FTI Survey Reveals Rising Political Disruption and Risk

A hard right turn is rattling investors’ views of the future. Results from a recent survey reveal the perceived risks that are keeping investors up at night. Many point to political disruption as a significant risk in the next year. At the same time, respondents indicated an expectation for fraud and cyberattacks to continue as significant threats.

with co-author Bryan Armstrong

Investors have long been aware of the known risks in doing business in emerging markets. From unstable governments to political corruption to regulatory inconsistencies, getting a return on investment in developing nations can be a bumpy road. But there’s increasingly been a sense of uncertainty among investors about the developed world, almost akin to doing business in developing nations.

An FTI survey of 142 global institutional investors conducted in mid January revealed as much. The investors, with sum assets under management of more than US$3 trillion, reported that political disruption or abrupt policy change will be a major risk to their portfolios, the companies they invested in and the ability of those companies to manage future corporate crises.

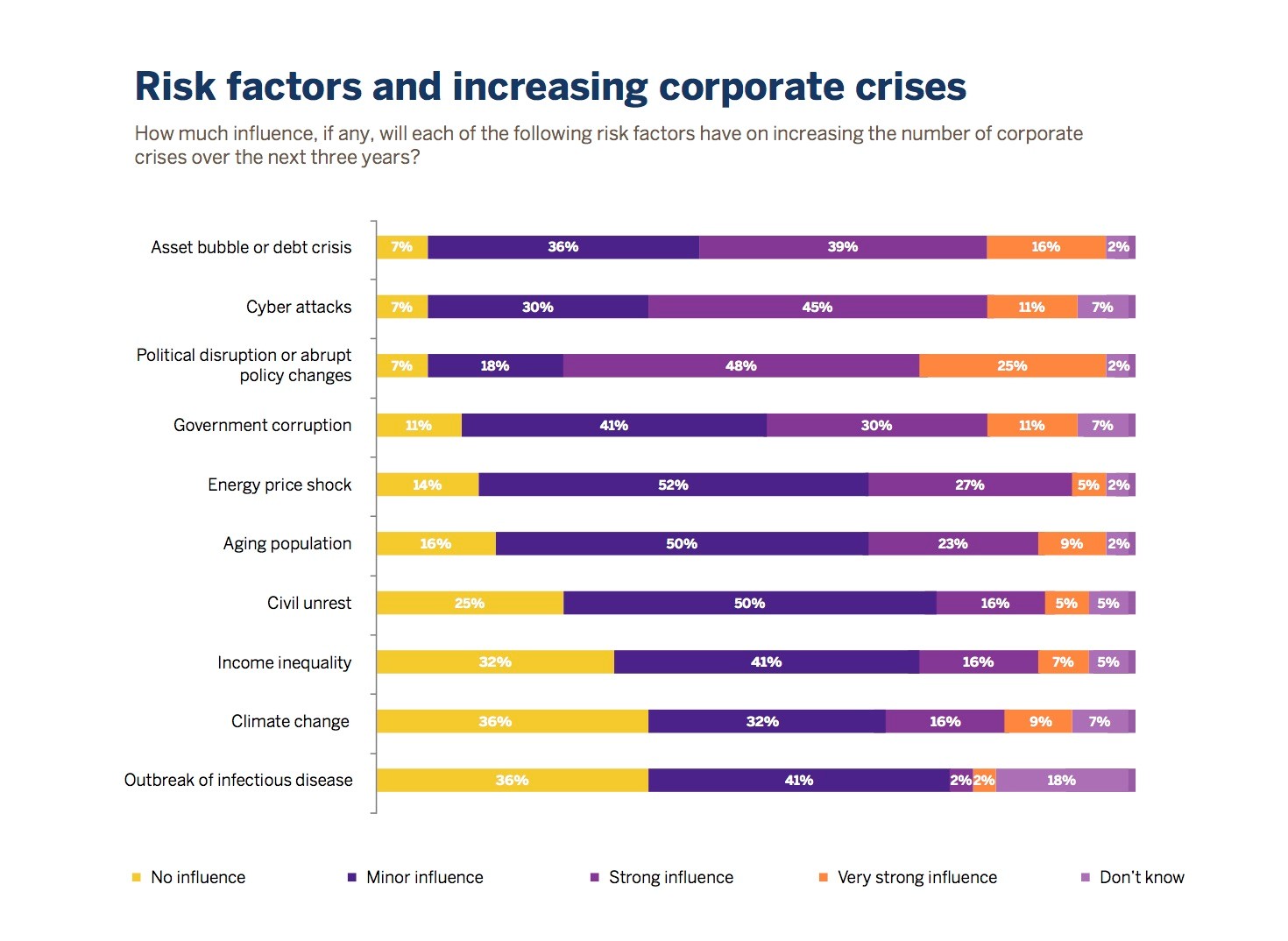

Indeed, a sizable majority of investors — almost three out of four (73 percent) — believe that political disruption or abrupt policy changes will have a strong to very strong influence on increasing the number of corporate crises over the next three years.

Political disruption and risk is clearly on the rise, and it starts with the votes on Brexit and Trump. Move into 2017, and people are collectively holding their breath as the French, Germans and Dutch go to the polls.

