulatory expectations and the enforcement of current rules as their greatest challenge, particularly with the introduction of FinCEN’s proposed beneficial owner rules.

Half the respondents were concerned about a shortage of skilled staff, while 41 percent cited outdated technology.

Other key findings include:

- FinCEN’s proposed beneficial owner rules (new to the 2016 survey) were cited by nearly 75 percent of respondents as contributing to increased workloads.

- Excessive false-positive alerts remain the key factor hurting confidence in client-screening data providers, cited by nearly half (47 percent) of those polled. Concerns about comprehensiveness of the data were noted by 42 percent of respondents – an increase of 10 percent from the 2015 survey.

- 40 percent of respondents reported their companies have exited a full business line or segment in the past 12 months due to regulatory risk. One-third (33 percent) said they were planning and/or investigating exiting a business line or segment in the next 12 months.

For more information and to view the full results of the survey, please visit the Dow Jones website.