This article was republished with permission from Tom Fox’s FCPA Compliance and Ethics Blog.

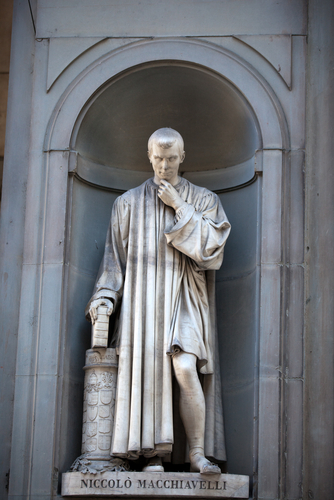

Last year was the 500th anniversary of the publication of one of the most significant books on political theory ever written, The Prince, by Niccolò Machiavelli. Just how evil do many people view the treatise as? Consider that this book alone is responsible for bringing the word “Machiavellian” into usage as a pejorative term. It also helped make “Old Nick” an English term for the devil and even contributed to the modern negative connotations of the words “politics” and “politician” in Western countries (imagine him presaging the U.S. Congress by 500 years). However, it is also viewed by many as one of the first works of modern philosophy – especially modern political philosophy – in which the effective truth is taken to be more important than any abstract ideal. It was also in direct conflict with the dominant Catholic and scholastic doctrines of the time concerning how to consider politics and ethics.

Many also find it a useful learning tool for a company’s management, though not the part about literally sawing a poor-performing employee in half. For instance, in the Texas Lawyer Work Matters blog, Michael P. Maslanka wrote an article entitled “Machiavelli’s 6 Insights for the General Counsel.” Duly inspired, I have adapted his thoughts for the Chief Compliance Officer (CCO).

Lesson No. 1 – Heed Selected Advice from Selected Advisors

While in medieval Florence, ruling as the supreme monarch, the Prince still needed advisors. Today, we are called subject matter experts (SMEs). Maslanka advises that “the prince decides from whom and about what he wants counsel, plus when he wants the advisers to offer it.” More importantly, a “prince’s demeanor must encourage truth-telling. This creates a virtuous circle from which ‘everyone may see that the more freely he speaks, the more he will be accepted.’”

For the CCO, this means that you should find a trusted SME or set of SMEs whom you can bounce issues off of and they will answer the question. This does not mean to provide you a memo or some type of cover. You need advisors who will give answers as to what you can and cannot do under such laws as the Foreign Corrupt Practices Act (FCPA) or UK Bribery Act. Moreover, they should be able to point out how to manage risks with increasing oversight as the risk profile increases.

Lesson No. 2 – Niccolò is Not Tony Soprano

Unlike Tony, who can do whatever he wants, whenever he wants, Maslanka writes that “as law professor Philip Bobbitt observes in ‘The Garments of Court and Palace: Machiavelli and the World He Made,’ this reasoning undergirds international law, allowing the aggrieved party to disavow its obligations because the reasons for entering into the agreement initially have evaporated.”

For the CCO, this means something like the following story: If a company president says that he wants to engage in some transaction or engage a particular agent and you tell him if he does so, he runs the risk of violating the FCPA, he might have a couple of responses. First, he might say that such risk is above his risk tolerance and he will not engage in the behavior. However, he might instead say you are the compliance professional, you figure out a way to do it legally. What I think that means is that as the risk goes up, the management of that risk also goes up. Would such a response be more costly or more intrusive? Probably, but if there is a way to manage a compliance risk and not violate the FCPA, I think you can legitimately suggest that to your company president.

Lesson No. 3 – If You Treat Others Well, They Will Treat You Well

Channeling his inner Machiavelli and HR 101, Maslanka quotes from The Prince when he writes, “A prince must … show himself a lover of merit, give preferment to the able, and those who excel in every act.” Maslanka then notes, “Who invented the suggestion box (aka incentivized ideas)? That’s right: Machiavelli. ‘The prince should offer rewards to whoever … seeks in any way to improve his city or state.’”

For the CCO, this means that if you are honest and fair with people, they will be much more willing to accept bad news in return. This is the basis of the Fair Process Doctrine. If a whistleblower brings allegations of corruption or a violation of your company’s Code of Conduct, keep that whistleblower apprised of the situation as is reasonable to do so.

Lesson No. 4 – People Are Bad. Work With It

No doubt channeling his inner FCPA Professor on rogue employees, Machiavelli says that there are bad people out there. Maslanka writes, “Not only are they bad, but they are also ‘ungrateful, fickle, desolators, apt to flee peril, covetous of gain.’” There are people who will see compensation as the be-all and end-all of corporate life. There are those beyond that who will work to defraud companies. Maslanka’s reading of The Prince leads him to write, “Ditch the naïveté and embrace a complex world. Use a one-two punch: Yes, we must have good laws, but we also must have ‘good arms.’ Yes, be a lion (it’s good for dismaying wolves) but also be a fox (that’s good for recognizing traps).”