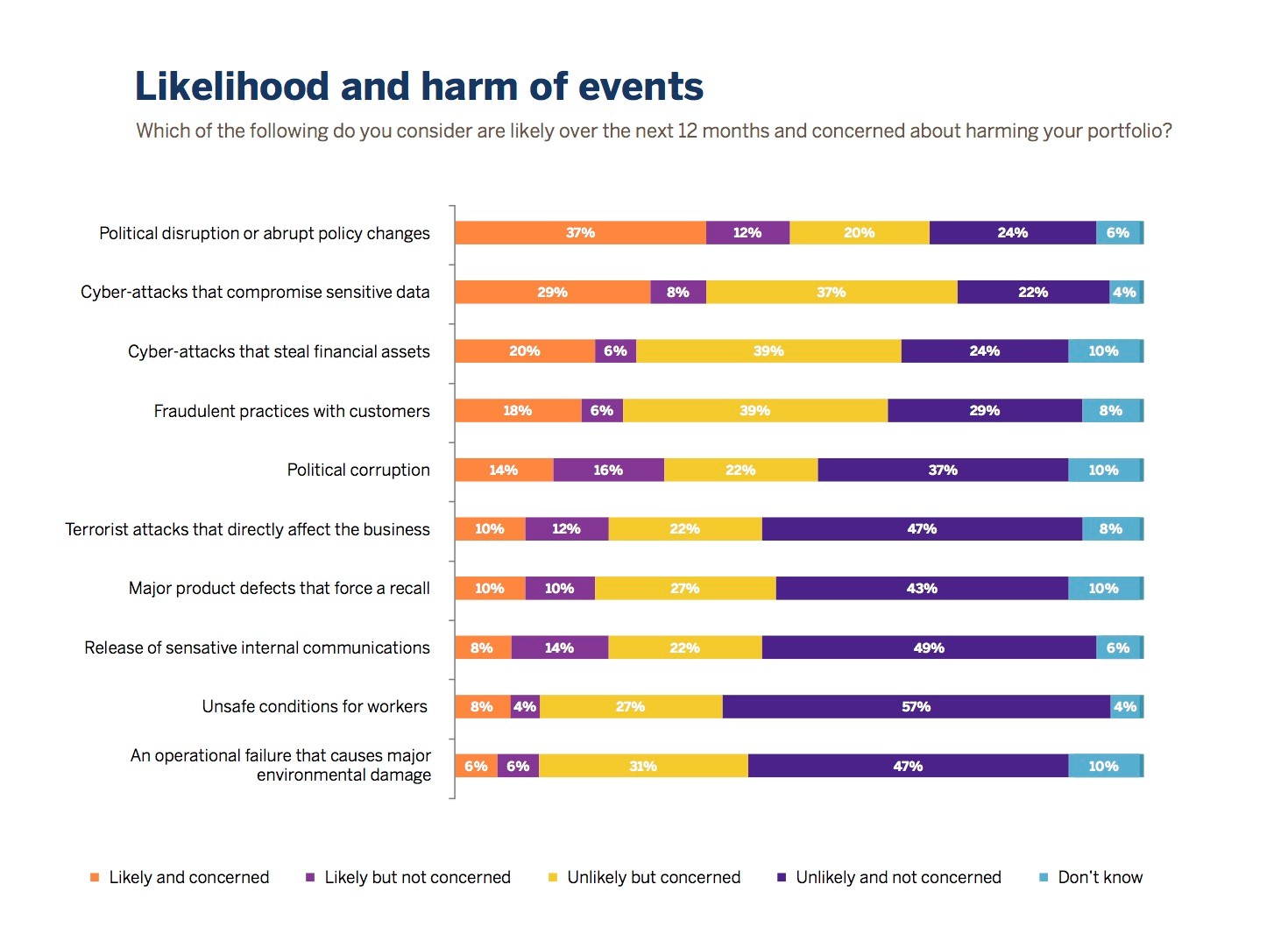

A similar unease held true for investors with regard to the potential impact on their portfolios. Thirty-seven percent of respondents said that political disruption or abrupt policy change was the type of event they deemed most likely to occur and concerns them the most about harm to their portfolios over the next 12 months. Though 37 percent may not be especially high, it is remarkable considering the next two leading concerns both deal with cyberattacks. In a sign of the seriousness of that concern, businesses are expected to spend $101.6 billion on cybersecurity by 2020, an increase of 38 percent over 2016.

Recently there have been two fairly seismic shifts in the political landscape of perhaps the two most developed countries — the U.S. and U.K., with ramifications for the European Union. There is uncertainty about what will come out of those two distinct, but somewhat related events. For investors, it’s very hard to put a financial target on what the actual impact will be on any one company or set of companies in a portfolio.

Calm Before the Storm

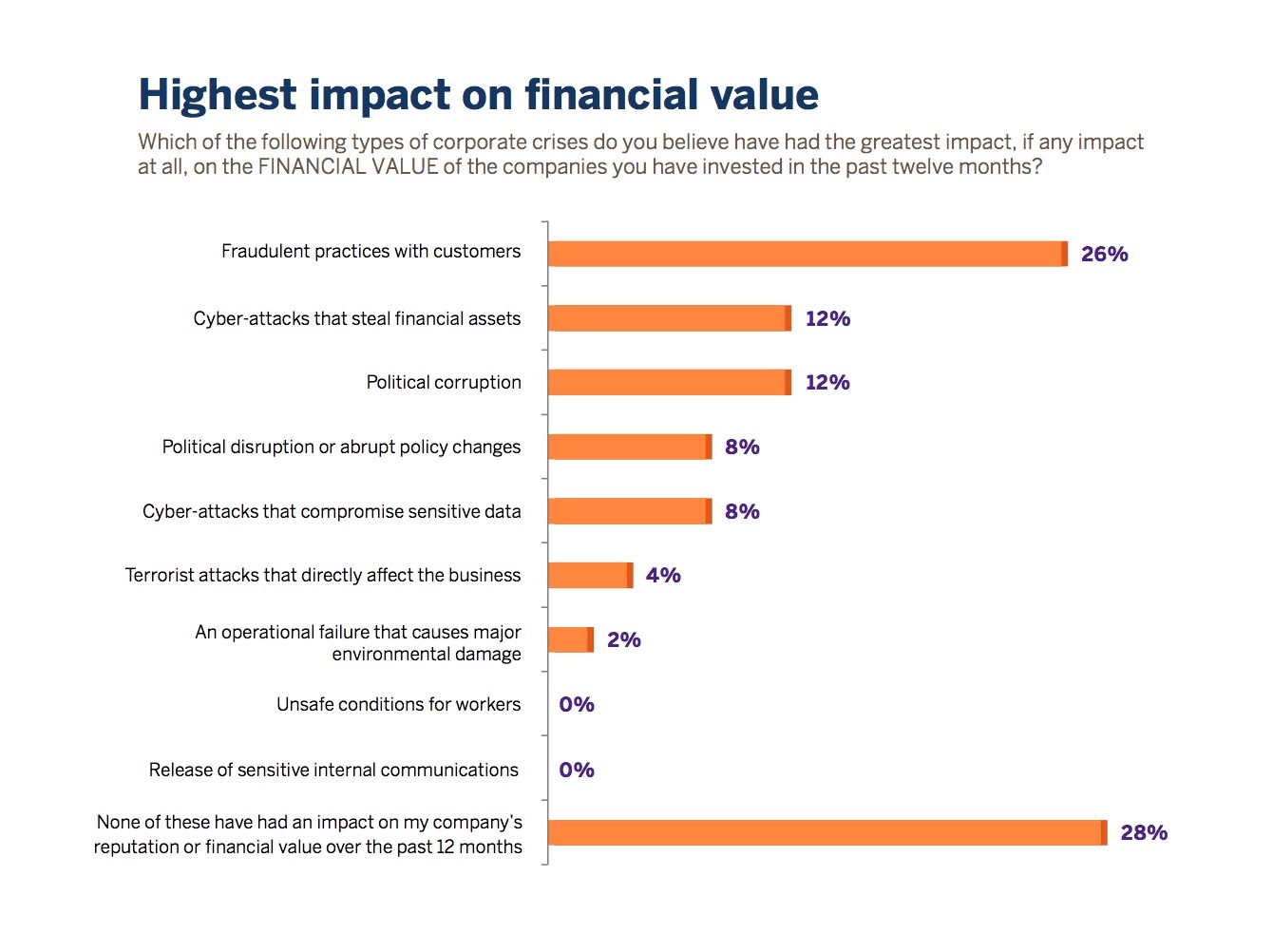

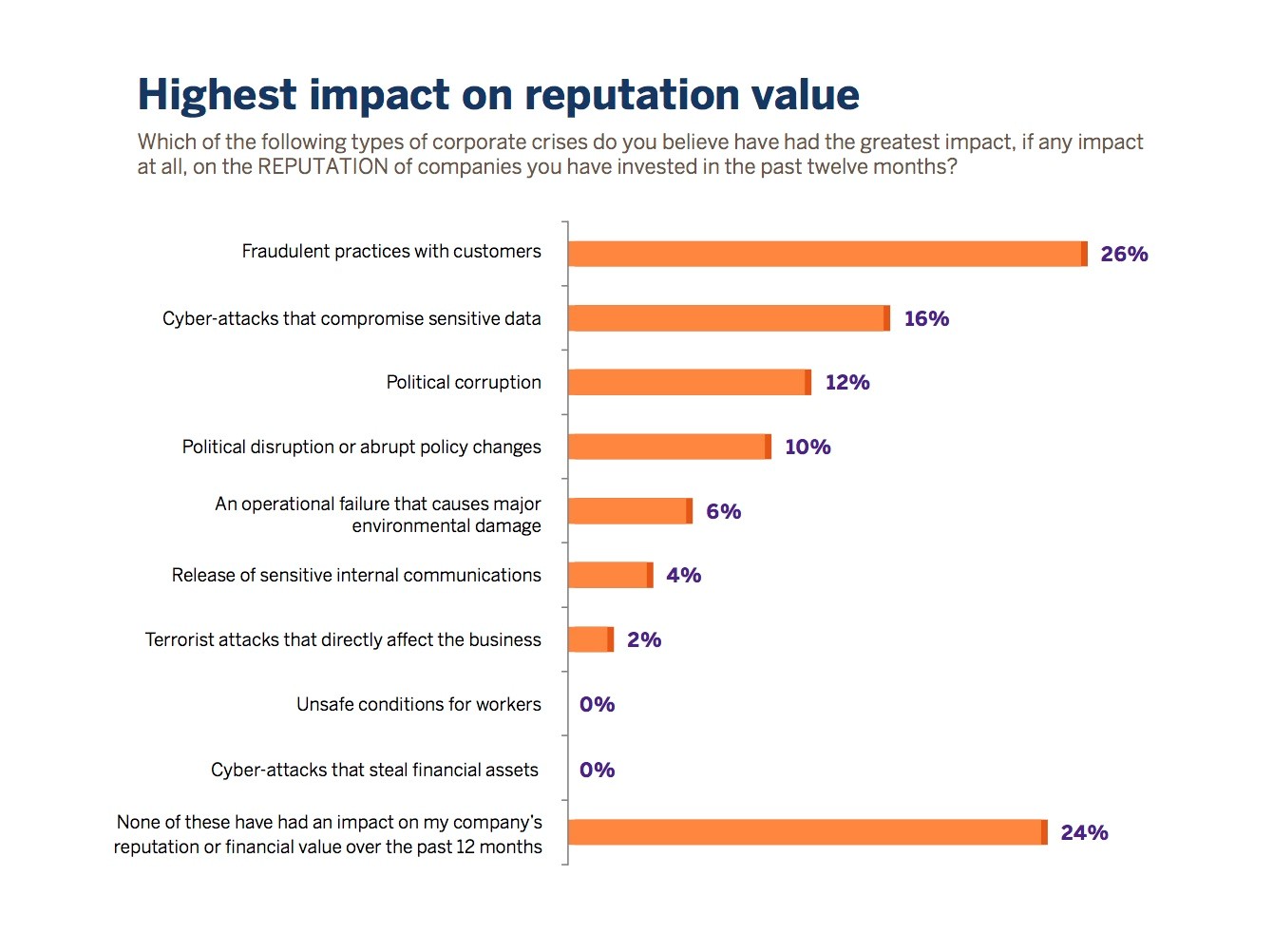

Considering the mid-January timing of the survey, FTI asked investors to look back over the previous year to assess the impact of corporate crises on the companies in their portfolios.

The investors reported that in the previous 12 months, two traditional crises — fraudulent practices and political corruption, and the relatively new crisis of cyberattacks — had the greatest impact on the reputation of the companies they invested in. When asked about impact on financial value, the same three crises again ranked above all others.