For the CCO, this means you should have an effective process to prevent, detect and remediate violations of your FCPA compliance program.

Lesson No. 5 – Be Neither a Yellow Stripe Nor a Dead Armadillo

Maslanka states “Jim Hightower, former Texas agriculture commissioner, famously remarked that the only items in the middle of the road are yellow stripes and dead armadillos. Machiavelli could not have agreed more. His advice: Take sides. Do not stay neutral. Cowboy up. In other words, man up.

For the CCO, I think this translates into taking a stand when you have to do so. Yesterday I wrote about CCOs and the analogy of the Alamo. If you have to draw a line in the sand, do so. The responses to the blog post were interesting in that readers were thankful that I pointed out what might happen to a CCO when they do draw the proverbial ‘line in the sand,’ but they also thought they were better for having done so in the past. Unfortunately, if a company moves forward and does not heed such advice, it may be the entity that faces sanctions for violating the FCPA.

Lesson No. 6 – Adapt, Adapt, Adapt

Maslanka wrote, “before Charles Darwin, Machiavelli grasped the power of adaptation. Whoever “adapts his mode of proceeding to the quality of the times is happy and, similarly, he whose procedure disagrees with the times is unhappy.” Adaptation is crucial because fortune changes, the earth moving under our feet without warning. Machiavelli’s counsel: “Adapt a mindset of being impetuous, not cautious; ferocious, not timid; calculating, not blindly trusting.” In other words, when in doubt, act.

For the CCO, this means that you must assess and then act upon that assessment. In the compliance realm this is particularly true because risks change, these days so quickly it is sometimes hard to keep track. Even if you perform a risk assessment every two years and believe you have assessed and remediated the new risks, how do you deal with the new environment in places like Ukraine and Turkey? What about China? Have you looked into your Chinese subsidiary’s use of travel agencies? How up-to-date is the due diligence on your third parties?

Maslanka ends his article with the following: “Machiavelli never wrote that the ends justify the means, and he didn’t intend that to be his message. He believed in what people now call ‘servant leadership,’ which would be a subordination of the prince’s needs and ego to the greater good. In his case, that was a unified Italy, free of foreign domination, achieved by using the principled and humane values—yes, humane values—that he wrote about in The Prince. It’s this servant leadership that suits GCs and the C-level executives that they advise.”

I would heartily agree with his sentiment but revise “GC” to CCO.

This publication contains general information only and is based on the experiences and research of the author. The author is not, by means of this publication, rendering business advice, legal advice or other professional advice or services. This publication is not a substitute for such legal advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified legal advisor. The author, his affiliates and related entities shall not be responsible for any loss sustained by any person or entity that relies on this publication. The author gives his permission to link, post, distribute or reference this article for any lawful purpose, provided attribution is made to the author. The author can be reached at tfox@tfoxlaw.com.

Thomas Fox has practiced law in Houston for 25 years. He is now assisting companies with FCPA compliance, risk management and international transactions.

He was most recently the General Counsel at Drilling Controls, Inc., a worldwide oilfield manufacturing and service company. He was previously Division Counsel with Halliburton Energy Services, Inc. where he supported Halliburton’s software division and its downhole division, which included the logging, directional drilling and drill bit business units.

Tom attended undergraduate school at the University of Texas, graduate school at Michigan State University and law school at the University of Michigan.

Tom writes and speaks nationally and internationally on a wide variety of topics, ranging from FCPA compliance, indemnities and other forms of risk management for a worldwide energy practice, tax issues faced by multi-national US companies, insurance coverage issues and protection of trade secrets.

Thomas Fox can be contacted via email at tfox@tfoxlaw.com or through his website

Thomas Fox has practiced law in Houston for 25 years. He is now assisting companies with FCPA compliance, risk management and international transactions.

He was most recently the General Counsel at Drilling Controls, Inc., a worldwide oilfield manufacturing and service company. He was previously Division Counsel with Halliburton Energy Services, Inc. where he supported Halliburton’s software division and its downhole division, which included the logging, directional drilling and drill bit business units.

Tom attended undergraduate school at the University of Texas, graduate school at Michigan State University and law school at the University of Michigan.

Tom writes and speaks nationally and internationally on a wide variety of topics, ranging from FCPA compliance, indemnities and other forms of risk management for a worldwide energy practice, tax issues faced by multi-national US companies, insurance coverage issues and protection of trade secrets.

Thomas Fox can be contacted via email at tfox@tfoxlaw.com or through his website