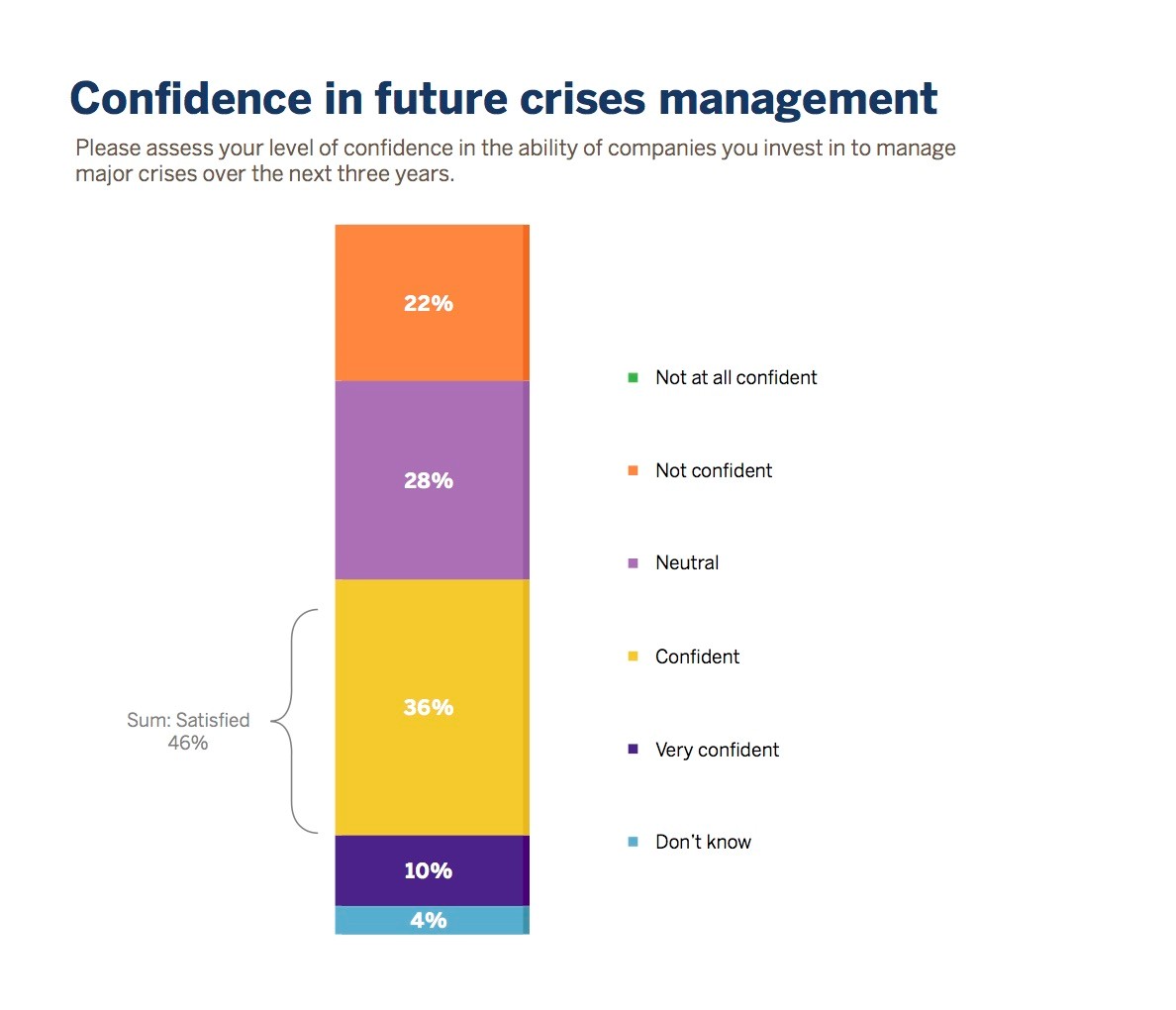

At the same time, the investors were pleased about management’s handling of those crises. When asked about their level of satisfaction with the companies they invest in to manage corporate crises over the past year, 44 percent indicated they were satisfied, with only 12 percent reporting dissatisfaction.

That faith in management even seemed to extend into the future as well. Forty-six percent reported they were confident in the ability of companies they invest in to manage major crises over the next three years.

The International Picture

Clearly, the Brexit and Trump effects play a major role in investors’ unease about the future, as well as their impact on doing business with the European Union. But the upcoming election season is also having an impact. In Germany, Chancellor Angela Merkel’s Christian Democratic party looks fairly stable ahead of September’s elections (though Merkel herself may be unseated). Populist movements in France and The Netherlands could move those countries to the right at the polls this spring. Elsewhere, a minority party in Spain and the weak center-left in Italy are on shaky ground while Poland and Hungary are under pressure from populist movements.

Then there is Asia. FTI’s John Green, Managing Director in Geopolitical Intelligence, remarks, “There’s a lot of uncertainty around trade relations in Asia these days. The region spent years pursuing the Trans-Pacific Partnership (TPP) and then Trump gets elected and throws it out the window.”

In Latin America, fallout from Brazil’s massive Petrobas corruption scandal has tentacles reaching across not only the region, but the rest of the world.

To get a better sense of the Brexit and Trump effects on investors’ attitudes, the survey explored these topics as well:

Most Likely Global Event: When asked to choose from a list of 10 events likely to occur in the coming 12 months, 98 percent of the investors said two stand out above others: “The U.K. will trigger Article 50 to leave the EU” and “Territorial border disputes in the South China sea will escalate.” Notable as the seventh-most likely event to occur, according to 82 percent of the investors: “President Trump having a successful first year.”

Confidence in the President: Asked to choose among nine achievements they are confident Donald Trump will accomplish in 2017, 40 percent of investors selected “attract business investment into the U.S.” as number one. Notable at number seven: 71 percent were not all confident about Trump’s ability to “promote global stability.”

What They Want from Trump: Asked to name one business-related priority they would suggest for Trump to focus on in 2017, 31 percent of the investors said “boost the U.S. economy.” The number two priority was “promote global stability” (21 percent).

The Trump Effect on My Company: When asked if they believe the result of the U.S. Presidential election will affect crisis management at their own company over the next few years, 26 percent of investors answered it will be “more challenging.” Nineteen percent replied “somewhat to more challenging,” and 52 percent indicated it would have “minimal impact.”

Ready to Lead

Finally, though the uncertainty of political disruption and its impact make planning particularly challenging for businesses in the near future, survey respondents have clear ideas about leadership during a time of crisis.

The survey results showed a robust 72 percent of investors strongly agreed with the statement “the board should play a proactive role in anticipating and planning for crises.” That’s not surprising, given the board’s traditional role of setting strategy and its fiduciary duty to shareholders.

But when asked who should lead a company in a time of crises, an overwhelming 74 percent of investors named the CEO compared to just 8 percent for a board member. Even further down among responses was “chief risk officer/head of risk” at just 2 percent.

What’s the thinking there? Assuming the crisis does not revolve around the CEO themselves, investors want the CEO to be accountable because they are directly involved in the day-to-day operations and can step into a situation that is moving lightning quick. The CEO also has a history of engagement with the various stakeholders. As in any part of the business, stakeholders look to the CEO, and a crisis shouldn’t be any different.

Given investor attitudes about political disruption and the likelihood of more corporate crises over the next three years, it seems CEOs may be especially busy through the end of the decade.

As a consequence of rounding up percentage results, the answers to some questions might not always add up to 100%.

© Copyright 2017. The views expressed herein are those of the author(s) and not necessarily the views of FTI Consulting, Inc., its management, its subsidiaries, its affiliates, or its other professionals.